Euro recovers mildly in early US session, after ECB said downside risks to the economic outlook are less pronounced. Though, it remains one of the worst performing for the week, together with Dollar, Yen and Swiss Franc. The greenback is clearly still under pressure for now, after worst than expected jobless claims data. Canadian Dollar is now leading other commodity currencies and Sterling higher, after BoC Governor Tiff Macklem said that there’s no need for more stimulus based on the base case.

Technically, EUR/USD’s break of 1.2157 minor resistance reaffirms the view that it has bottomed out for near term at 1.2052. Focus will be on 126.19 minor resistance in EUR/JPY and 1.0787 minor resistance in EUR/CHF to confirm. Though, risks for Euro remains on the downside against Sterling and commodity currencies.

In Europe, currently FTSE is up 0.06%. DAX is up 0.02%. CAC is down -0.46%. German 10-year yield is up 0.037 at -0.488. Earlier in Asia, Nikkei rose 0.82%. Hong Kong HSI dropped -0.12%. China Shanghai SSE rose 1.07%. Singapore Strait Times rose 0.61%. Japan 10-year JGB yield dropped -0.0037 to 0.036.

ECB maintains very accommodative monetary policy stance

ECB left the “very accommodative monetary policy stance” unchanged as widely expected. Main refinancing rate was held at 0.00%, marginal lending rate a and deposit rate at 0.25% and -0.50% respectively. Rates will “remain at their present or lower levels until it has seen the inflation outlook robustly converge to a level sufficiently close to, but below, 2% within its projection horizon, and such convergence has been consistently reflected in underlying inflation dynamics.”

Envelope of the “pandemic emergency purchase programme (PEPP)” is kept at EUR 1850B, running through at least March 2022. Asset purchase programme (APP) will continue at monthly net purchase of EUR 20B. ECB will will also continue to provide “ample liquidity” through refinancing operations, in particular the third series of targeted longer-term refinancing operations (TLTRO III).

ECB Lagarde: Risk tilted to the downside but less pronounced

In the post meeting press conference, ECB President Christine Lagarde said “the roll-out of vaccines, which started in late December, allows for greater confidence in the resolution of the health crisis”. But it will “take time until widespread immunity is achieved”. Thus “further adverse developments related to the pandemic cannot be ruled out.

But over the medium term, recovery of Eurozone should be supported by “favourable financing conditions, an expansionary fiscal stance and a recovery in demand as containment measures are lifted and uncertainty recedes.”

Lagarde also said that risks surrounding growth outlook remain “tilted” to the downside but less pronounced”. Positive development including vaccination, and EU-UK agreement.

US initial jobless claims dropped to 900k, continuing claims down to 5.05m

US initial jobless claims dropped -26k to 900k in the week ending January 16, higher than expectation of 860k. Four-week moving average of initial claims rose 23.5k to 848k. Continuing claims dropped -127k to 5054k in the week ending January 9. Four-week moving average of continuing claims dropped -67k to 5126k.

Also released, Philly Fed manufacturing conditions rose to 26.5 in January, up from 9.1, above expectation of 12.2. Housing starts rose to 1.67m in December versus expectation of 1.56m. Building permits rose to 1.71m versus expectation of 1.60m.

BoJ kept policy unchanged, raised growth fiscal 2021, 2022 growth forecasts

BoJ left monetary policy unchanged today as widely expected,. Under the yield curve control framework, short-term policy interest rate is held at -0.1%. The central bank will continue to purchase unlimited amount of JGBs to keep 10-year yield at around 0%, with some fluctuations allowed. Goushi Kataoka dissented again in a 7-1 vote, pushing for further strengthening monetary easing.

In the Outlook for Economic Activity and Prices, BoJ raised fiscal 2021 growth forecasts to 3.3-4.0% (median at 3.9%), up from October’s projection of 3.0-3.8% (median at 3.6%). Fiscal 2022 growth forecasts was also raised to 1.5-2.0% (median at 1.8%), from 1.5-1.8% (median at 1.6%).

Core CPI forecasts for fiscal 2021 was revised to 0.3-0.5% (median at 0.5%), from 0.2-0.6% (median at 0.4%). Fiscal 2022 core CPI was projected at 0.7-0.8% (media 0.7%), from 0.4-0.7% (median at 0.7%).

BoJ Kuroda: Risk of sliding back into deflation is not high

In the post meeting press conference, BoJ Governor Haruhiko Kuroda admitted that “output gap is worsening sharply at present”. However, they won’t have a “huge immediate negative impact on medium- and long-term inflation expectations”. “I don’t think the risk of Japan sliding back into deflation is high,” he added.

Also, “it’s too early to exit from our massive monetary easing programme at this point. Western economies have been deploying monetary easing steps for a decade, and none of them are mulling an exit now.”

Regarding the march policy review, Kuroda maintained that yield curve control is “working properly”. In the review, ” we will seek how best to balance the need to curb the side-effects of yield curve control (YCC) while making it more effective … We also need to make our framework sustainable and be able to respond flexibly as needed.”

