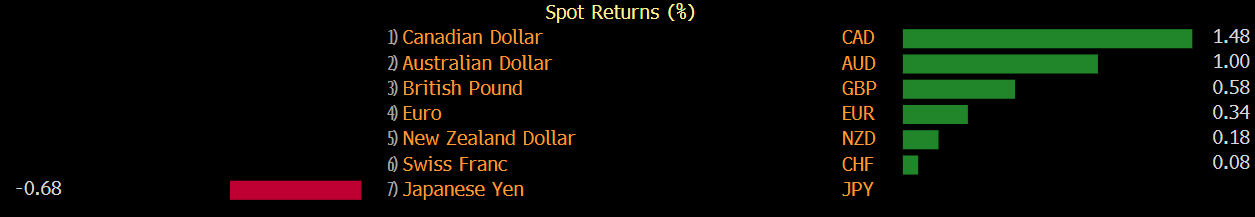

Canadian dollar was the top performer this week

At the bottom of the ledger is the yen, which isn’t a surprise given the rebound in risk sentiment and rising global bond yields. Even the BOJ looks to be backing away from its most-aggressive QE and ETF buying programs.

Five weeks ago, I made the case for CAD/JPY longs just after a soft Canadian jobs report. It’s been a sensational trade, rising to 87.40 from 82.50 — 500 pips in a straight line.

It was a case of fundamentals and technicals aligning.

Here it is now:

At the time I wrote:

The market is increasingly focused on the prospects for US stimulus and ignoring near-term headwinds around pandemic job losses.

There’s

this seemingly-unbreakable paradigm in markets where bad news is

ignored as the market looks towards a idealized post-vaccine world.

Couple that with governments spending like never before and central

banks promising to keep rates low and every hiccup in markets begins to

look like an opportunity.

I’m on board with

that thinking, at least until we start to see if the post-vaccine

economy matches the market’s imagination (I think it will fall short

after the initial boom). For now, though, none of that matters.

It was the best possible G10 currency trade in the last 5 weeks. What next?

Nothing has changed on the fundamental side. I’m still struck by the levels of pessimism and worry. Obviously, there are some overbought indications so there’s no rush to get in but a target of 90 or 92 on a pullback is prudent.