Huge volatility continues in stock markets as Asian indices dive following the selloff in US overnight. But movements in exchange rates are relatively subdued, and mixed. Swiss Franc, Yen and Euro are currently the weaker ones for the week, followed by Dollar. Australian Dollar is leading other commodity currencies and Sterling as the strongest. However, odds of a come back of risk aversion is building, with NASDAQ near completing and head and shoulder pattern. Fundamentally, we’ll have a speech by Fed Chair Jerome Powell today, and US non-farm payrolls tomorrow, which could trigger more volatility.

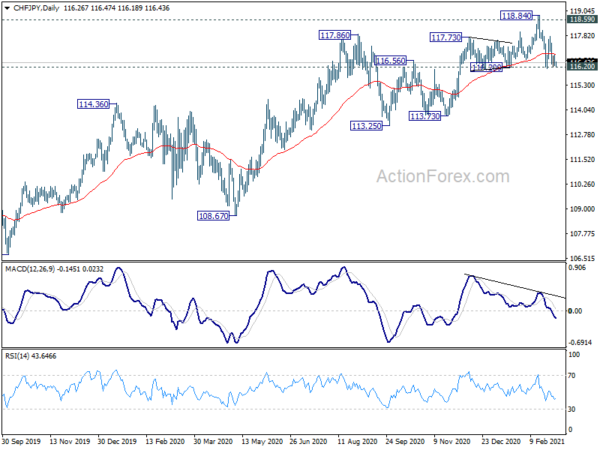

Technically, in case of risk off trades, we’ll monitor 106.66 minor support in USD/JPY and 0.9135 minor support in USD/CHF. Break of these levels would indicate that Dollar is over-powered by Yen and Swiss Franc for the near term at least. At the same time, 116.20 support in CHF/JPY will decide which one will decide if Yen could outperform the Swiss Franc.

In Asia, currently, Nikkei is down -2.39%. Hong Kong HSI is down -2.55%. China Shanghai SSE is down -1.58%. Singapore Strait Times is up 0.17%. Japan 10-year JGB yield is up 0.0111 at 0.135. Overnight, DOW dropped -0.39%. S&P 500 dropped -1.31%. NASDAQ dropped -2.70%. 10-year yield rose 0.055 to 1.470.

NASDAQ completing head and should top reversal pattern

NASDAQ closed down -2.7% or -361 pts to 12997.75 overnight, losing 13k handle. More importantly, it’s now pressing 12985.05 support. Decisive break there will confirm a head and shoulder top formation (ls: 13728.98, h: 14175.11, rs: 13601.33. That would confirm near term reversal and target 100% projection of 14175.11 to 13003.98 from 13601.33 at 12430.20 and below.

Nevertheless, the medium term up trend is not too under threat yet. We’re looking at cluster support at 12074.06 (61.8% retracement of 10822.57 to 14175.11 at 12103.24) to contain downside and bring rebound. That would set the base for another up leg in the current up trend from 6631.42. However, firm break of 12074/12103 will open up the case of deeper medium term correction.

Fed Beige Book: Most businesses remain optimistic

Fed’s Beige Book noted that economic activity expanded “modestly” from January to mid-February for most Districts. “Most businesses remain optimistic” regarding the next 6-12 months, with vaccine distributions.

Consumer spending and auto sales were “mixed”. Despite “challenges from supply chain disruptions”, overall manufacturing activity for most districts “increased moderately”. Employment levels rose, albeit slowly” in most district. Wage increases for many districts are “expected to persist or to pick up somewhat” over the next several months.

In many districts, rise in costs was “widely attributed to supply chain disruptions and to strong overall demand”. Transportation costs “continued to increase” partly on rising fuel costs and capacity constraints. Several districts reported “anticipating modest price increase over the next several months”.

Australia retal sales rose 0.5% in Jan, trade surplus widened to AUD 10.1B

Australia retail sales rose 0.5% mom in January, slightly below expectation of 0.6% mom. Comparing to a year ago, sales turnover rose 10.6% yoy. All state and territories reported growth, except Queensland with -1.5% mom decline. Western Australia reported strongest sales growth by 2.1% mom, followed by Victoria and Tasmania at 1.0%.

