Daily thread to exchange ideas and to share your thoughts

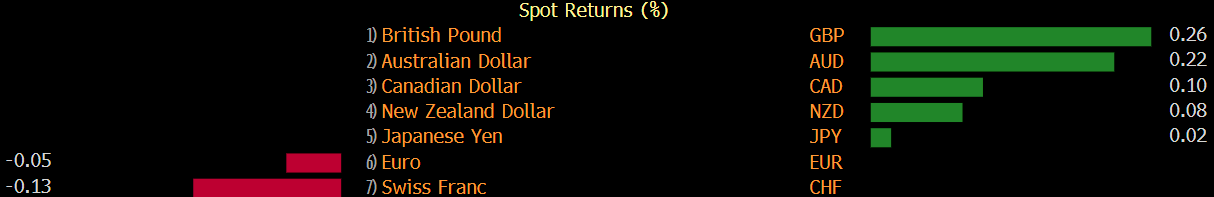

Major currencies are little changed in general to start the new week, though there is a slight hint of a tilt towards risk-on sentiment as we see equities recover after the hammering on Friday last week.

This comes as the retail trading frenzy starts to turn its attention to silver and away from short squeezes perhaps, helping to alleviate some pressure off broader market sentiment.

That said, when it comes to silver, the retail “squeeze” is very much siding with what the big boys are doing – or at least what they are calling for.

Silver fundamentals are pretty much similar to gold, with there only being a couple of differences in terms of supply and demand dynamics. Otherwise, this is continuing to play out as how the big boys are expecting; just with a quicker timeline maybe.

Goldman has silver pinned for $30 in its 12-month target last week, while Citi had argued in December that silver could peak at $28 to $30 as demand recovers. Meanwhile, UBS had at the start of the year also made a case for silver to touch $30 in Q1.

As much as this is supposedly a “revolt against the authority”, it turns out the retail trading frenzy may just have helped exacerbate the timeline in which precious metals should gain during this period on the back of solid fundamentals.

Nonetheless, when things go too far, too fast, there is always the risk of a sharp correction. Silver is up a whopping 14% in three days and is testing daily resistance from its 1 September high @ $28.90 to start the week.

Adding to that will be the August highs @ $29.41 to $29.86 and that will ultimately prove to be the key level to watch if silver is to truly break out in some stunning fashion.