- USD/TRY adds to recent gains above the 8.0000 mark.

- CBRT Chief Kavcioglu said a rate cut is not guaranteed.

- The lira is expected to remain under heavy pressure.

The sell-off around the Turkish currency remains well and sound, with USD/TRY advancing to fresh 5-day peaks in the proximity of 8.2000 on Monday.

USD/TRY focused on the CBRT

USD/TRY posts strong gains and consolidates further the recent breakout of the key barrier at 8.00 the figure at the beginning of the week.

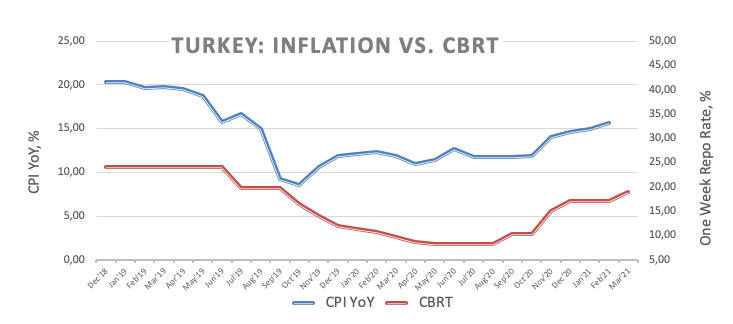

Investors’ shrinking faith on the lira does nothing but increase by the day following recent events around the Turkish central bank (CBRT). On the latter, Chief Kavcioglu said earlier on Monday that an interest rate cut is not guaranteed (at the next meeting), something that market participants find hard to believe.

What to look for around TRY

The near-term outlook for the lira remains fragile to say the least. The new CBRT Governor S.Kavcioglu is expected to reverse (wipe out) the shift to a market friendly approach of the monetary policy that was successfully implemented by former Governor N.Agbal back in November 2020. President Erdogan’s appointment of Kavcioglu demonstrated once again whose hand is rocking the monetary cradle in Turkey and will most likely be the prelude of the return to unorthodox/looser measures of monetary policy in combination with rapidly rising bets of a Balance of Payments crisis and a drain of FX reserves. Against this backdrop, it will surprise nobody to see spot trading around 10.00 in the months to come.

Key events in Turkey this week: Economic Confidence Index, Trade Balance figures (Wednesday) – March’s Manufacturing PMI (Thursday).

Eminent issues on the back boiler: Potential US/EU sanctions against Ankara. Government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Much-needed structural reforms. Growth outlook vs. progress of the coronavirus pandemic.

USD/TRY key levels

At the moment the pair is gaining 1.18% at 8.1701 and faces the next up barrier at 8.1838 (high Mar.29) seconded by 8.2881 (2021 high Mar.22) and finally 8.5777 (all-time high Nov.6 2020). On the other hand, a drop below 7.7772 (high Mar.9) would aim for 7.4576 (200-day SMA) and then 7.1856 (monthly low Mar.19).