- AUD/USD drops around 15-pips following the news suggesting Beijing’s readiness for a military drill in the South China Sea.

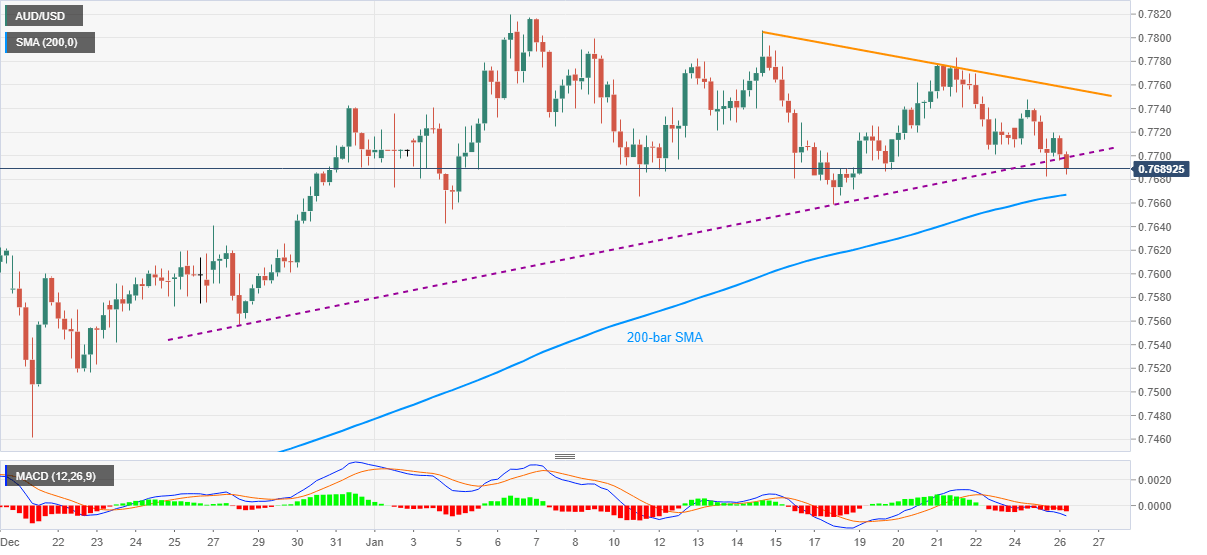

- Bearish MACD, break of short-term key support favor sellers.

- Eight-day-old resistance line adds to the upside filters.

AUD/USD prints 0.32% intraday losses, currently heavy near the day’s low of 0.7684, ahead of Tuesday’s European session. In doing so, the aussie pair drops below an upward sloping trend line from December 28 amid bearish MACD signals.

The pair recently got sold after news crossed wires that China will conduct military drills in the South China Sea amid tensions with the US. The dragon nation seems in a mood to escalate the Sino-American tussle after the US aircraft carrier group recently entered the disputed waters.

Read: S&P 500 futures drop further as China says to conduct military drills in South China Sea

Despite the quote’s sustained downside break of the previous support line and a risk-off mood, 200-bar SMA near 0.7665, followed by the monthly low around 0.7640, will challenge the AUD/USD sellers.

In a case where the AUD/USD bears dominate past-0.7640, December 28 low near 0.7560 becomes the key support to watch before the previous month’s bottom surrounding 0.7460.

Meanwhile, an upside bounce beyond the previous support line, now resistance, near 0.7700 threshold, will have to cross a short-term falling resistance line, currently around 0.7760 to recall the AUD/USD buyers.

AUD/USD four-hour chart

Trend: Further weakness expected