- Sustained USD selling assisted gold to stage a modest bounce from multi-month lows.

- An uptick in the US bond yields, the underlying bullish tone capped gains for the metal.

- The set-up still favours bearish traders and supports prospects for further weakness.

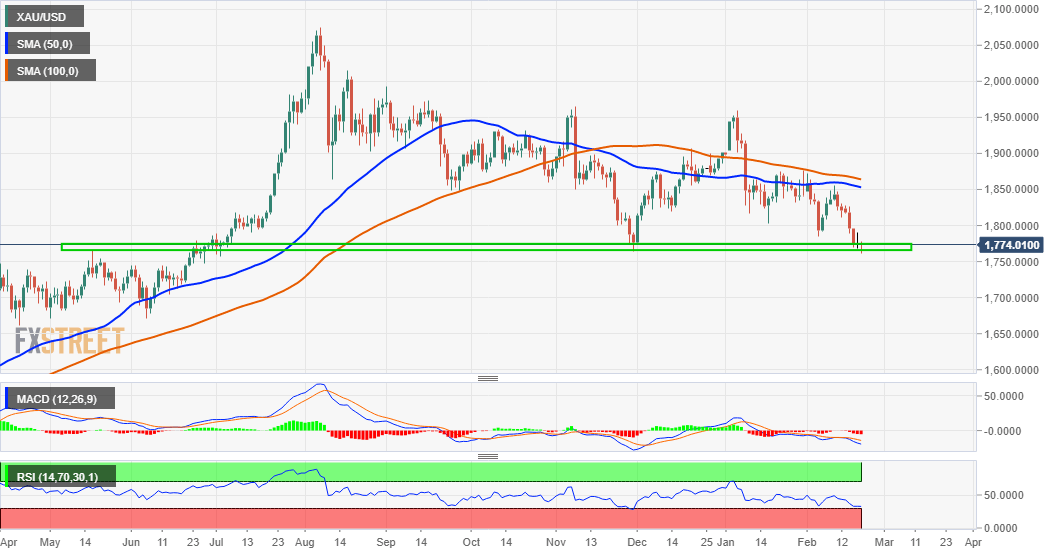

Gold struggled to capitalize on its attempted recovery from the lowest level since July 2020 and was last seen trading with modest losses, around the $1773 region.

Some follow-through US dollar selling extended some support to the dollar-denominated commodity. That said, a pickup in the US Treasury bond yields and the underlying bullish sentiment capped the upside for the non-yielding yellow metal.

From a technical perspective, the commodity’s inability to register any meaningful recovery suggests that the near-term bearish bias might still be far from being over. This, in turn, supports prospects for a further depreciating move.

That said, slightly oversold conditions on short-term charts seemed to be the only factor limiting the downside for the XAU/USD, at least for the time being. Nevertheless, the bias remains tilted firmly in favour of bearish traders.

Some follow-through weakness below the daily swing lows, around the $1760 region will reaffirm the negative outlook and set the stage for a slide towards the $1745 support. The metal might eventually drop to test the $1732-30 support zone.

On the flip side, momentum beyond the $1775-76 region might still be seen as an opportunity for bearish positions and runs the risk of fizzling out rather quickly. This should keep a lid on further gains for the XAU/USD ahead of the $1800 mark.

A sustained move beyond the mentioned barrier might negate the bearish outlook and prompt some near-term short-covering move. The commodity might then accelerate the slide further towards the next relevant resistance near the $1825 horizontal zone.