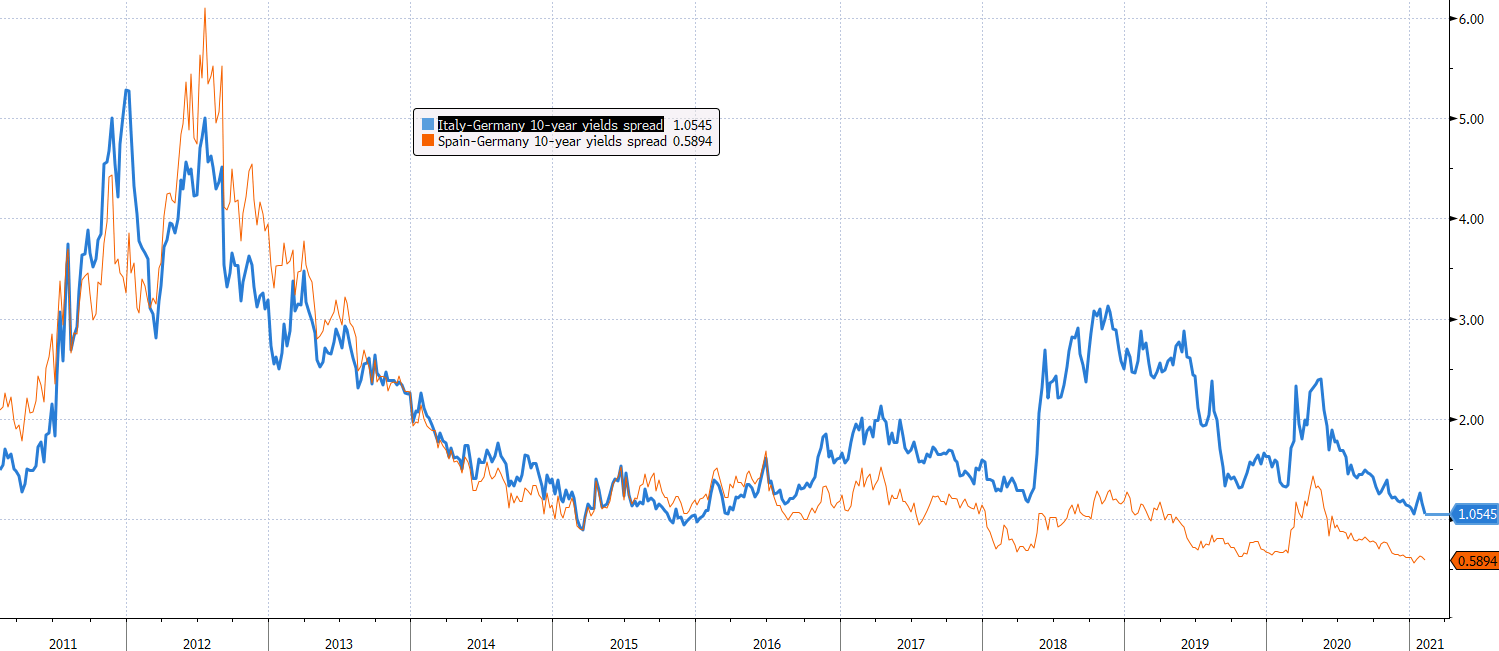

The yields spread between core and riskier debt in the Eurozone narrows

The rise in Treasury yields over the past few days on stimulus hopes is helping to light a fire on yields elsewhere but this also alludes to the market being less confident about the ECB cutting rates further as an option to deal with any inflation fallout.

The rise in long-term euro area inflation expectations (now @ 1.38%) to the highest levels since May last year is also helping to feed into the equation, with the report two weeks ago on the ECB pursuing yields spread control not hurting one bit.

In fact, the yields spread between 10-year Italian and German bond yields has narrowed to its tightest levels since 2016. That is also helped by a rally in BTPs as investors take heart in the possibility of a Draghi-led Italian government this week.

Although the euro may be in a precarious spot against the dollar (one certainly can’t ignore the technical implications of a break below 1.2000), this is one positive backdrop to consider in the bigger picture of things moving forward.

*wink* *wink*

*wink* *wink*This article was originally published by Forexlive.com. Read the original article here.

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)