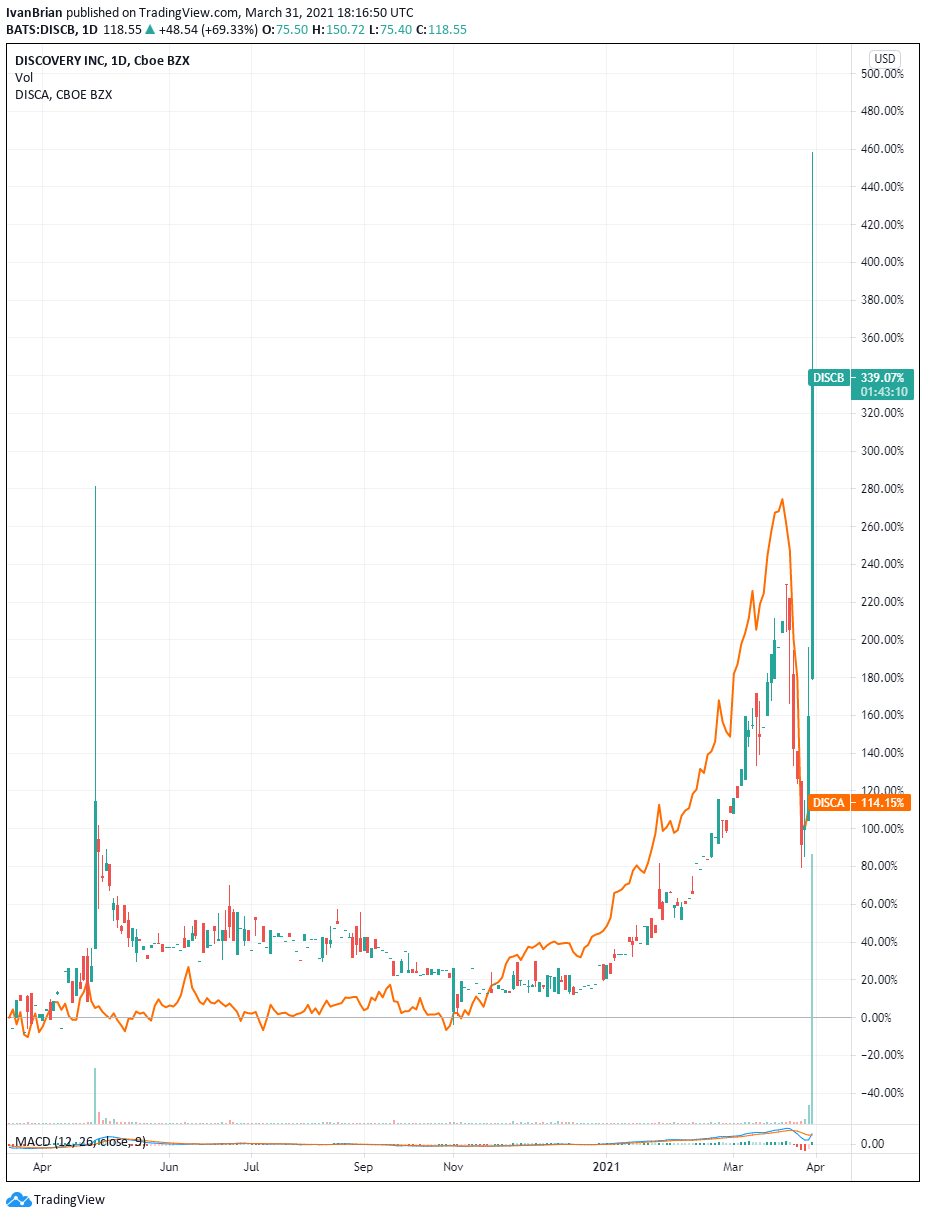

- Discovery is one of the companies caught up in the Archegos fund liquidation.

- DISCB shares rocket on Wednesday, Why?

- DISCA shares are the “normal ones”, hardly move.

