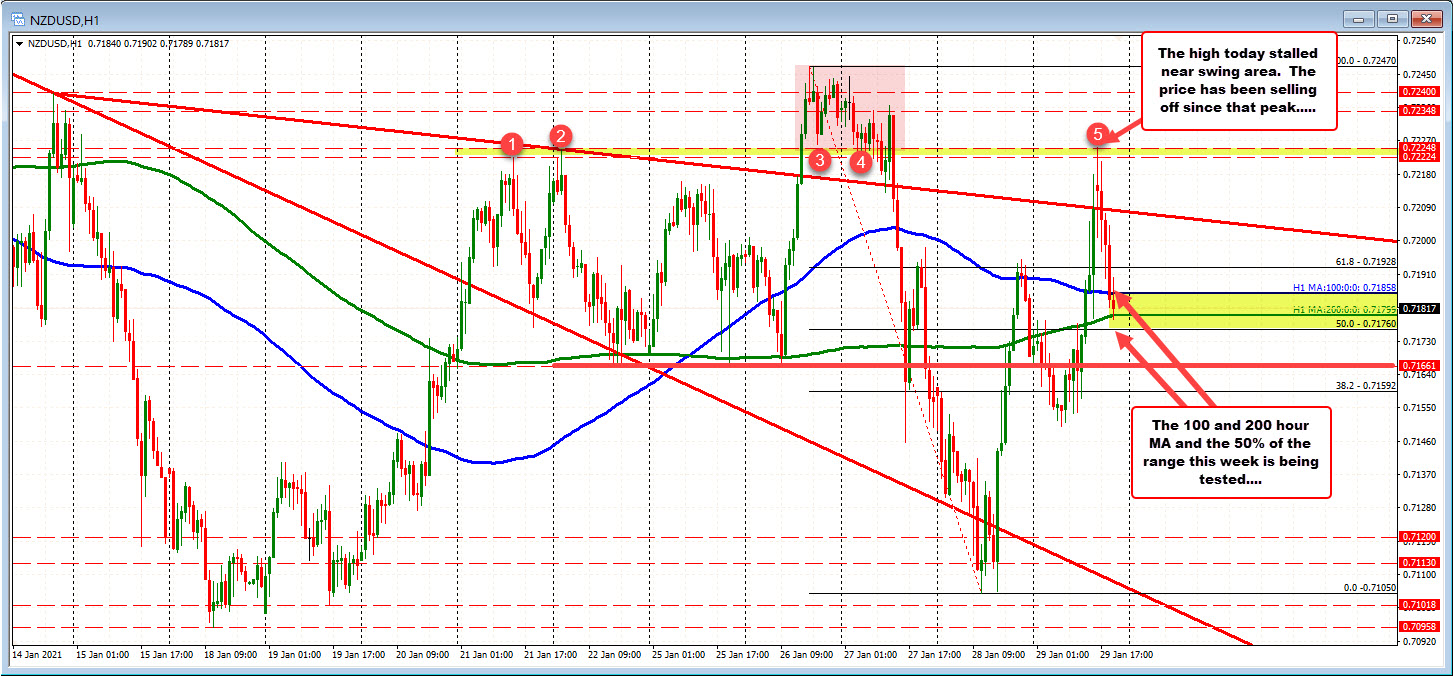

The 100/200 hour MA is being tested

The NZDUSD has tumbled lower over the last 5 hours as stocks hit the skids and risk off flows drive the price lower.

Also helping was the high for the day stalled near an old swing area between 0.77224 and 0.72248. The price moved above that area on Tuesday and tried to stay above on Wednesday, but could not stay above, and tumbled lower to the low for the week during yesterday’s trading.

Today’s move to retest the level and holding, increases that areas importance going forward. Keep the level in mind for next week’s trading.

For now, however, stock declines have the pair testing the week’s midpoint and MAs. Fall below and bias tilts more to the downside.

This article was originally published by Forexlive.com. Read the original article here.