Ups and downs continue in the NZDUSD pair

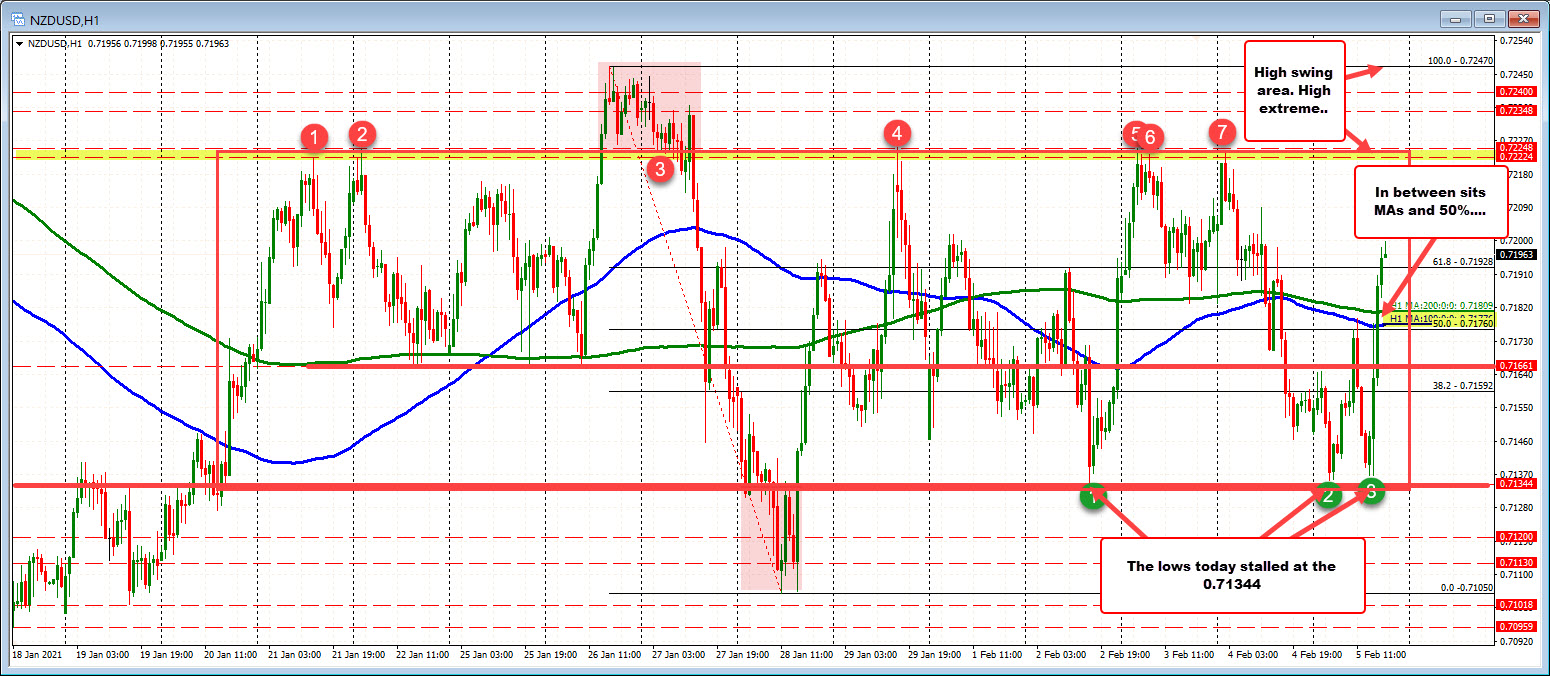

The NZDUSD has tilted the bias back to the upside after moving back above the 50% of the range (going back to January 20) and the 100 and 200 hour MAs. Those three technical levels are between 0.7176 and 0.71809.

The lows today tested the low from Tuesday is trade (and the week) at 0.71344, but found willing buyers against the level not just once, but twice.

The rally off the first low stalled near the 50% retracement and 100 hour moving average (blue line). The most recent rise initially stall against the 100 hour moving average again, only to retrace and push through the resistance area.

As long as the price remains above those technical levels, the buyers remain more in control.

On the topside, a key swing area comes in between 0.7222 and 0.72248. That is the next target area. Get above and traders will be looking toward the extreme at 0.72470 .

Overall the pair has been chopping up and down since January 20 with the inside trading range at 0.71344 to 0.72248. There has been a single push above the area, and a single push below the area, with each break failing (see red shaded areas). At some point there will be a shove outside the range with momentum in the direction of the break. For now the 100 and 200 hour moving average and 50% retracement will act as a bullish and bearish barometer as traders await the break.