The central banks are listed below with their current state of play. The link for each central bank is included in the title of the bank and the next scheduled meeting is in the title too.

Reserve Bank of Australia, Governor Phillip Lowe,0.10%,Meets 02 March

The Reserve Bank of Australia met on February the 02 and delivered a surprise to the markets. They kept the interest rate and the 3yr bond yield target unchanged at 0.10%. This was as expected. Like December’s meeting the RBA noted that the recent economic recovery had been based on significant fiscal and monetary support. The RBA said they will not increase interest rates until actual inflation is above the 2-3% target range. This means that interest rates are expected to stay as they are until 2024. There was, however, a change. Thatchange to monetarypolicy was the expansion of the RBA’s bond purchases.Bond purchases were extended by $AUD100 billion. This was slightly unexpected as some desks had been expecting the possibility of QE coming to an end in April on the back of stronger labour data.

Like last time, the RBA’s statement was generally quite upbeat, despite the dovish twist in their policy action. Remember that QE purchases weaken a currency, so the AUD was weaker out of the meeting. You can read the whole statement here from the RBA. The optimistic tone was affirmed by the Australian Treasury Secretary Kennedy who said that the recovery exceeded expectations and the labour market participation is somewhat surprising.

Remember that the Australian economy is closely tied to China’s economy. Approximately 30% of Australia’s GDP comes from its trade with China. Therefore, expect the AUD to be pushed or pulled along with the US-China trade sentiment. A falling S&P500 tends to weaken the AUD and vice versa, so keep an eye on the latest US stock moves as well in deciding the next path for AUD. The AUD should remain supported medium term on the reflation narrative.

European Central Bank, President Christine Lagarde, -0.50%, Meets March 11

The ECB repeated that Interest rates are expected to remain low until the inflation outlook moves up to a level sufficiently close to, but below 2% within its horizon framework. However, there was a shift in the language about the PEPP programme size.The key takeaway was the emphasis shift about the full use of the PEPP envelope. The ECB reminded markets that the full envelope does not necessarily have to be used. This is a decidedly more upbeat message and is an acknowledgement to ECB policy makers who did not want such a large PEPP envelope in the first place. The total amount of the PEPP envelope remains at €1850 billion with purchases are set to remain until at least the end of March 2022.

In the press conference just after the announcement Christine Lagarde echoed this positive sentiment reflected in the statement noting that risks to growth is still tilted to the downside, but less pronounced. This now sees the ECB joining the ranks of the central banks who are turning more upbeat due to vaccine optimism. One interesting point is that the ECB are asking staff to come up with new gauges to help with stimulus decisions as well as a new gauge of euro area financial conditions. The proposals are wanted from staff for March. Finally, with regard to the EURUSD exchange rate Lagarde said that the ECB was carefully monitoring FX rates.The ECB don’t like a strong EURUSD as it harms euro exporters and if the EURUSD gets too strong, too fast the ECB may act. She repeated that no-tools are off the table.

The reaction of the EURUSD after the decision was very muted and mainly dollar driven. The bog picture remains that are pressures on the eurozone which may face a double dip recession and is slow with the vaccine roll outs. If the US starts to outperform Europe in terms of GDP growth and vaccinating their citizens far more quickly this will weigh on the EURUSD going forward.

Bank of Canada, Governor Stephen Poloz, 0.25%, Meets March 10

Like the ECB the Bank of Canada also had a more optimistic outlook. The general hope is that the current vaccine will boost the world economy and central banks are starting to cautiously enter into that hope. The Bank of Canada signalled that they too can see some possible light at the end of the COVID-19 tunnel.Heading into the latest meeting there had been rumoured to be a slight chance of a very small rate cut mooted by market participants.However, these were unfounded and rates were kept unchanged at 0.25% and bond purchases remained at the CAD $4 billion per week level. The Bank of Canada repeated that interest rates were not expected to rise until 2023, like the Federal Reserve.However the bullish twist for the CAD was due to see pretty hearty revisions for growth.End of 2021 growth is now seen as +4.6% vs +3.8% previously. Inflation was revised up to +1.5% vs +1.3%. The big push higher for oil has been helping the Canadian oil export economy and the growth revisions show the better outlook.

Macklem in the Press Conference

Macklem’s noteworthy comments in the press was the BoC’s concern about a stronger CAD. The rise in CAD does provide some risks to the outlook for the Canadian economy, so the BoC will not want to thwart their own hand by appearing ‘too rosy’ on Canada’s prospects. Out of the event the CAD rose sharply (USDCAD falls) sensing a better outlook for Canada. The OiS futures curve suggest that the BoC is likely to keep rates at the current level for the foreseeable future.

