Forex news for North American trading on March 22, 2021.

In other markets as NY session comes to a close:

- Spot gold is trading down $6.06 or -0.35% at $1739.11

- Spot silver is trading down $0.48 or -1.85% at $25.75

- WTI crude oil futures for May delivery are trading down $0.14 or -0.23% at $61.30

- Bitcoin is trading down $-2290 or -3.96% at $55,547

him quiet day on the economic front as the week gets off to a start. Existing home sales in the US came in weaker than expected 6.22 million annualize versus 6.5 million estimate. Inventory it is down -29.5% y/y to record low 1.03m units. The weather in February was also brutal which likely contributed to a decline. Nevertheless interest rates are moving higher and prices showed a gain of 15.8% year on year which can be a drag going forward.

Fed’s Barking got the Fed Talk going this week by saying that over the next six months we need to ‘look through’ 12 month inflation, and told the market that the Fed will be focused on month-over-month inflation and trimmed mean inflation. On growth, he added retailers are already seeing things ‘flying off the shelves’ because of stimulus cheques, and prospects for the economy are getting stronger.

Fed’s Powell will testify with Treas Sec Yellen tomorrow. There is a full schedule of speakers se for tomorrow:

- Feds Bullard discusses economy at LSE event (9 AM ET)

- Fed’s Barkin takes part in virtual discussion (11 AM ET)

- Powell, Yellen appear before House panel on CARES act (12 PM ET)

- Feds Williams takes part in virtual discussion ( 2:45 PM ET)

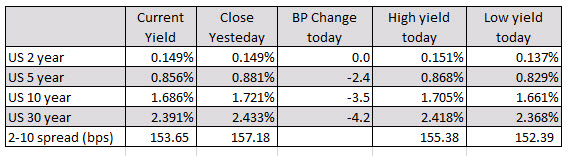

In the US debt market today, yields declines with the yield curve flattening (the 30 year moved down the most). The 2-10 year spread moved from 157.18 basis points on Friday to 153.65 near the close today.

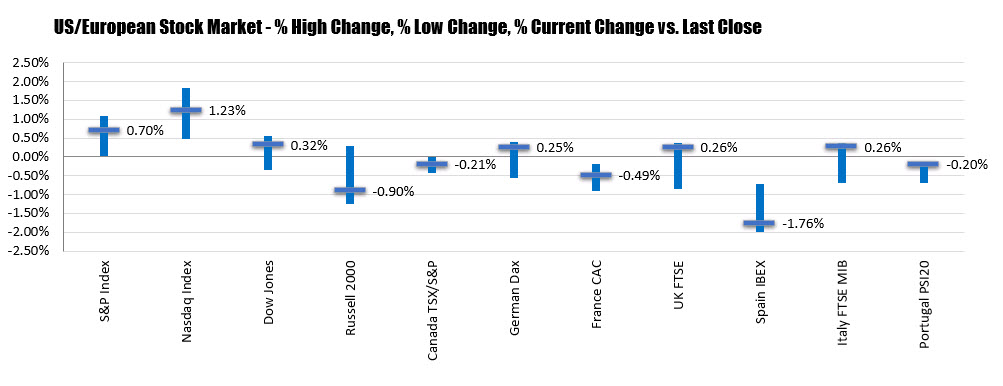

European shares were mixed with German, UK and Italy shares higher, and France, Spain, Portugal markets lower.

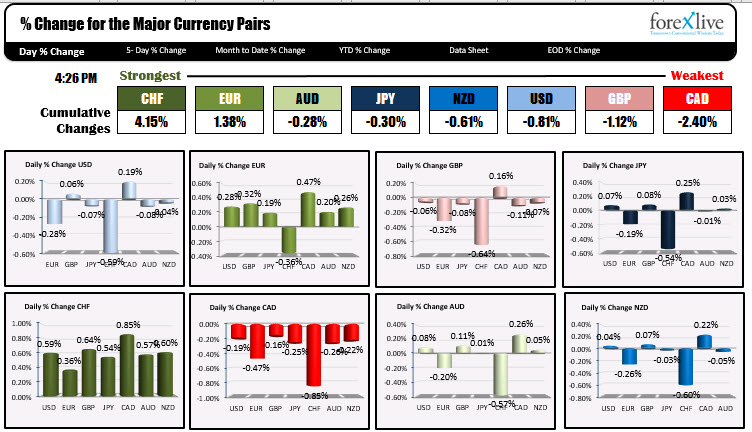

In the Forex market today, the USD started the North American session as the weakest of the majors, but was then outpaced by the falling CAD and GBP currencies. The greenback was still lower but was near unchanged versus the GBP, JPY, CAD, AUD and NZD. It fell the most mercy EUR and CHF. The CHF was the strongest currency today after cracking back below its 200 and 100 hour moving averages.

In the Forex market today, the USD started the North American session as the weakest of the majors, but was then outpaced by the falling CAD and GBP currencies. The greenback was still lower but was near unchanged versus the GBP, JPY, CAD, AUD and NZD. It fell the most mercy EUR and CHF. The CHF was the strongest currency today after cracking back below its 200 and 100 hour moving averages.

Some technical levels to eye in some of the major currency pairs:

- EURUSD: The EURUSD broke back above its 100 and 200 hour moving averages at 1.1917 and 1.1927. The high price extended up to 1.19464 before rotating lower. The 200 hour moving average 1.1927 will be the early barometer for the buyers and sellers. Stay above is more bullish. Move below it and the 100 hour MA at 1.19176 and the bias shifts back to the downside.

- GBPUSD: The GBPUSD trading down, up, down and up in a confined trading range today. The pair remains well below its 100 hour moving average above at 1.3899 and 200 hour moving average at 1.39099. The current price is trading at 1.38558. That tilt a bias more to the downside. The next key target area comes between 1.3801 and 1.3808. Move below that and then the March low at 1.3778, and the sellers start to believe more (and control more too).