Mixed results for the week

The European major indices are ending the week with mixed result today and also ending the week mixed.

The provisional closes are showing:

- German DAX, flat

- France’s CAC, -0.5%

- UK’s FTSE 100, up 0.2%

- Spain’s Ibex, unchanged

- Italy’s FTSE MIB, -0.45%

For the week,:

- German DAX -0.9%

- France’s CAC, +0.2%

- UK’s FTSE 100, +0.45%

- Spain’s Ibex, +2.3%

- Italy’s FTSE MIB, -1.0%

How did the indices end the month? The major indices are mostly higher with Italy’s FTSE MIB the one exception.

- German DAX up 0.9%

- France’s CAC, +3.3%

- UK’s FTSE 100, +3.8%

- Spain’s Ibex, +2.7%

- Italy’s FTSE MIB, -2%

A look at other markets as London/European traders look to exit for the week and month:

- Spot gold is trading down $3.58 or -0.2% of $1768.71

- SPot silver is down -16 censor -0.64% at $25.92

- WTI crude oil futures is down $1.53 or 2.35% at $63.48

- Bitcoin is trading up $3900 or 7.39% of $56,900.

In the US stock market, the major indices remain in the red:

- S&P index -24.6 points or -0.58% of 4186.89

- NASDAQ index -60 points or -0.43% at 14022.20

- Dow -218 points or -0.64% at 33841.90

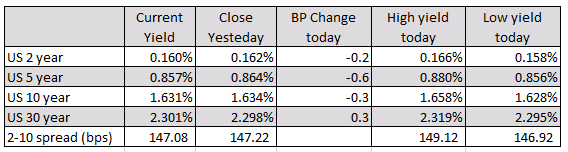

In the US debt market, yields are marginally lower:

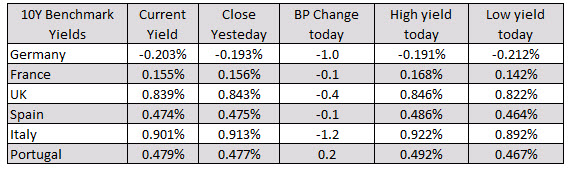

In the European debt market today, the major indices were mostly lower as well:

Looking at the German tenure yield, it’s traded to the its highest level since March 2020 today. The high yield reached -0.191% the November 2020 high was still negative at -1.49%. That is the next target.

Looking at the German tenure yield, it’s traded to the its highest level since March 2020 today. The high yield reached -0.191% the November 2020 high was still negative at -1.49%. That is the next target.

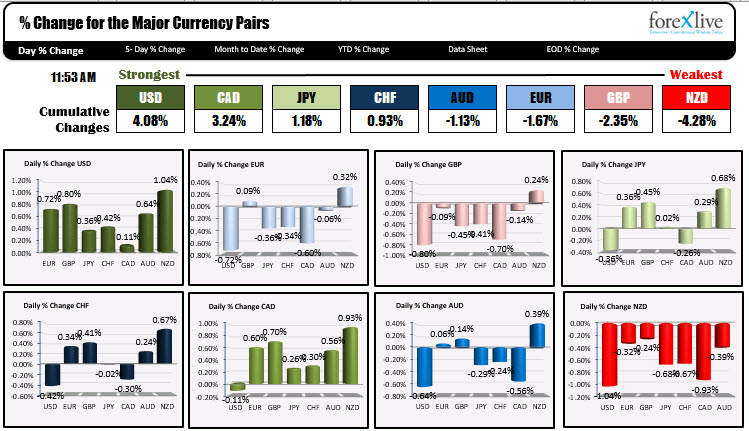

A snapshot of the forex market, has the USD taking the lead with the sharp rise into the London fix. The NZD and GBP are the weakest of the majors.

This article was originally published by Forexlive.com. Read the original article here.