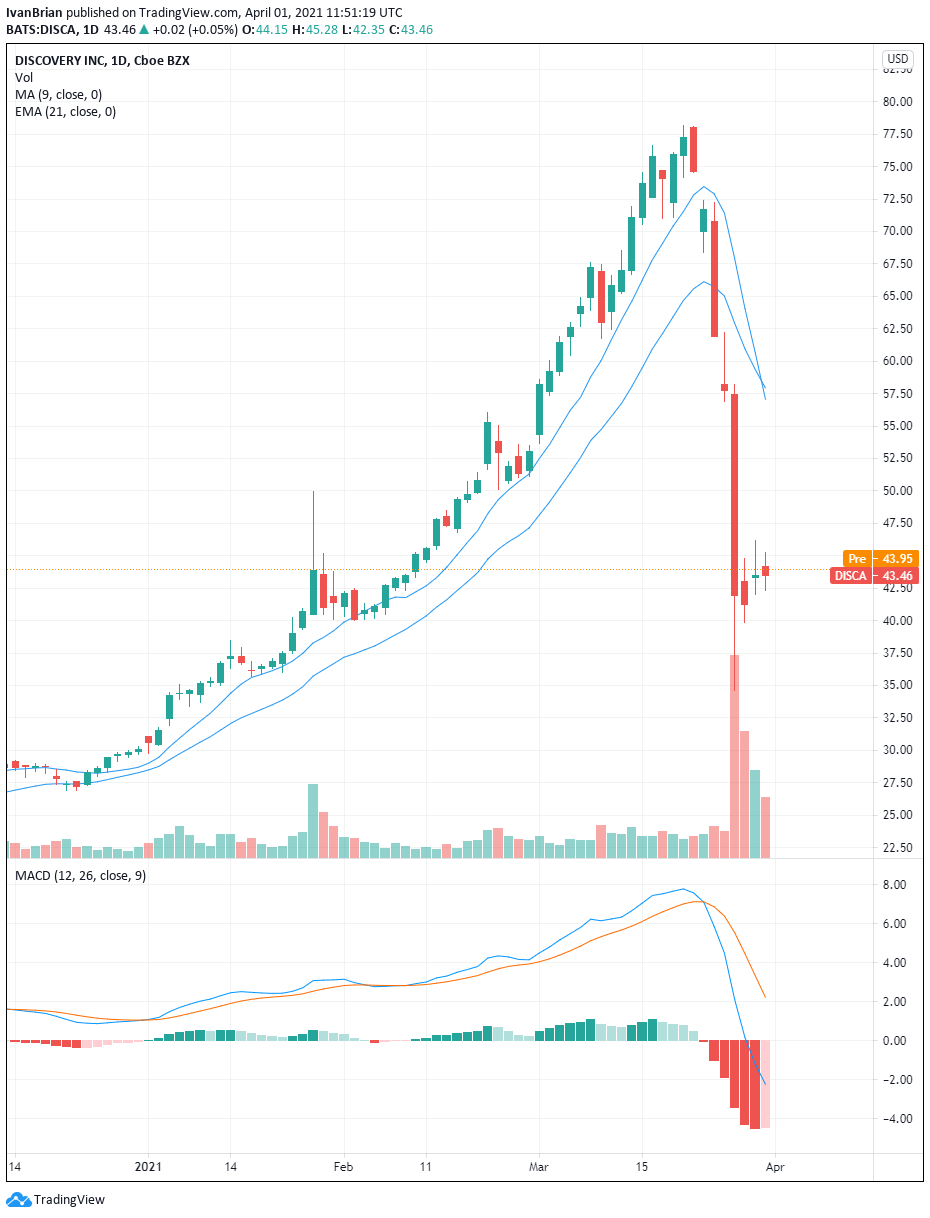

Discovery was one of the shares caught up in the recent Archegos liquidation rumours as Discovery (DISCA) shares dumped from near $78 to close last Friday at $41.90.

Archegos was is a hedge fund/family office that is reported to have taken large positions in certain TMT stocks (tech, media, telecom). Archegos is reported to have failed to meet a margin call from one of its investment bank account holders and this resulted in a domino effect as multiple banks began liquidating positions across a number of related stocks.

Stay up to speed with hot stocks’ news!

DISCB stock news

IPO Edge broke the news last Friday that the sharp price moves in some TMT stocks and VIAC and Discovery (DISCA) in particular were tied to Archegos Capital Management. Several investment banks warned of losses from an unnamed US client on Monday before the market opened. Credit Suisse and Nomura both made such statements on Monday and other investment banks were also under investor scrutiny to see if they were affected.

The situation took a fresh twist on Wednesday as Discovery B shares rallied nearly 80%, moving from $75 to over $150 before closing up 83% at $128.

DISCA and DISCB are heavily correlated shares as the chart shows. But this DISCB spike has happened once before back on May 1, 2020. DISCB shares spiked 68% on May 1, 2020, again for no apparent reason. Discovery issued a release after the huge move saying it was unaware of the reasons and DISCB shares quickly returned to normal levels.

DISCB has a tiny free float (amount of shares available for trading). 321k shares out of a free float of 6.51 million from Refinitiv. This makes it more volatile if interest and volume increases.

These are lightly traded shares held almost entirely by media tycoon John Malone according to Factset, from CNBC. The B shares, DISCB, usually trades around 3,000 shares per day, volume on Wednesday was over 1.3 million shares!

DISCB shares have different voting rights to the more regular DISCA shares with DISCB carrying ten votes per share as opposed to the DISCA shares carrying one vote.

DISCA stock price

Market participants were busy trying to find reasons for the move on Wednesday with various hypotheses (guesses!) being put forward. Talk of an arb between the A and B shares gone wrong or retail traders driving the move were the main reasons given. The arb theory seems unlikely, given the tiny volume in the B shares, making any arb more difficult. Retail traders certainly were all over DISCB on social media with it being one of the top trending tickers across the usual stock social media sites. The move may also have been triggered by the recovery in DISCA shares on Tuesday when they closed up 5.5% and had been up nearer 10%. As the DISCB shares are correlated these also jumped on Tuesday, by over 20%. This may have flagged on several breakout systems and retail traders jumped in accordingly. The lack of liquidity then exaggerated the move.

Whatever the reason, traders should exercise extreme caution here. Discovery A-shares have been trying to recover but are still merely back to where they were in January! The move in the B shares seems way overdone.

At the time of writing, the author is long DISCA and VIAC shares. The author has no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)