- XAU/USD resting at critical support while the dollar losses some commitments at critical resistance.

- Can the greenback regain its footing in 2021?

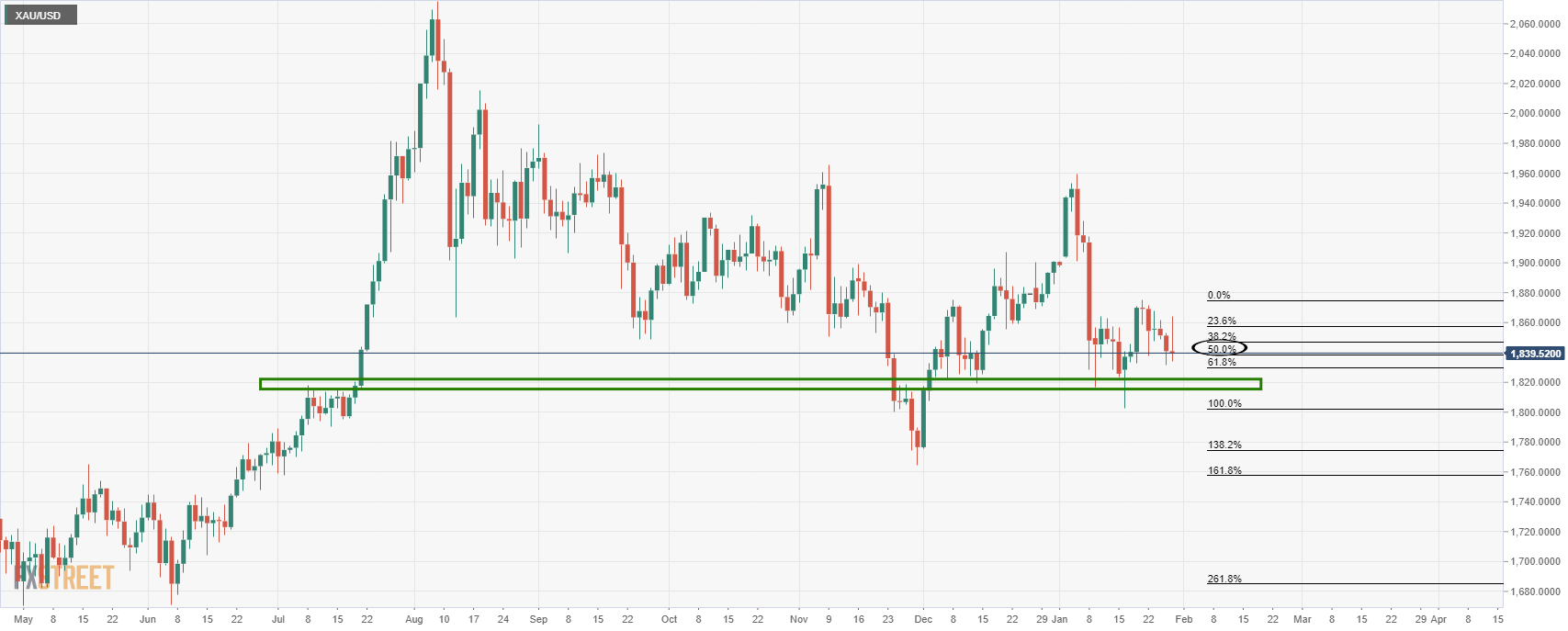

Gold is trading at $1,839, a touch lower on the day, travelling between $1,834.18 and $1,864.11 despite the US dollar’s slide in Europe and New York.

The Federal Reserve’s decision which knocked risk appetite on Wednesday, but gold remains firmly in the recent trading range.

Overall, 2021 had started out with large bearish bets on the dollar since and net short USD positions had edged higher in the week ending December 22. However, the spot market is telling a different story.

