US treasury yield jumped last week after Fed gave way to more yield strength. In the background, there were some concerns over resurgence of coronavirus infections in some countries like France, Brazil and India. There was also risk of slower than originally expected vaccine rollouts. Tensions between US China heightened after the “diplomatic” talks in Alaska. Yet, overall, investors were rather unmoved by the negative news. There was no synchronized free fall in stocks, and overall sentiments were just cautious, but still positive.

Yen, Swiss Franc and Dollar ended as the best performers last week but all closed inside prior week’s range only. Dollar lacked committed buying to extend it’s corrective rebound. Though, Yen crosses look ready for a near term pull back. Euro and Sterling ended as the joint weakest.

10-year yield’s up trend on track to 2% handle

10-year yield broke out of range and surged to as high as 1.754 last week, before closing strongly at 1.732. While TNX is clearly overbought (bond oversold), as seen in daily and weekly RSI. There is no sign of topping yet, and the up trend should continue as long as 1.5785 support holds.

Nevertheless, on next rally, it could enter in to an important resistance zone. First, there is 1.971 structural resistance. Second, there is 55 month EMA at 1.998. Third, there is 61.8% retracement of 3.248 to 0.398 at 2.159. Additionally, 2% handle should be an important psychological level. These should be the levels that traders are looking at.

For now, we’re not expecting much drastic reactions in other parts of the markets to further rally in 10-year yield, unless the above mentioned resistance zone is taken out firmly (which we don’t expect to happen in the near term).

Stocks in consolidations at worst, despite surging yields

By drastic reaction mentioned above, we mean, for example, broad based free fall in stocks. That hasn’t happened in the past few weeks despite the steep rise in treasury yields. The lack of synchronized decline in major US indices suggests that the markets are at worst entering into a consolidation phase, rather than a medium term correction

DOW actually made new record high as 33227.78 and matched 61.8% projection of 18213.65 to 29199.35 from 26143.77 at 32932.93. Daily MACD suggests that it might be in upside acceleration phase again. Friday’s pull back was just shallow by technical standard. As long as 32009.67 resistance turned support holds, we’d still expect more record highs ahead.

The “leading” NASDAQ continued to trade in range and was starting to gyrate around flat 55 day EMA. Price actions from 14175.11 could be developing into a sideway consolidation pattern. As long as 12074.06 cluster support holds, (61.8% retracement of 10822.57 to 14175.11 at 12103.24) holds, this is our favored case. However, firm break of this cluster support will argue that NADSAQ might have started a correction to back to 10822.57 support. That might be a early sign that deeper pull back in risk sentiment, and in DOW and S&P 500, is underway.

Dollar index extending corrective pattern from 89.20

Dollar index stayed in sideway consolidation last week as the recovery pattern from 89.20 extended. There was no committed buying to push it through prior week’s high at 92.50. Further rise might be seen ahead as long as 90.63 support holds. But DXY will firstly need to overcome 55 week EMA at 93.45 decisively, to indicate that it’s ready for a bullish trend reversal. Otherwise, we’re treat the current recovery as a corrective move, with medium term outlook staying bearish.

