EUR/GBP broke to fresh lows since May last year below 0.8800 yesterday

After having flirted with a break of key support around 0.8866-67 at the start of the year, sellers are gathering more momentum in shoving the pair lower this week.

The nudge lower below 0.8800 comes after the BOE meeting yesterday, in which the central bank reaffirmed that negative rates are but an insurance policy and not in the base case scenario at the moment – helping to underpin the pound.

That said, the extended break in EUR/GBP below the key support above might have exacerbated the pound upside (in turn, euro downside) this week.

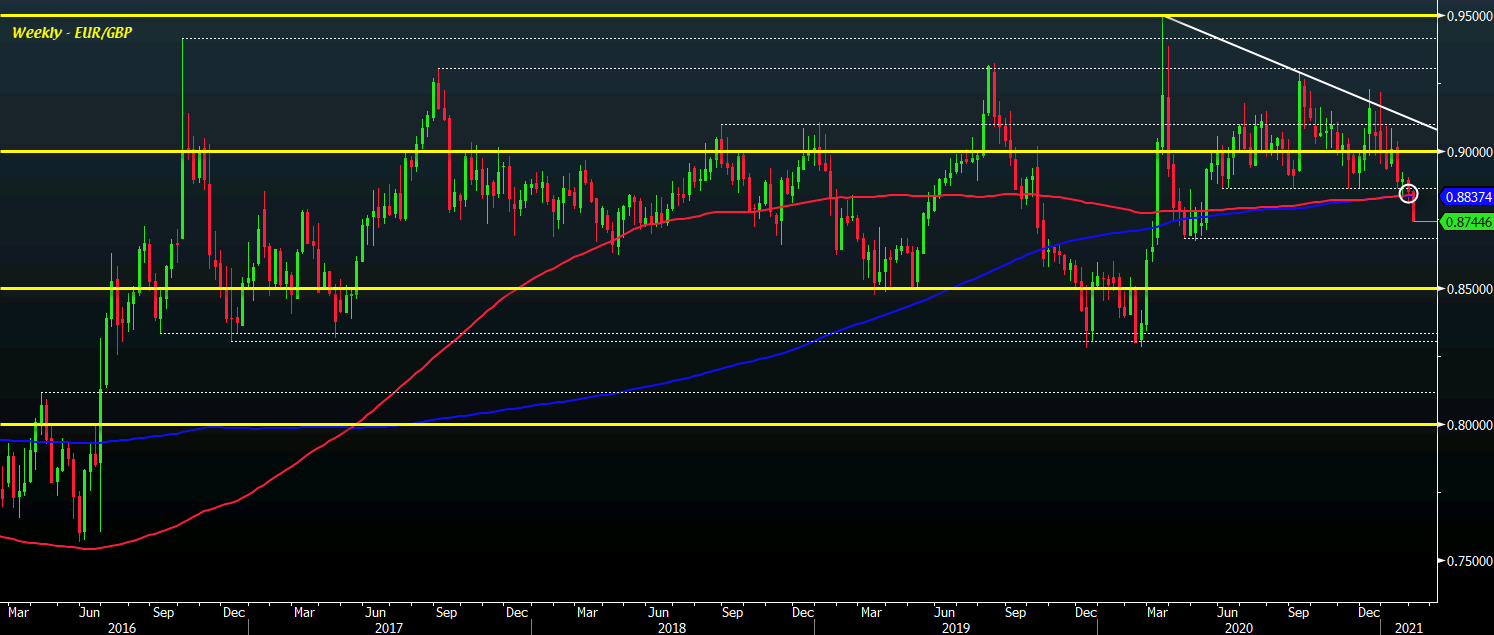

The weekly chart offers a better picture of the technical breakdown as we see price also fall below its key weekly moving averages:

That leaves little in the way of sellers chasing a move towards the April to May lows last year around 0.8671-82 next and that will keep the euro more vulnerable moving forward.

Inadvertently, the technical landscape here also bodes well for the pound as such.