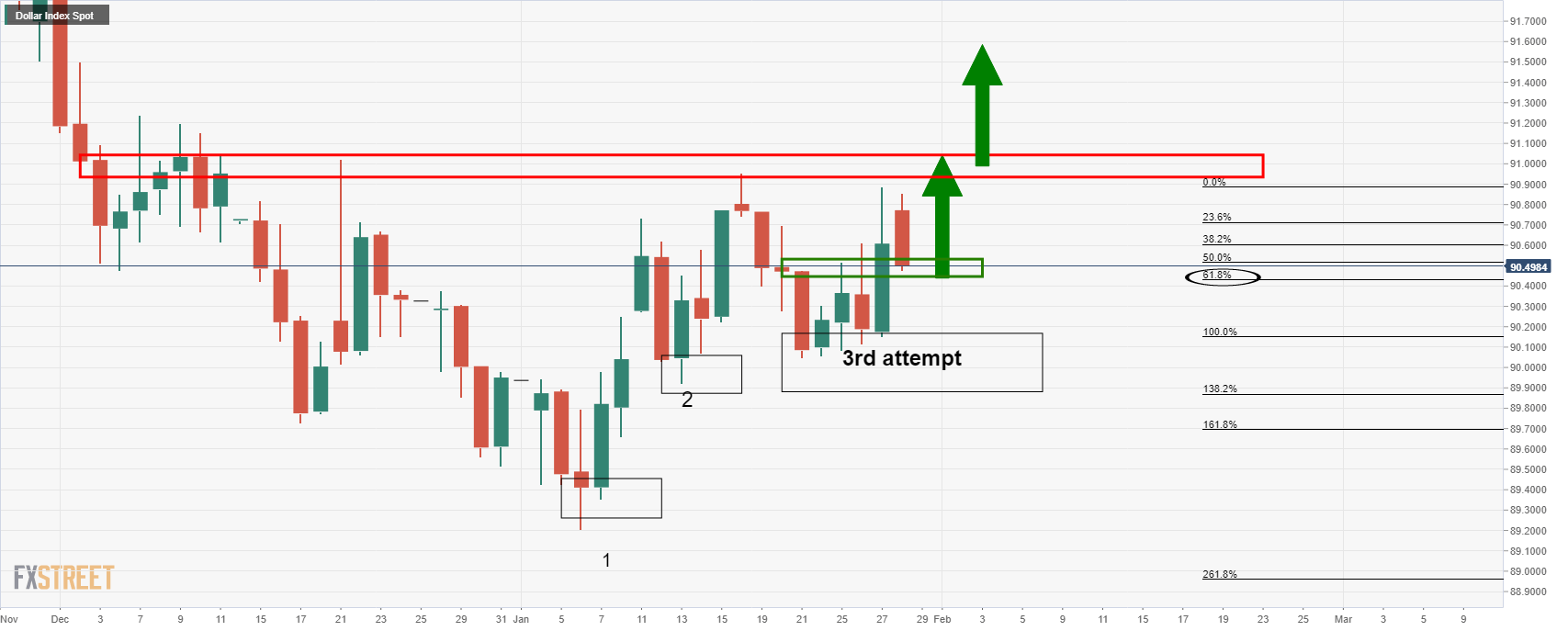

The US dollar has climbed in the FX space and risen some 1.9% measured by the DXY index, rallying from a low 89.20 to a high of 90.95 and attempting to break higher this week.

Despite the market expectations that the Fed will maintain an ultra-accommodative monetary policy for an extended period of time, there is the underbelly of risk-off sentiment regarding the coronavirus vaccines.

”While the dollar may benefit from a brief spike in risk aversion potentially triggered by a new set of weak economic indicators – tough restrictions imposed by various countries to regain control over the coronavirus pandemic will cause more damage to economies – our house view is that the greenback will struggle to regain its footing in 2021,” analysts at Rabobank explained.

Meanwhile, TD Securities said that their Global Macro PCA model suggests that gold prices are increasingly building in a discount relative to other markets related to the reflation theme.

”We argue that the yellow metal’s discount is attributable to its trading regime. Indeed, gold is now trading more as a safe-haven asset rather than an inflation-hedge asset, which argues for lacklustre investment flows for the time being.”

The lower real interest teme had been a big driver of the precious metal’s trajectory last year and the analysts argue that slumping Treasury yields, rather than rising inflation expectations, are likely to now fuel lower real rates.

However, the US dollar is intent on the upside US yields may only be getting started in their come back.

From a weekly perspective, the US 10 years have broken a key resistance this week and the DXY is not going down with a fight.

The daily chart shows the DXY now at critical support:

In gold, 1820 is the major level to the downside below the current 50% mean reversion support:

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!) RULE-BASED Pocket Option Strategy That Actually Works | Live Trading

RULE-BASED Pocket Option Strategy That Actually Works | Live Trading