GBP/JPY and CAD/JPY turning into consolidations

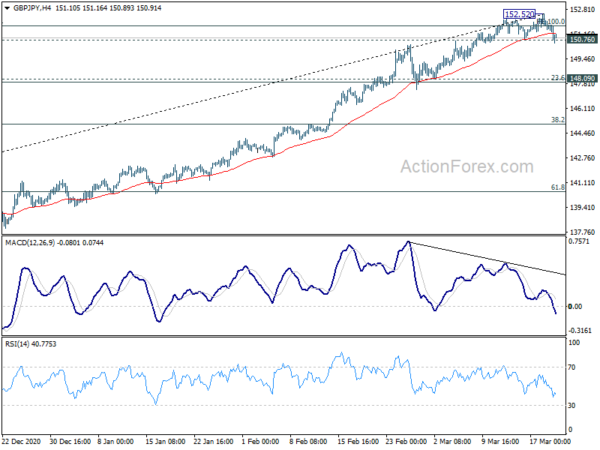

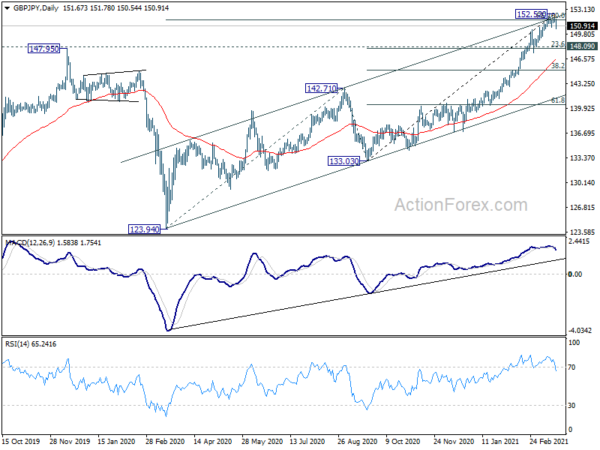

If the stock markets turn into consolidative mode, some Yen crosses might follow. In particular GBP/JPY struggled to break through a key resistance between 100% projection of 123.94 to 142.71 from 133.03 at 151.80 and medium term channel resistance. The late breach of 150.76 minor support suggests short term topping, with bearish divergence condition in daily 4 hour MACD. Deeper retreat could be seen for the near term. But we’d expect strong support from 148.09, 23.6% retracement of 133.03 to 152.52 at 147.92 to contain downside, and set the range of the consolidation.

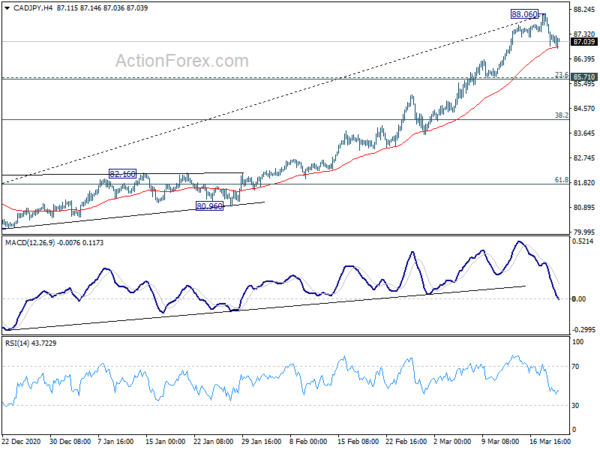

CAD/JPY could have formed at short term top at 88.06 too. Deeper pull back might be seen for the near term. But we’d expect strong support from 85.71, 23.6% retracement of 77.91 to 88.06 at 85.66 to contain downside, and set the range of the consolidations.

Nevertheless, firm break of the mentioned cluster support level for GBP/JPY and CAD/JPY could indicate that broader risk correction is underway, which would be reflected in the development in selloff in stocks, and likely stronger rally in Dollar index.

Nevertheless, firm break of the mentioned cluster support level for GBP/JPY and CAD/JPY could indicate that broader risk correction is underway, which would be reflected in the development in selloff in stocks, and likely stronger rally in Dollar index.

