- USD/TRY adds to Tuesday’s losses in the proximity of 7.40.

- The CBRT decides on the interest rate on Thursday.

- Markets’ attention remains on the US Inauguration Day.

The Turkish lira extends the upside momentum so far this week and now drags USD/TRY to the proximity of 7.40.

USD/TRY cautious ahead of the CBRT

USD/TRY trades with losses for the second session in a row on Wednesday and remains stuck within the multi-week consolidative range between 7.55 and 7.24.

TRY managed well to fade the pessimism seen on Monday after President Erdogan’s comments over the weekend, when he reiterated his views (well) against high interest rates.

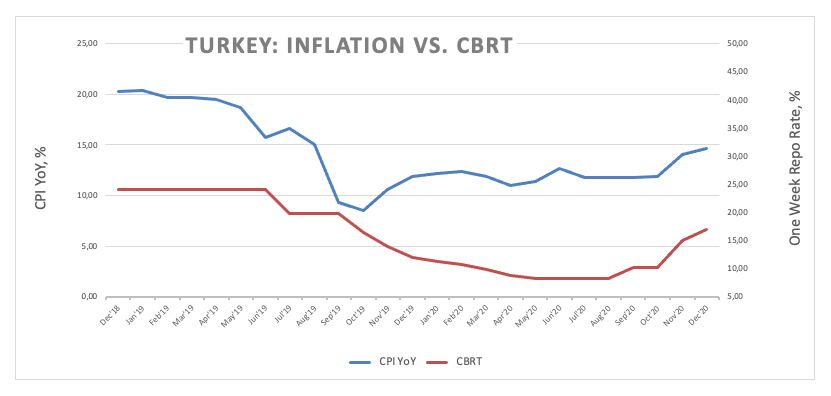

Erdogan’s comments seem to have sparked some (logical) caution among investors, as they came just before the Turkish central bank’s (CBRT) monetary policy meeting on Thursday. On the latter, consensus among investors sees the central bank leaving the One-Week Repo Rate unchanged at 17.00%.

Data wise in Turkey, the Central Government Debt Stock shrunk a tad to TRY 1,812.1 billion in December (from TRY 1,872.1 billion). Apart from the CBRT decision, January’s Consumer Confidence is also due on Thursday.

USD/TRY key levels

At the moment the pair is losing 0.43% at 7.4313 and a drop below 7.3458 (200-day SMA) would expose 7.2391 (2021 low Jan.7) and then 7.2019 (low Aug.21). On the flip side, the next resistance emerges at 7.5415 (2021 high Jan.18) followed by 7.7073 (55-day SMA) and finally 8.0250 (monthly high Dec.11).