- XAU/USD lost its traction after advancing to multi-month highs.

- Near-term support seems to have formed a little below $1,770.

- Gold continues to react to fluctuations in US Treasury bond yields.

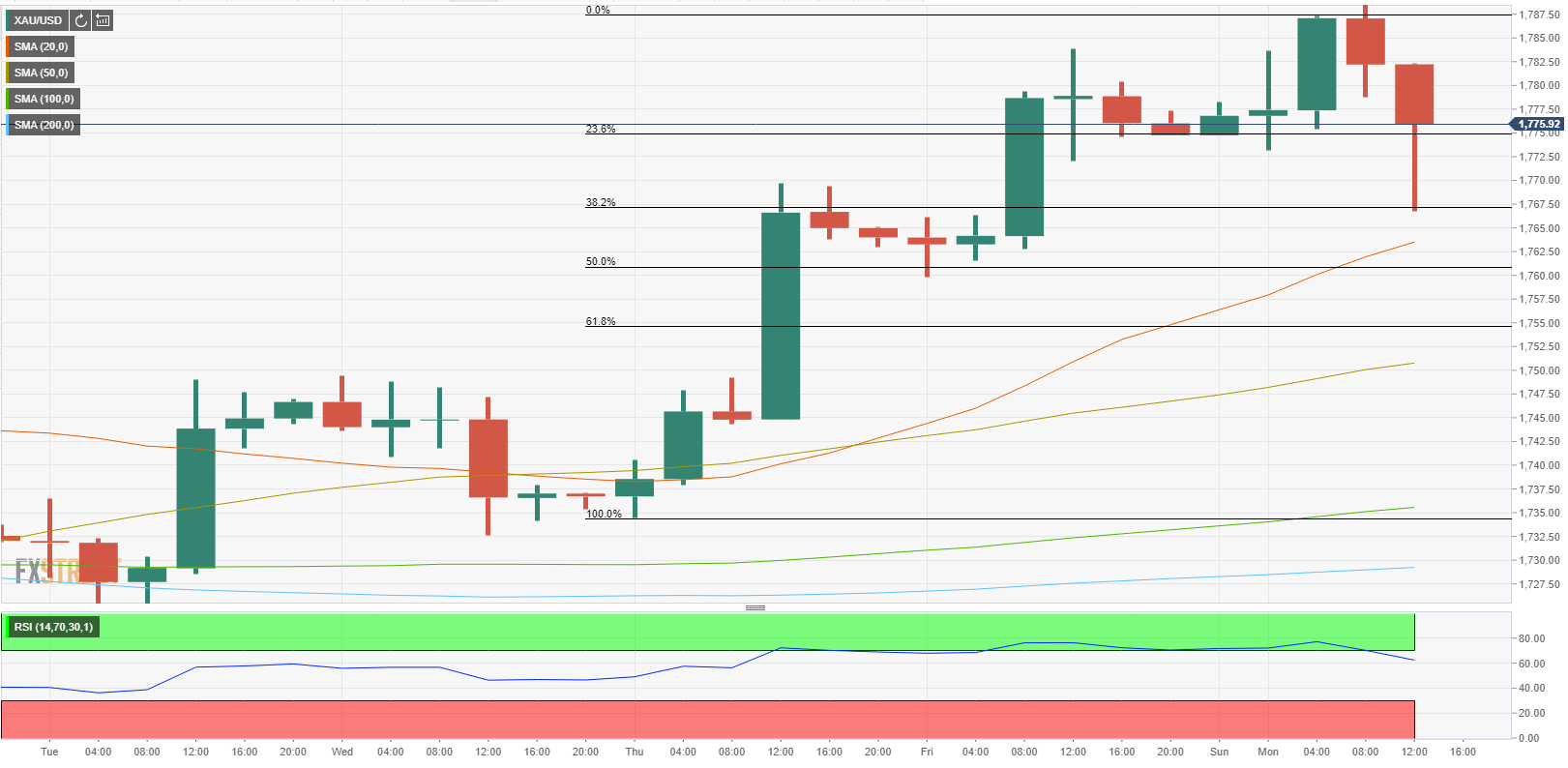

The XAU/USD pair managed to build on last week’s gains and touched its highest level since late February at $1,790 on Monday. However, the pair failed to preserve its bullish momentum in the second half of the day and reversed its direction. As of writing, XAU/USD was losing 0.13% on a daily basis at $1,774.

In the absence of significant fundamental drivers, the US Treasury bond yields’ performance continues to impact gold’s valuation. The benchmark 10-year US Treasury bond yield, which spent the first half of the day in the negative territory, was last seen rising nearly 1% on the day.

Gold technical outlook

On the four hour chart, the 38.2% Fibonacci retracement of the rally that started last week on Thursday and ended earlier in the day on Monday seems to have formed strong support at $1,767. Meanwhile, the Relative Strength Index (RSI) indicator on the same chart continues to hold above 50, suggesting that the pair is staging a technical correction. Below $1,767, the 20-period SMA aligns as the next support at $1,764 ahead of $1,760 (Fibonacci 50% retracement).

On the flip side, the pair could target $1,790, once again, if it closes a four-hour candle above $1,775 (Fibonacci 23.6% retracement). Finally, $1,800 (psychological level) could be seen as the next target on the upside if bulls retake control of the price.