Powell wraps up the press conference

You would have to dig very deep to find anything remotely hawkish about the FOMC statement or Powell’s press conference.

The market reaction has been definitive and it’s extending following the Q&A:

- USD lower

- Stocks higher

- Treasury curve on a front-end led bull steepener

- Commodity prices higher including 1% in gold

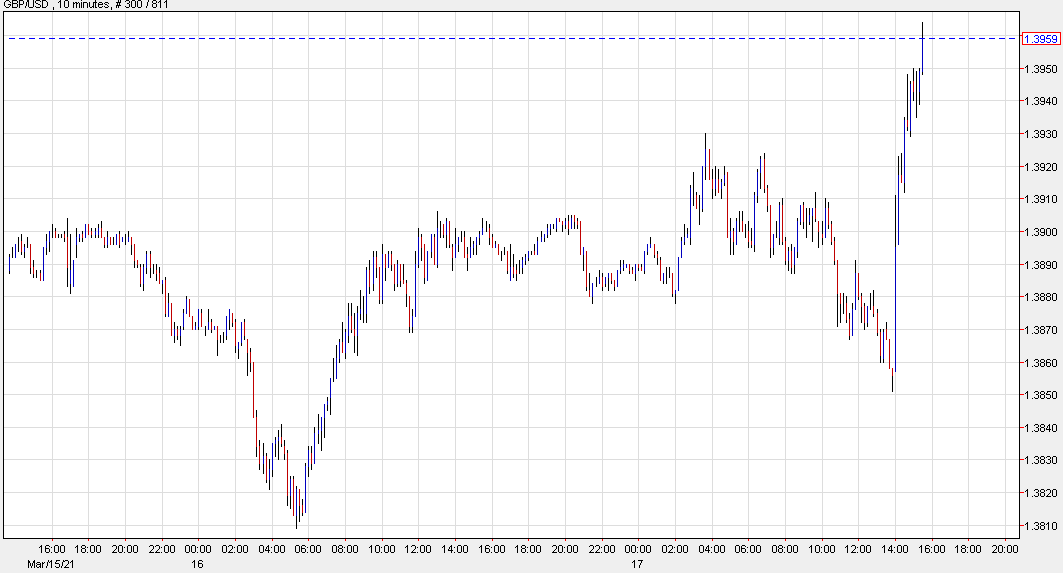

Cable was really caught out on the FOMC. It hit the lows of the day just before the dots and statement but is up more than 100 pips from the lows.

I don’t see any reason to fade this. The stimulus money is flowing and the economy is roaring to life. One exception might be USD/JPY, which is 40 pips from the highs but will benefit from higher equities. A better trade would be to go with the move in USD/CAD, which is hitting a 3-year low.

This article was originally published by Forexlive.com. Read the original article here.