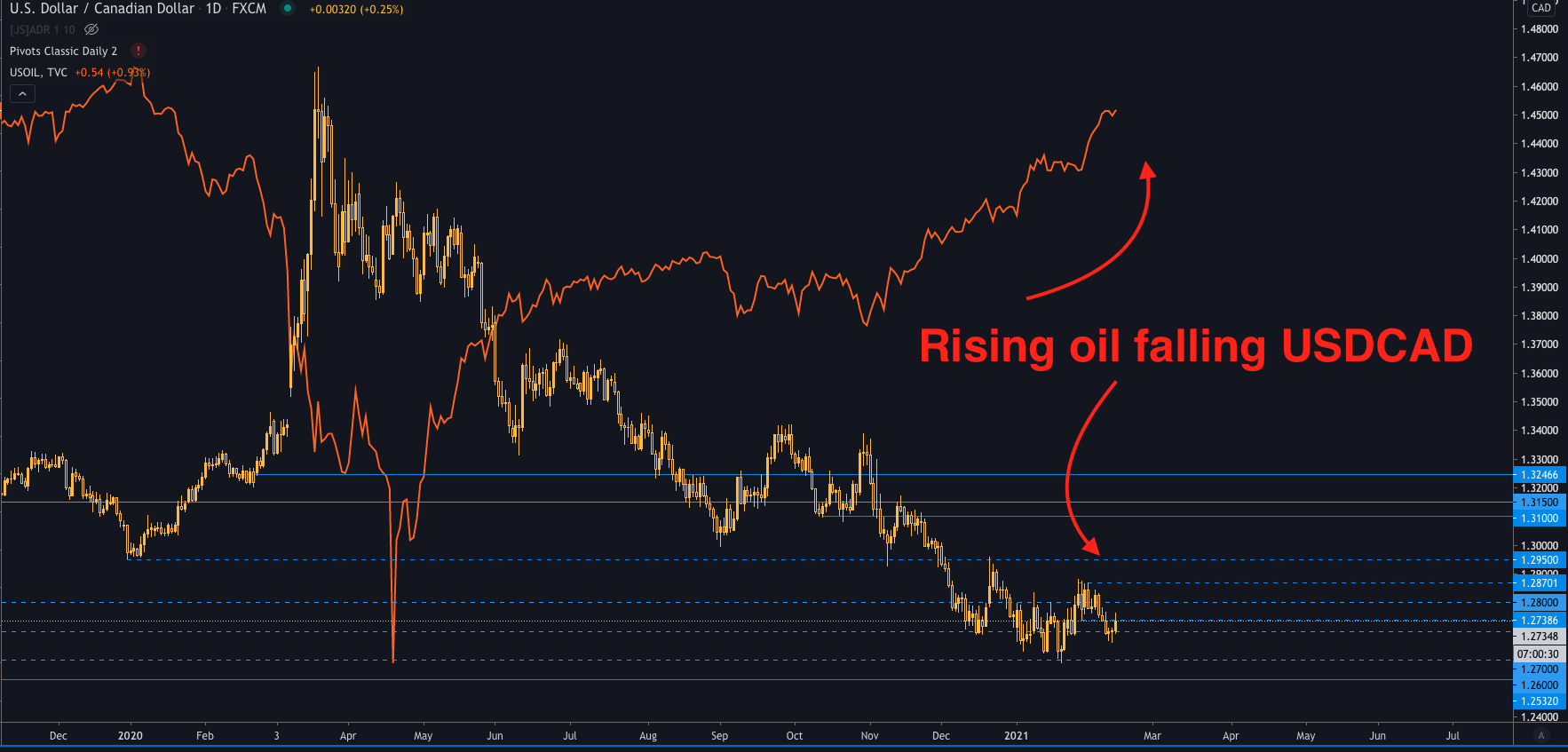

Remember that stronger oil supports the CAD as around 17% of all Canadian exports are oil related. There is negative correlation between USD/CAD and oil has broken down recently. Canada’s top export is Crude Petroleum at over $66 billion and around 15.5% of Canada’s total exports.

Federal Reserve, Chair: Jerome Powell,0.125%. Meets March 17

The US rates were left unchanged at the January meeting, as expected. The Fed recognised there was a ‘moderation’ in the pace of the US recovery in recent months and managed on balance to strike the right note between vaccine optimism yet sufficient dovishness.If they were too hawkish there would be risk of a 2013 taper tantrum repeat. In the press conference after the statement Powell said that he considered real levels of unemployment to be closer to 10% in the US. Two key points of market focus was bind tapering and inflation.

Bond tapering: One key aspect that was anticipated before the meeting was whether the Fed would mention anything on bond tapering. The consensus view was that this would be unlikely. Powell kept to the expected line and stated that it was, ‘too early to talk about tapering’. This reassured markets. Powell went a little further and said that more could be done with bond purchases. This was the right message for the market to hear and hit the right dovish notes.

Inflation: Powell said the Fed will not react to small and transient inflation rises. This is to avoid the scenario where markets start pricing in interest rate rises on the first sign of inflation. Investors will almost certainly do this anyway, but Powell is wanting to warn against that. There were no comments on the exact levels of inflation as you would expect, but Powell said he would ‘welcome’ higher inflation.

The takeaway is that the Fed is on hold and there bias is to strike a balance that sounds a little hopeful, but doesn’t get the market thinking that bond tapering is coming. At some point the US will come out of this crisis and if it comes out strongly watch the US dollar for gains and the US10 year yields should lead that story.

You can read January’s full statement here.

Part 2 to follow with the BoE, BoJ, SNB, and RBNZ