NASDAQ index close higher. Down industrial average has a modest decline

The US stocks are closing mixed with the NASDAQ index leading the way to the upside. The Dow industrial average fell modestly but closed near the day’s highs. The S&P was in between although it too closed near session highs.

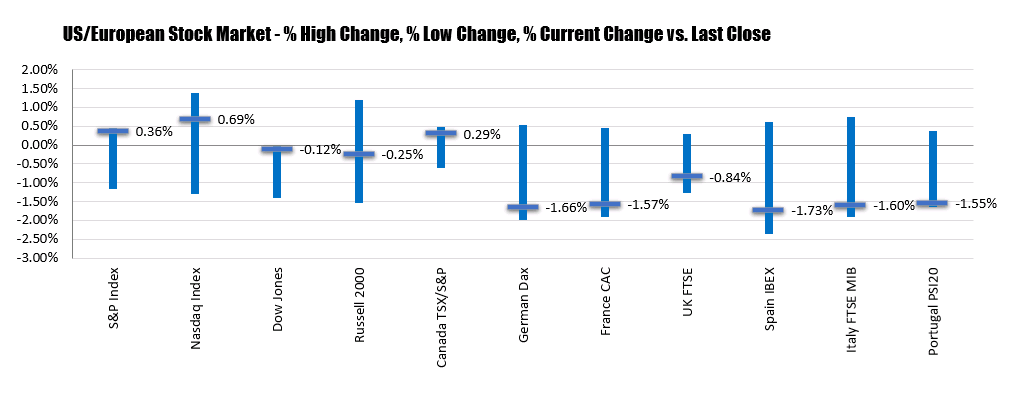

A look at the major indices at the close show:

- S&P index up 13.91 points or 0.36% at 3855.38

- NASDAQ index closed up 92.93 points or 0.69% at 13,635.99

- Dow fell -36.91 points or -0.12% at 30960.07

The stock story today focused on the WallStreetBets stocks which have dominating the chatter over the last few days.

Today GameStock (GME, soared to a high of $159.18 before tumbling back down to settle at $76.92. That was still up 18.32% on the day. Other high flyers today included Blackberry which rose by 20.49% and AMC Entertainment which increased by 25.5%.

Earnings start to kick-in tomorrow with:

- 3M

- American Express

- Johnson & Johnson

- Microsoft

- Verizon

Later in the week, there are a number of other big names reporting including:

Wednesday

- AT&T

- Apple

- Tesla

- Boeing

Thursday

- McDonald’s

- Visa

- Comcast

- American Airlines

- Mondelez

Friday

- Lily

- Caterpillar

- Chevron

- Honeywell

- Colgate-Palmolive