Japan posted first annual export growth since 2018

In non seasonally adjusted terms, Japan’s exports rose 2.0% yoy in December to JPY 6.71T, slightly below expectation of 2.4% yoy rise. But that’s still the first annual growth since November 2018. Imports dropped -11.6% yoy to JPY 5.96T, above expectation of -14.0% yoy. Trade came in at JPY 751B, small than expectation of JPY 943B.

In seasonally adjusted terms, exports dropped -0.1% mom to JPY 5.98T. Imports rose 1.3% mom to 5.50T. Trade surplus narrowed to JPY 477B, below expectation off JPY 760B.

Australia employment grew 50k in Dec, unemployment rate dropped to 6.6%

Australia employment grew 50k in December, or 0.4% to 12.9m, matched expectations. Full time employment rose 35.6k to 8.76m. Part-time employment rose 14.3k to 4.15m. Over the year to December 2020, employment dropped by -0.5% or -63.9k. Unemployment rate dropped to 6.6%, down from 6.8%, better than expectation of 6.7%. Participation rate rose 0.1% to 66.2%.

Bjorn Jarvis, head of labour statistics at the ABS, said, “Although employment has recovered 90 per cent of the fall from March to May, the recovery in part-time employment has outpaced full-time employment. While part-time employment was higher than March, full-time employment was 1.3 per cent below March.”

Also released, consumer inflation expectations dropped to 3.4% in Dec.

EUR/USD Mid-Day Outlook

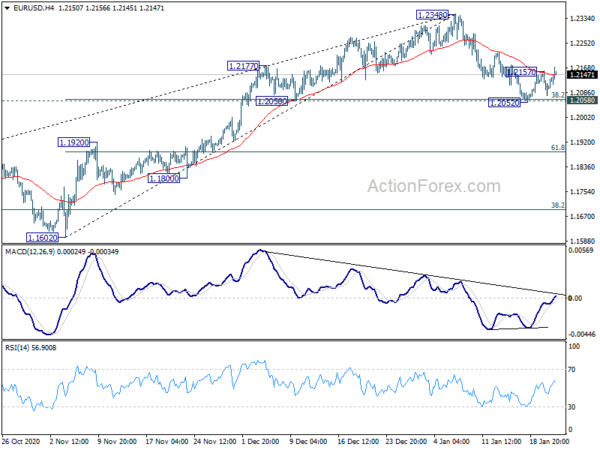

Daily Pivots: (S1) 1.2069; (P) 1.2114; (R1) 1.2150; More…

EUR/USD’s rise and break of 1.2157 minor resistance reaffirms the case that pull back from 1.2348 has completed at 1.2052. Intraday bias is back on the upside for retesting 1.2348 high. However, decisive break of 1.2052 will resume the correction from 1.2348. Intraday bias will be turned to the downside for 61.8% retracement of 1.1602 to 1.2348 at 1.1887.

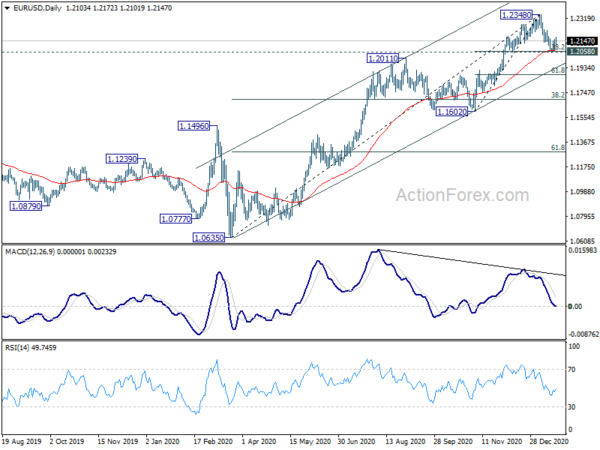

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. We’d be alerted to topping sign around 1.2516/55. But sustained break there will carry long term bullish implications.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Trade Balance (JPY) Dec | 0.48T | 0.76T | 0.57T | 0.55T |

| 00:00 | AUD | Consumer Inflation Expectations Jan | 3.40% | 3.50% | ||

| 00:30 | AUD | Employment Change Dec | 50K | 50K | 90K | |

| 00:30 | AUD | Unemployment Rate Dec | 6.60% | 6.70% | 6.80% | |

| 03:00 | JPY | BoJ Interest Rate Decision | -0.10% | -0.10% | -0.10% | |

| 12:45 | EUR | ECB Interest Rate Decision | 0.00% | 0.00% | 0.00% | |

| 13:30 | EUR | ECB Press Conference | ||||

| 13:30 | CAD | New Housing Price Index M/M Dec | 0.30% | 0.80% | 0.60% | |

| 13:30 | USD | Building Permits Dec | 1.71M | 1.60M | 1.64M | |

| 13:30 | USD | Housing Starts Dec | 1.67M | 1.56M | 1.55M | 1.58M |

| 13:30 | USD | Initial Jobless Claims (Jan 15) | 900K | 860K | 965K | 926K |

| 13:30 | USD | Philadelphia Fed Manufacturing Survey Jan | 26.5 | 12.2 | 11.1 | 9.1 |

| 15:00 | EUR | Eurozone Consumer Confidence Jan P | -15 | -14 |