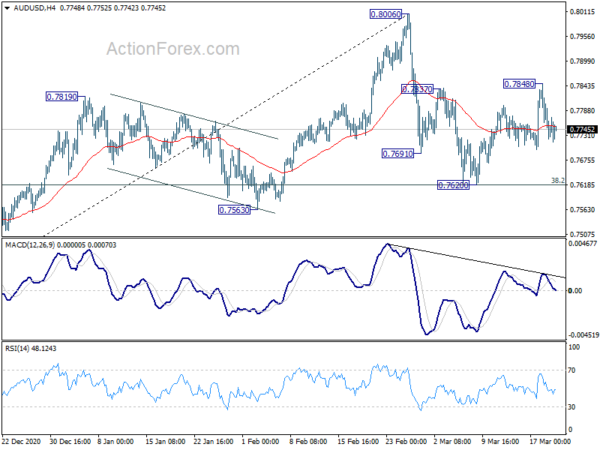

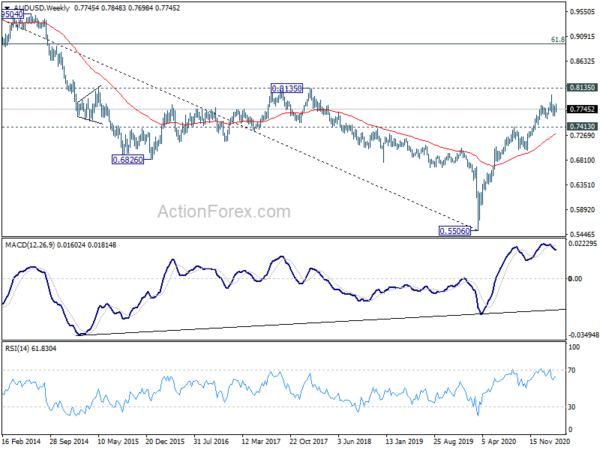

AUD/USD recovered to 0.7848 last week but failed to sustain above 0.7837 resistance and reversed. Initial bias remains neutral this week first and correction from 0.8006 could extend further. On the upside, above 0.7848 will bring retest of 0.8006 high. However, break of 0.7629 support will resume the fall from 0.8006. Firm break of 0.7563 will indicate that deeper correction is underway, back towards 0.7413 resistance turned support.

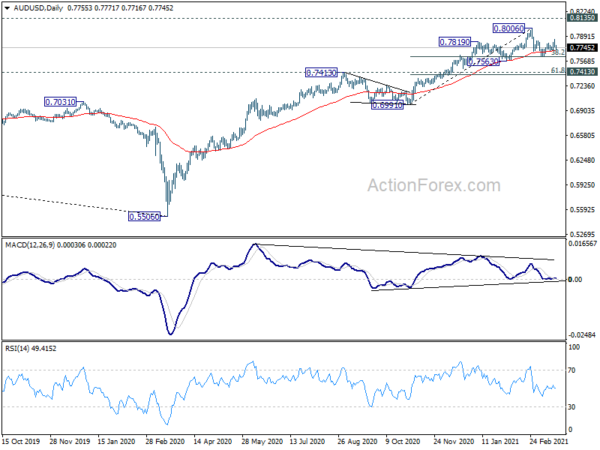

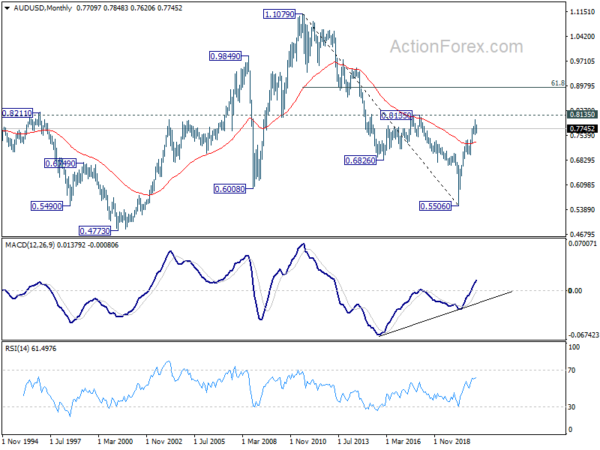

In the bigger picture, whole down trend from 1.1079 (2001 high) should have completed at 0.5506 (2020 low) already. Rise from 0.5506 could either be the start of a long term up trend, or a corrective rise. Reactions to 0.8135 key resistance will reveal which case it is. But in any case, medium term rally is expected to continue as long as 0.7413 resistance turned support holds.

In the longer term picture, 0.5506 is a long term bottom, on bullish convergence condition in monthly MACD. Focus is now back on 0.8135 structural resistance. Decisive break there will raise the chance that rise from 0.5506 is an impulsive up trend. Next target should be 61.8% retracement at 0.8950 and above. Though, rejection by 0.8135 will keep the case of medium to long term sideway consolidation open.