Risk trades and the dollar wait on the bond market reaction to the Fed

US futures are keeping flat, with the dollar mostly little changed across the board as narrower ranges continue to prevail for the time being. EUR/USD is resting close to 1.1900 and trading within a 15 pips range to start European morning trade.

Other than that, light flows are seeing the pound a touch higher with the aussie on the weaker side but nothing substantial as we get the session underway.

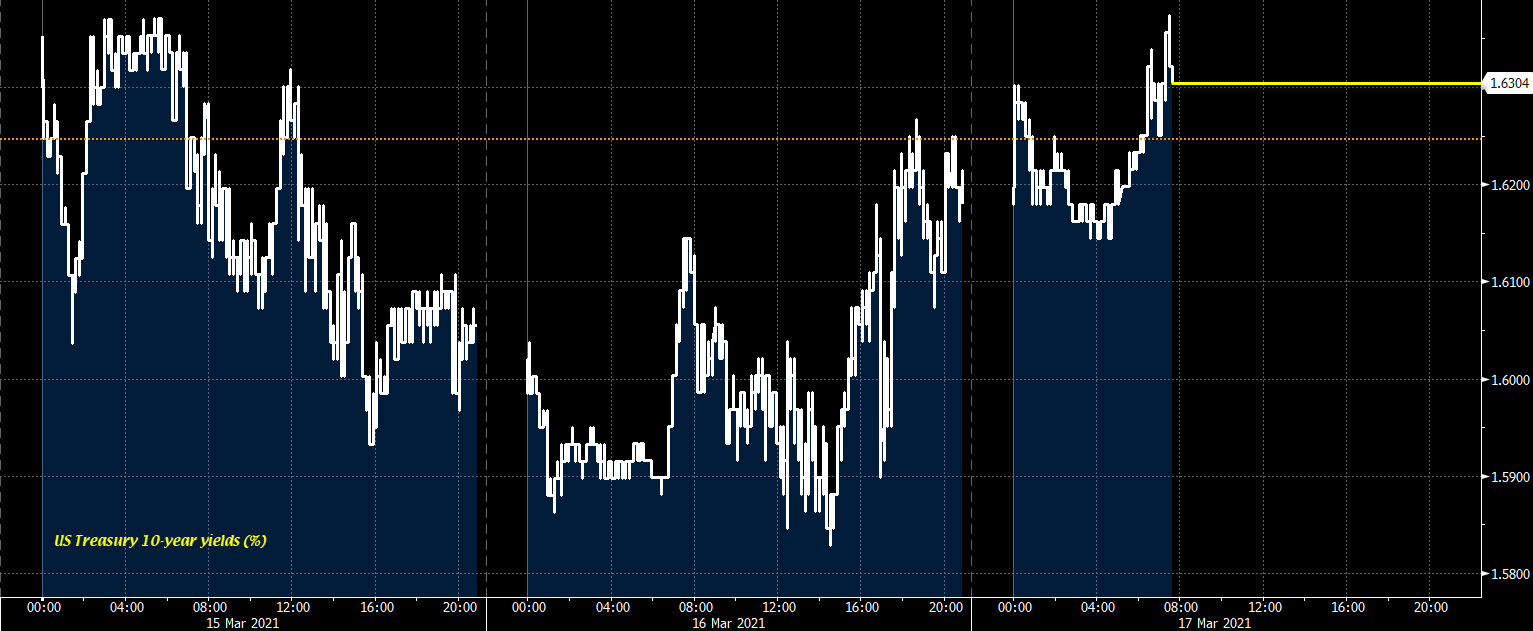

Elsewhere, Treasuries are also not offering much for the market to work with though 10-year yields are a little higher. I wouldn’t look much into it though as volumes are relatively light and will stay that way until we navigate through the post-FOMC period.

Whether the Fed wants to or not, Treasuries will see a significant move come the end of the day and that will spark a reaction elsewhere across the market.

I would expect the Fed to keep a more dovish tone but the dot plots and SLR extension decision may just be what investors choose to focus on.

In that sense, it reaffirms that regardless of what happens today, the path of least resistance for Treasuries is lower i.e. yields higher. Although, one can argue that with how much the market is getting ahead of the Fed already, there might not be much else to move for the remainder of the year if investors get the green light again today.