Exports of goods and services rose 6% mom to AUD 39.8B in January. Imports of goods and services dropped -2% mom to AUD 29.7B. Trade surplus widened to AUD 10.1B, above expectation of AUD 6.3B.

RBNZ Orr: We will not be resuming business as previous in its entirety any time soon

RBNZ Governor Adrian Orr said in a speech, the current pic up in economic activity is “sector and event specific”, and “we will not be ‘resuming business as previous’ in its entirety any time soon”.

While the initiation of global vaccination program is positive, “there remains a significant period before widespread immunity is achieved”. In the meantime, “economic uncertainty will remain heightened and international mobility restrictions will continue”.

Looking ahead

UK will release PMI construction in European session. Eurozone will release unemployment rate, retail sales and ECB economic bulletin. Later in the day, US will release jobless claims, non-farm productivity and factory orders. Canada will release labor productivity.

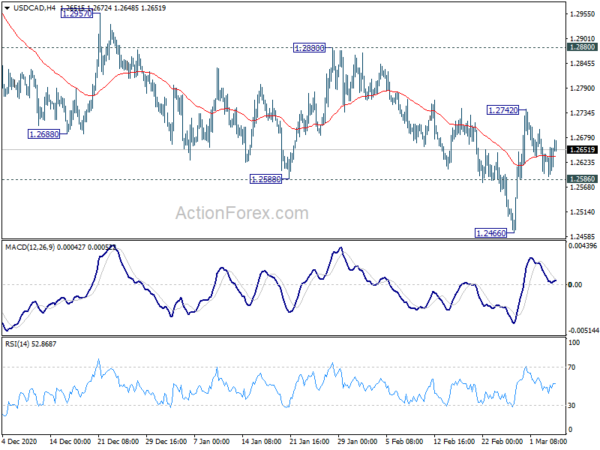

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.2612; (P) 1.2636; (R1) 1.2678; More….

Outlook in USD/CAD is unchanged and intraday bias remains neutral for the moment. Rebound from 1.2446 could still extend with another rise through 1.2742. But overall, outlook will remain bearish as long as 1.2880 resistance holds. Below 1.2586 will turn bias to the downside and bring retest of 1.2466 low first. However, sustained break of 1.2880 will argue that fall from 1.3389 has completed and bring stronger rise to 1.2994 support turned resistance.

In the bigger picture, fall from 1.4667 is seen as the third leg of the corrective pattern from 1.4689 (2016 high). Further decline should be seen back to 1.2061 (2017 low). In any case, break of 1.2994 support turned resistance resistance is needed to indicate medium term bottoming. Otherwise, outlook will remain bearish in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 0:30 | AUD | Retail Sales M/M Jan | 0.50% | 0.60% | 0.60% | |

| 0:30 | AUD | Trade Balance (AUD) Jan | 10.14B | 6.30B | 6.79B | 7.13B |

| 5:00 | JPY | Consumer Confidence Index Feb | 33.8 | 30.6 | 29.6 | |

| 9:00 | EUR | ECB Economic Bulletin | ||||

| 9:30 | GBP | Construction PMI Feb | 51.5 | 49.2 | ||

| 10:00 | EUR | Eurozone Unemployment Rate Jan | 8.30% | 8.30% | ||

| 10:00 | EUR | Eurozone Retail Sales M/M Jan | -1.10% | 2.00% | ||

| 12:30 | USD | Challenger Job CutsY/Y Feb | 17.40% | |||

| 13:30 | CAD | Labor Productivity Q/Q Q4 | -10.30% | |||

| 13:30 | USD | Initial Jobless Claims (Feb 26) | 755K | 730K | ||

| 13:30 | USD | Nonfarm Productivity Q4 | -4.70% | -4.80% | ||

| 13:30 | USD | Unit Labor Costs Q4 | 6.70% | 6.80% | ||

| 15:00 | USD | Factory Orders M/M Jan | 1.90% | 1.10% | ||

| 15:30 | USD | Natural Gas Storage | -338B |