Latest data released by Markit/CIPS – 24 march 2021

That is a solid beat and adds to the optimism surrounding the rebound in the UK economy once restrictions are eased later on in the year.

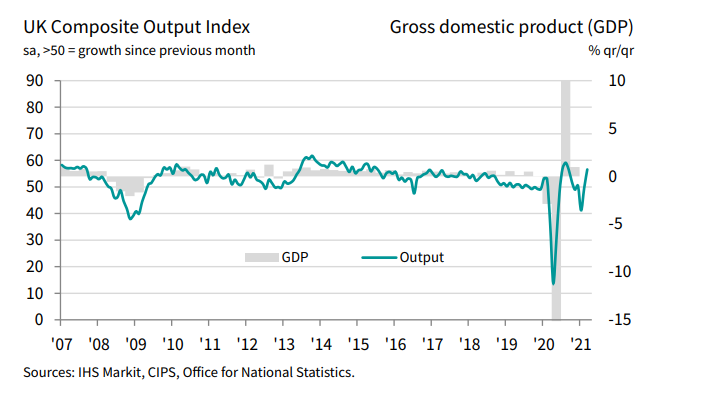

Business activity in the UK returned to expansion and improved at its quickest pace in seven months, with the services reading also coming in at the highest since August last year. Meanwhile, the manufacturing reading is the highest in 40 months.

Service providers noted forward bookings from domestic consumers as the higher level of activity is linked to the prospect of looser restrictions later in the year.

“The UK economy rebounded from two months of decline

in March, with business activity growing at its fastest rate

since last August as children returned to schools, businesses

prepared for the reopening of the economy and the vaccine

roll-out boosted confidence. Companies reported an influx

of new orders on a scale exceeded only once in almost four

years, and business expectations for growth in the year

ahead surged to the highest since comparable data were first

available in 2012. Employment consequently rose for the first

time since the pandemic struck as firms expanded capacity in

response to the new inflows of work and brighter outlook.“The surge in business activity is far stronger than any

economists expected, according to Reuters polls, and hints

at only a modest contraction of GDP during the first quarter,

adding to evidence that the economy has shown far greater

resilience in the third lockdown compared to the first. The

encouraging readings on future expectations, job creation

and new order inflows meanwhile all point to robust economic

growth in the second quarter, especially if virus restrictions

are lifted further.“Worries persist though, especially in relation to near-record

supply chain delays, a continued fall in exports and sharply

rising prices, all of which are making life difficult for many

companies. Many consumer facing companies meanwhile

remain constrained by COVID-19 restrictions, which are likely

to curb the overall pace of economic growth for some time to

come, especially if we see a third wave of infections.”