Forex news for North American trading on February 19, 2021

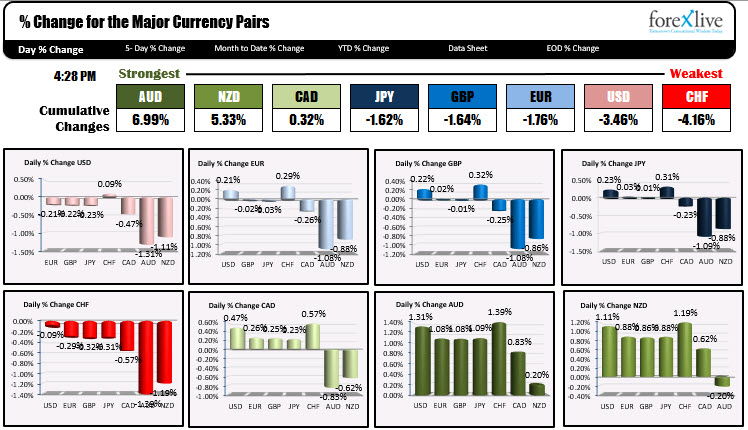

The USD was the weakest currency at the close of yesterday and it continued the move to the downside today. Although it was not the weakest of the majors (the CHF was the weakest), it fell vs all the majors with the exception of the CHF. The biggest declines were centered vs. the AUD (-1.31%) and the NZD (-1.11% ). The USD also lost ground vs the CAD (-0.47%). The other declines were worse intraday, but saw some after dollar buying to ease some of the declines. For the day the AUD was the strongest of the majors.

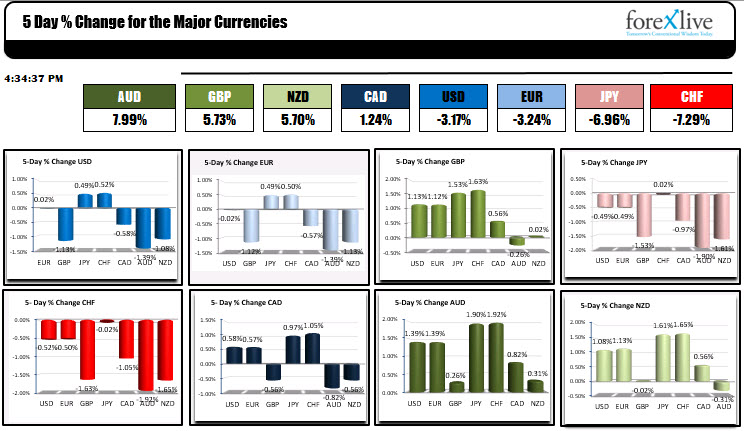

For the week, thanks to the oversized gains today, the AUD is also the strongest of the majors. The CHF is the weakest. The US dollar is mostly lower with declines vs. the GBP (-1.14%), AUD (-1.39%), NZD (-1.08%) and the CAD (-0.58%). The greenback rose vs. CHF (+0.52%) and JPY (+0.49%). The USD was unchanged vs. EUR for the week. The charts below show the percentage changes of the major currencies vs. each other along with the rankings from the strongest of the weakest.

Fundamentally today

Fundamentally today

- US existing home sales came in slightly better than expectations as the housing market remains strong.

- The Markit preliminary services PMI was slightly higher-than-expected 58.9 vs. 50.0 estimate

- Feds Barkin does not see inflation in the numbers, while Fed’s Rosengren sees a robust recovery underway in the 2H but is all for a big fiscal package given 10M workers are still displaced as a result of Covid

Other markets today show:

- spot gold plus $7.44 or 0.42% $1783.11.. The price last week settle at $1824. The $41 decline represents a fall of -2.2% for the week

- Spot silver is trading up $0.24 or 0.89% to $27.27. That is down marginally from the closing price last Friday at $27.36

- WTI crude oil futures for April is trading down $1.57 or -2.59% at $58.95. Last Friday closed at $59.38. The -$0.43 decline is surprising given the Arctic freeze that gripped the US and sent prices up to the highest level in over year on Thursday ($62.29). Yesterday and continuing today, the thaw in the market sent prices lower.

- Bitcoin is trading a $55,555 (might as well pick that number). That is up $3579 or 6.88%. The sharp rise today, caps a week that saw the digital currency move up from $47,947 at the close last Friday. The percentage gain for the week was at 15.8%.

In the US equity markets this week:

- Dow, +0.2%

- S&P index -0.25%

- NASDAQ index, -1.08%

- UK FTSE 100, +0.52%

- France’s CAC, +1.23%

- German DAX, -0.4%

- Spain’s Ibex, +1.2%

- Italy’s FTSE MIB, -1.17%

- Japan’s Nikkei, +1.69%

- Hong Kong’s Hang Seng index +2.02%

- China’s Shanghai composite index +5.72%

- Australia’s S&P/ASX index -0.19%

Next week the reserve Bank of New Zealand interest rate decision, and testimony from Feds Powell on Capitol Hill will highlight the events for the week.

Wishing everyone a safe and happy weekend. Thank you for your support.