But retesting the MA levels as stocks rebound off the lows

The AUDUSD trended lower as stocks headed lower into the NY session. There were also concerns in the Asian market that Hong Kong would impose lockdown restrictions as a result of covid outbreak.

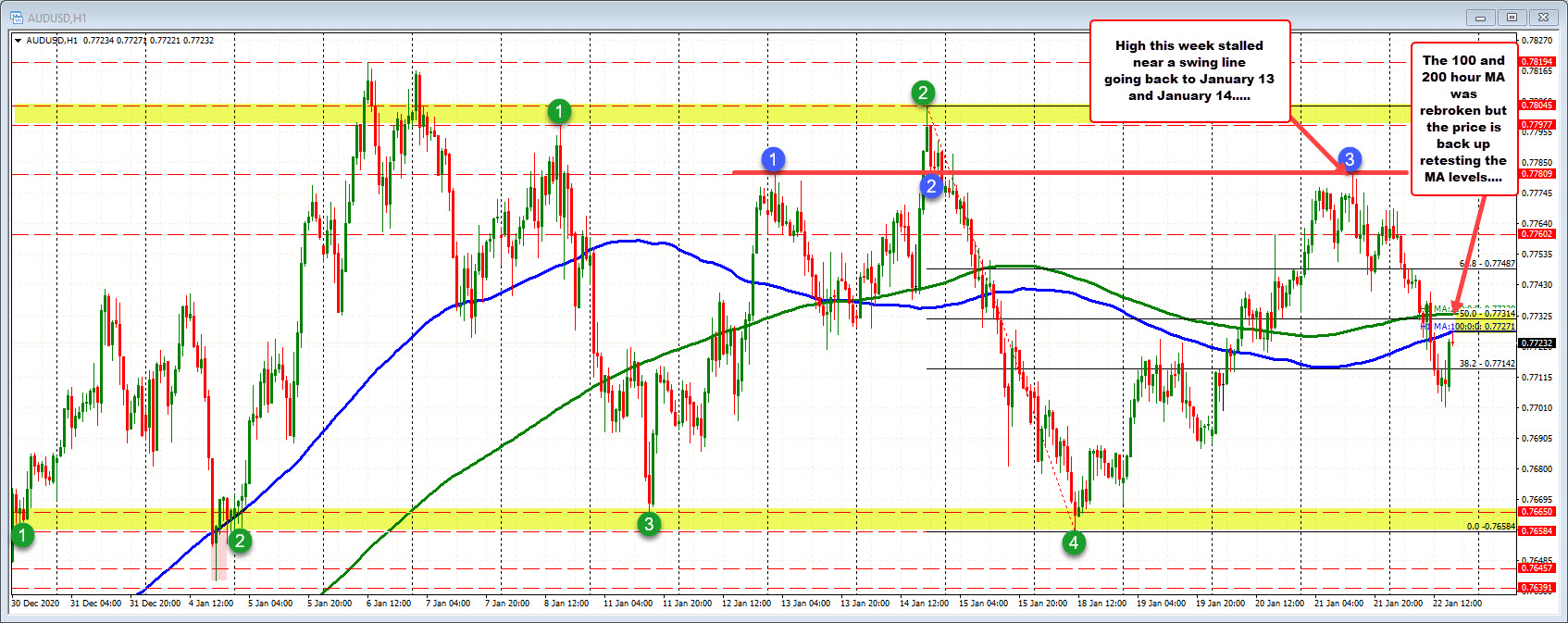

The price move to the downside worked it’s way back below the 100/200 hour MAs (blue and green lines) and also the 50% midpoint of the week’s trading week.

However, after falling toward the natural support at the 0.7700 level (the low reached 0.7701), the price rebounded with the help of rebounding stocks in the early NY trading.

The price is back up retesting the 100 and 200 hour MAs at 0.7727 and 0.77314. The corrective high price just reached 0.77305 – between the two levels – and has backed off (trades at 0.7723 as I type).

If seller can keep the price below the MAs, the sellers remain in control. Move above and the tilt goes back to the buyers.

For the week, the pair bottomed on Monday at 0.76584. The high price was on Thursday at 0.7781. That was near a swing hi from January 13, and a swing low from January 14 before it broke lower and moved to the Monday low price (see blue numbered circles).