Canadian dollar the laggard this week

Timing is everything.

That’s true in life, in trading and in analysis.

The Canadian dollar is the worst-performing G10 currency this week. That’s strange given the bounce in oil prices, rising commodities more broadly, strong US data and fresh records in stock markets.

The obvious concern is covid, with more measures coming to Ontario today as variant-related cases mount. It’s not a great scene.

That said, Canada is an exporter and the picture globally is improving. It also proved that in Q1 it could prosper despite covid restrictions. Finally, the market has consistently looked through the pandemic and towards the boom afterwards.

Add it all up and the small dip in CAD today is likely an opportunity.

The timing is always tricky though. CAD might be soft today but it’s the best performer this year so this might be more of a case of other currencies catching up, rather than CAD stumbling.

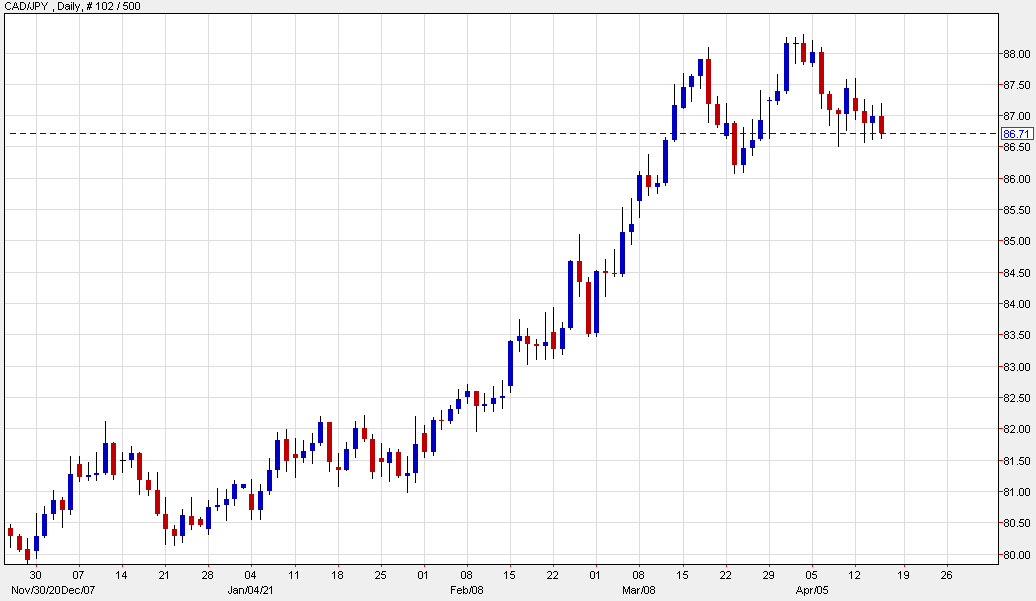

I continue to keep a close eye on CAD/JPY, which will eventually break out of this consolidation pattern. If the indications in commodities and equities can be trusted, it will be a break to the upside.