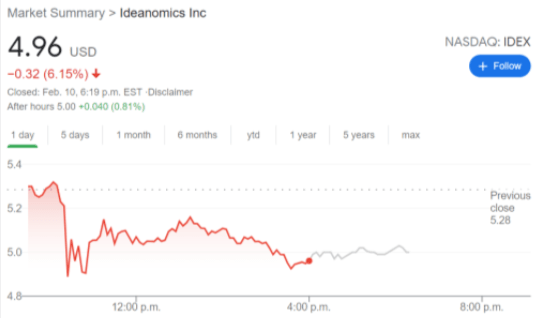

- NASDAQ:IDEX drops by 6.15% amidst a broader market decline as momentum wanes.

- Recent acquisitions position IDEX well for the current electric vehicle revolution.

- Ideanomics has announced an initial order for its BYD D1 ride-hailing electric vehicles for China.

NASDAQ:IDEX has been one speculative play on the booming electric vehicle industry that has certainly paid off for investors. While it does not get the same headlines or mainstream discussion as companies like Tesla (NASDAQ:TSLA) or Nio (NYSE:NIO), Ideanomics has still returned nearly 880% to investors over the past 52 weeks. On Wednesday, shares dipped 6.15% as global markets, as well as the broader electric vehicle sector, experienced a slight correction after soaring all of last week. The stock started the trading session off strong, hitting as high as $5.37 as it approached its 52-week high, but then dropped off to $4.96 at the closing bell.

Ideanomics has been fairly busy over the past year as it has worked on acquiring smaller firms to build up its product line and intellectual property. Recently Ideanomics has purchased WAVE or Wireless Advanced Vehicle Electrification, Inc. as well as real estate technology platform, Timios. The latter was an acquisition by Ideanomics Inc.’s fintech branch, which is hoping to bring in over $100 million in revenue from Timios in 2021.

IDEX stock news

Perhaps more exciting for investors is the order of 2,000 BYD D1 ride-hailing electric vehicles that were ordered in China at the end of 2020. The Chinese government has put an emphasis on expanding its electric vehicle infrastructure and provides corporate subsidies to companies who buy clean energy vehicles for their operations. The D1 is the first ride-hailing specific vehicle in the world, and should boost IDEX’s 2021 outlook as the first batch of deliveries are expected to go out during the first half of this year.

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading