Is the consolidation over?

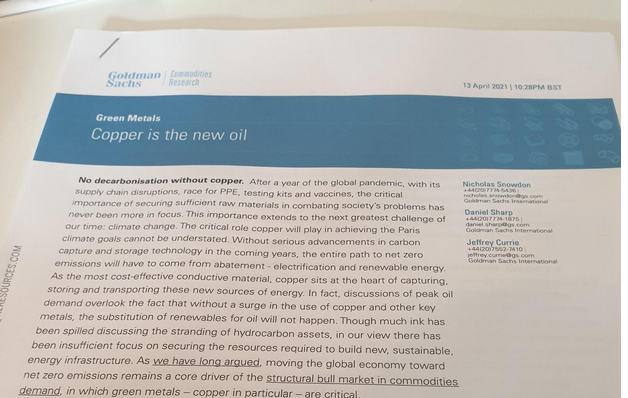

Look at the title of this new report from Goldman Sachs. That’s the kind of thing to get anyone’s attention:

“Without a surge in the use of copper and other key metals, the substitution of renewables for oil will not happen,” they write.

Copper is certainly surging today, up 2% to the best levels since March 3.

Last week, copper looked like it was breaking out a wedge consolidation but China clamping down erased the break.

Now it has taken a second run and broken the mid-March high.

Combined with the moves in other commodities, commodity currencies and equities, this time it looks like it’s for real.

This article was originally published by Forexlive.com. Read the original article here.