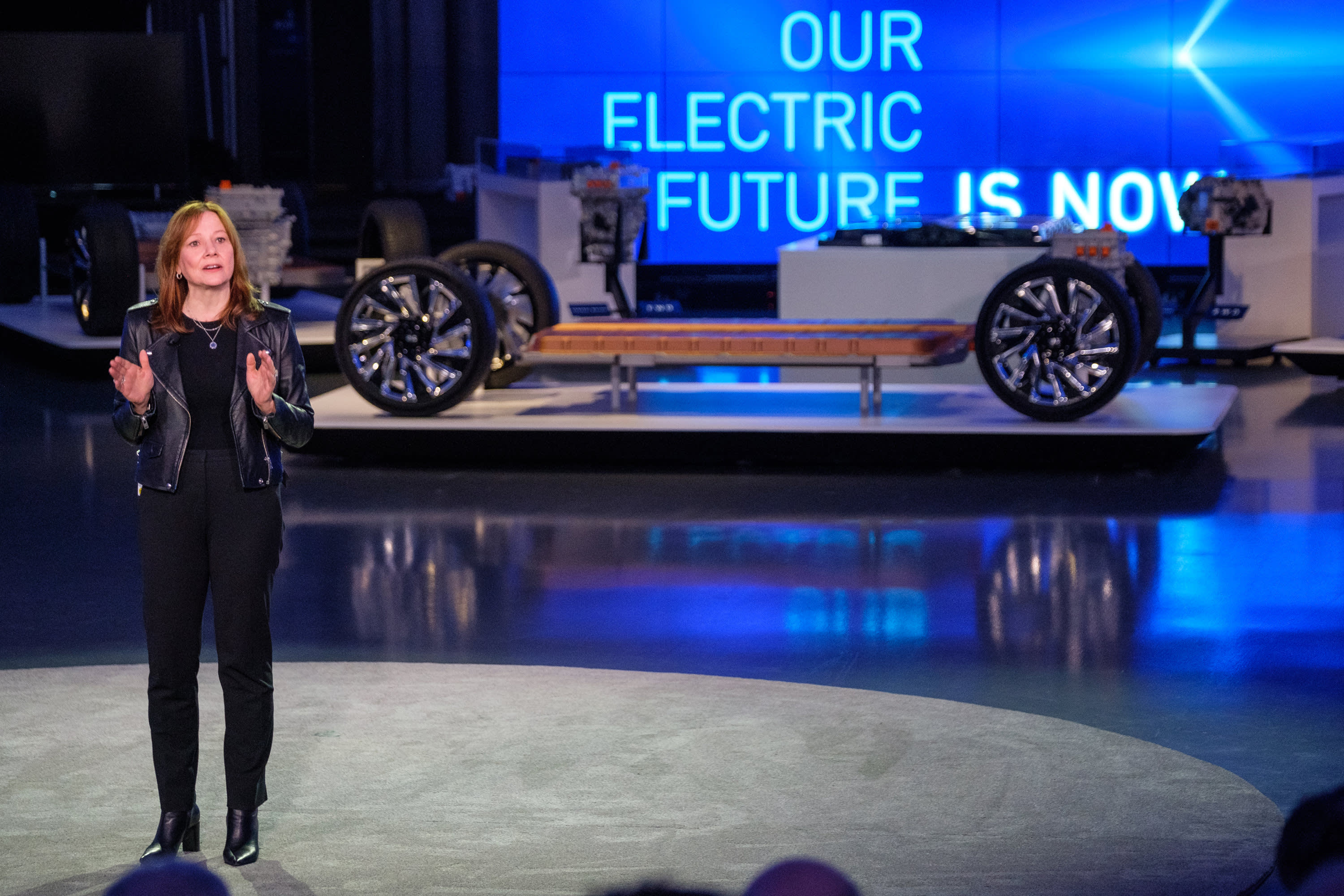

GM CEO and chairman Mary Barra speaks during an “EV Day” on March 4, 2020 at the company’s tech and design campus in Warren, Mich., a suburb of Detroit

GM

General Motors is set to report its fourth-quarter earnings before the bell on Wednesday. Here’s what Wall Street is expecting, based on average analysts’ estimates compiled by Refinitiv.

- Adjusted EPS: $1.64

- Revenue: $36.12 billion

That would be in-line with unofficial guidance from the company. In November, John Stapleton, then-GM’s interim CFO, told Wall Street analysts that GM expected its pretax adjusted earnings would be around $8.5 billion and $9 billion for the second half of the year.

The automaker reported pretax adjusted earnings of $5.3 billion, or $2.83 earnings per share, for the third quarter, while saying the fourth quarter would be weaker due to seasonality.

GM reported an adjusted pretax profit of $105 million in the fourth quarter of 2019 due to a 40-day labor strike impacting vehicle production. Revenue was $30.8 billion during that quarter.

Wall Street is also looking to CEO Mary Barra and other executives for insight into a number of other issues – from 2021 guidance and potential dividend reinstatement to updates on the company’s all-electric and autonomous vehicle plans.

Wall Street analysts also will want to know how a global semiconductor chip shortage is expected to impact the automaker in 2021. GM’s crosstown rival, Ford Motor, last week said the shortage could lower its earnings by $1 billion to $2.5 billion this year.

Barclays analyst Brian Johnson in a note to investors Monday said the firm expects GM to provide “a cautious 2021 outlook” due to the semiconductor chip shortage.

GM’s shares are up by more than 30% so far this year, led by optimism regarding its all-electric vehicle plans and new technologies.

This story is developing. Please check back for updates.