A number of tries below the 100 hour MA, but a number of fails too

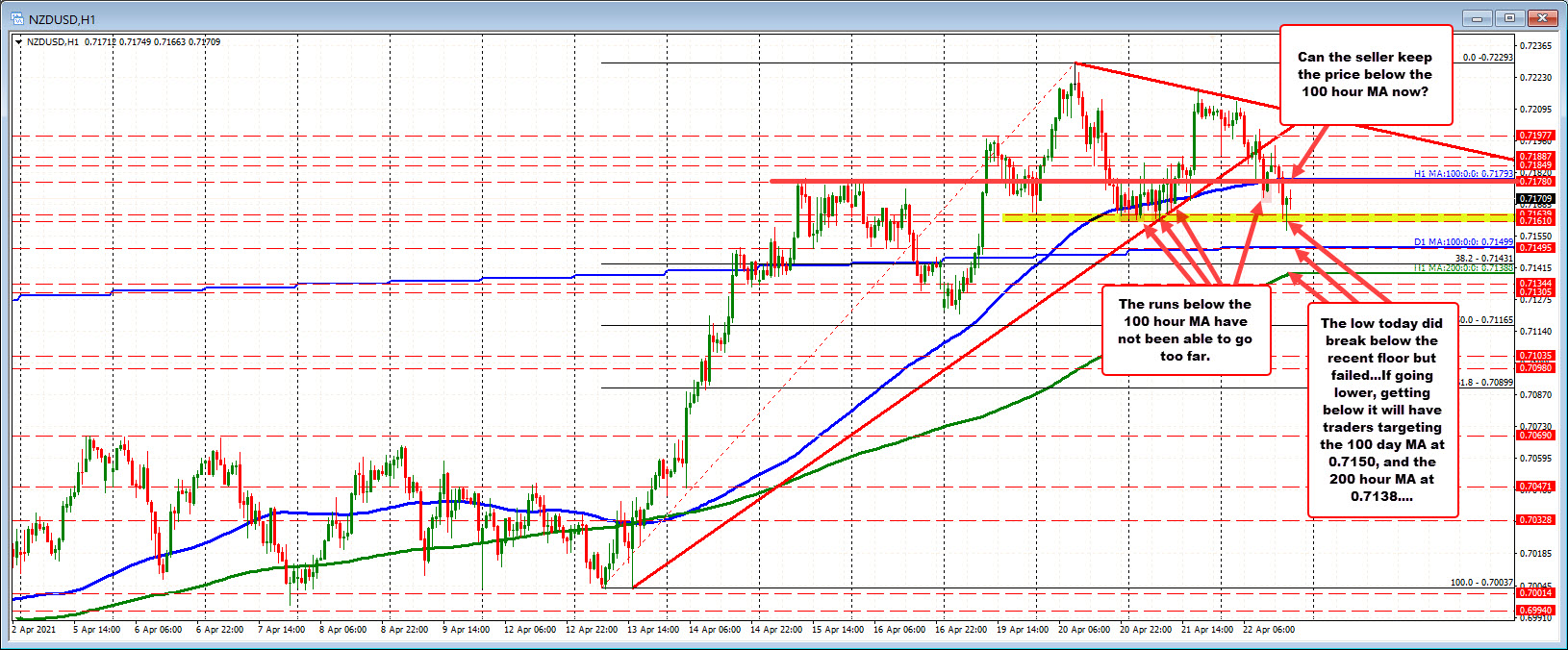

The NZDUSD has moved back below the 100 hour MA AGAIN. That MA currently comes in at 0.71793.

The pair has seen a number of hourly bars below the rising MA line going back to late Tuesday. Each break eventually failed.

Recall from yesterday in the NY session, the price based against the MA level (after a number of bars with the price trading above and below the MA line), and raced higher.

Today, with the price moving back below the line – and moving the farthest away from the MA line on the break – the sellers are making a bigger play for control. Stay below, keeps that hope alive (risk is a move back above the MA line now at 0.71793).

With risk defined, what are the downside targets that would increase the bearish bias?

The 0.7161-638 area was home to a floor from late Tuesday and into Wednesday. Today, the low did crack below that level but failed. Getting back below is essential now.

Below that the 100 day MA is at 0.7150 and the rising 200 hour MA is at 0.7138. Between them sits the 38.2% of the move up from the April 13 low.

If the sellers are prove themselves, getting below each of those levels is essential. Absent that, and the move lower is a correction of the recent move higher.

Nevertheless, sellers are making the play today. Stay below the 100 hour MA keeps those sellers satisfied with more work to do to prove their strength.