German Dax makes new all time highs

The German Dax broke higher today and in the process moved to a new all time high at 15473.83. The price of the index had been waffling up and down over the last 8 trading days in a non-trending market before breaking higher and running to the upside.

France’s CAC also moved to new highs for the week and trades at the highest level since December 2000. The high price reached 6299.56. The new high close is at 6287.07.

A look at the final numbers shows:

- German DAX, +1.34%

- Francis CAC, +0.85%

- UKs FTSE 100, +0.5%

- Spain’s Ibex +0.5%

- Italy’s FTSE MIB, +0.88%

For the week, the France’s CAC led the way with a gain of 1.91%. The final numbers for the week show:

- German DAX, +1.48%

- France’s CAC, +1.91%

- UKs FTSE 100, +1.5%

- Spain’s Ibex, +0.56%

- Italy’s FTSE MIB, +1.29%

Year to date, France leads the way with a 13.25% gain

- German DAX, +12.69%

- France’s CA +13.25%

- UKs FTSE 100, +8.65%

- Spain’s Ibex, +6.69%

- Italy’s FTSE MIB, +11.3%

A look at the other markets as London/European traders exit shows:

- Spot gold, plus $13.77 or 0.78% at $1777.22

- SPot silver plus $0.18 or 0.73% at $26.03.

- WTI crude oil futures $-0.29 or -0.46% at $63.17

- Bitcoin $-1975 or -3.12% at $61,420

In the US stock market, the major indices are mixed:

- S&P index up nine points or 0.22% of 4179.45

- NASDAQ index unchanged at 14039

- Dow +89 points or 0.26% at 34125

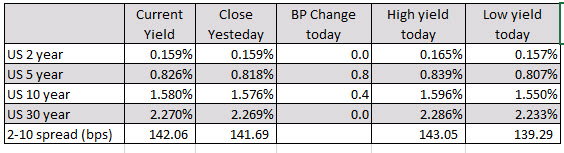

In the US debt market, yields are trading above and below unchanged today:

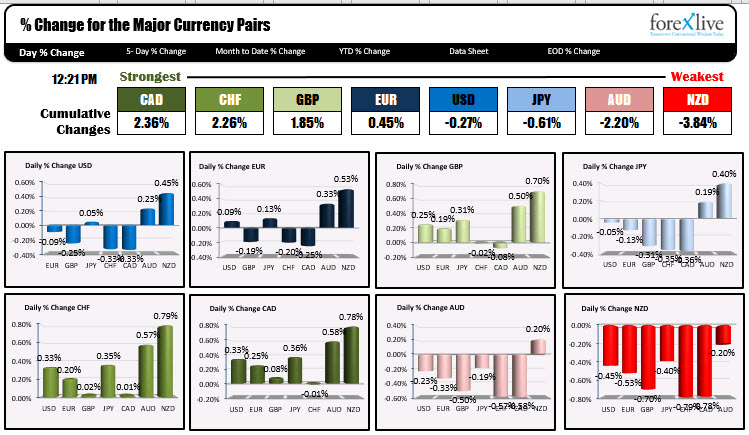

In the forex, the snapshot shows, the CAD and CHF are the strongest of the majors, while the AUD and the NZD are the weakest. The USD is mixed with gains vs the NZD and AUD, declines vs the GBP, CAD and CHF and more modest moves vs the EUR and JPY.

In the forex, the snapshot shows, the CAD and CHF are the strongest of the majors, while the AUD and the NZD are the weakest. The USD is mixed with gains vs the NZD and AUD, declines vs the GBP, CAD and CHF and more modest moves vs the EUR and JPY.