Asian markets are trading in strong risk-on mode today, with particular strength seen in Hong Kong. DOW future is also currently up 150 pts, as markets look forward to US Treasury nominee Janet Yellen’s confirmation hearing. Yen is back under heavy selling pressure, followed by Dollar and Swiss Franc. Australian Dollar is leading commodity currencies higher. Though, gold, oil and bitcoin are range bound.

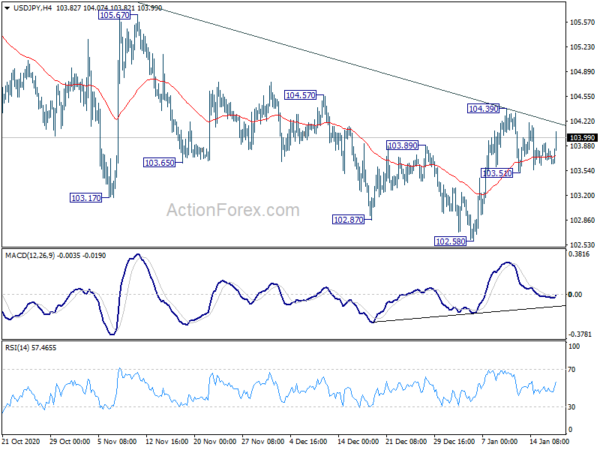

Technically, the focuses today will now be on whether Yen would break recent support levels with today’s selloff. Some closer levels to watch include 142.23 resistance in GBP/JPY and 80.91 resistance in AUD/JPY. USD/JPY is also a pair to watch. Firm break of 104.39 resistance would resume rebound from 102.58 and be a strong sign of bullish reversal. That could prompt steep rally in other Yen pairs.

In Asia, currently, Nikkei is up 1.44%. Hong Kong HSI is up 3.06%. China Shanghai SSE is flat. Singapore Strait Times is up 0.49%. Japan 10-year JGB yield is down -0.0030 at 0.046.

Asian stocks rally on US Yellen, HSI up more than 3%

Asian stock, except China, surge broadly today as US Treasury nominee, former Fed chair, Janet Yellen is report to adopt an “act big” stance on fiscal stimulus. Commodity currencies are trading broadly higher, as led by Australian Dollar. Yen, Dollar and Swiss Franc are back under pressure.

Yellen will appear before the Senate Finance committee today for her confirmation hearing. According to the prepared remarks obtained by the Financial Times, Yellen will say, “neither the president-elect, nor I, propose this relief package without an appreciation for the country’s debt burden.”

“But right now, with interest rates at historic lows, the smartest thing we can do is act big. In the long run, I believe the benefits will far outweigh the costs, especially if we care about helping people who have been struggling for a very long time,” She’ll add.

At the time of writing, Hong Kong HSI is up 883.4 pts or 3.06%. The strong break of the medium term channel resistance should confirm upside acceleration. Next target is 161.8% projection of 21139.26 to 26782.61 from 23124.25 at 32255.19. Current development also suggest that rise from 21139.26 is likely the start of another long term up trend, that would likely take out 33484.7 record high in the medium term.

Prospect of stronger rebound in EUR/CHF, EUR/JPY and EUR/USD today

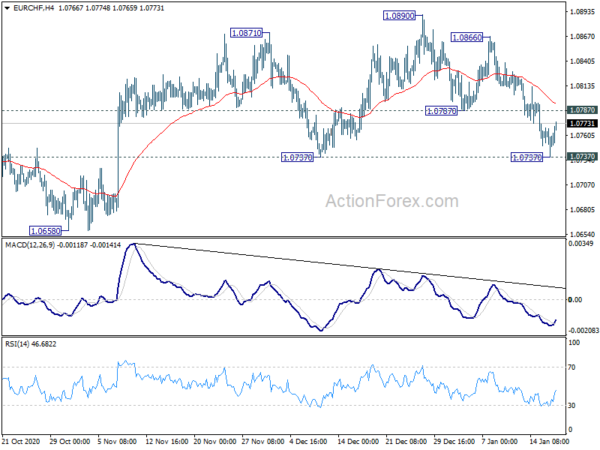

Following strong risk on-markets in Asia, Euro is trading generally higher against Dollar, Yen and Swiss Franc. Considering that respectively pairs have just drew support from near term support levels, there is prospect of a stronger rebound in the common currency today.

EUR/CHF recovered after touching 1.0737 near term support level. 4 hour MACD’s cross above signal line indicates stabilization. Focus is back on 1.0787 support turned resistance. Firm break there will argue that the three wave corrective fall from 1.0890 has completed. That would also retain near term bullishness for another up-move through 1.0890.

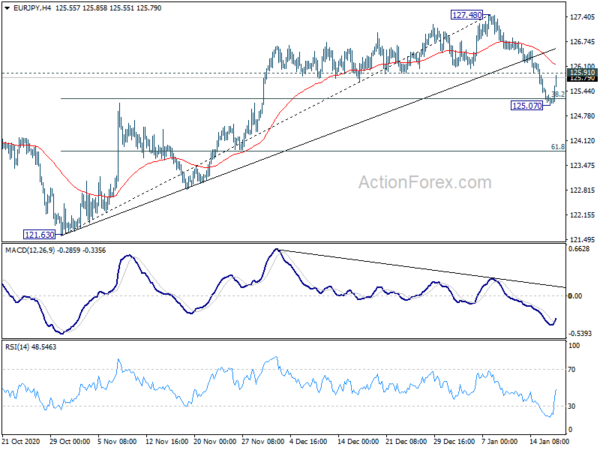

EUR/JPY also recovered after breaching 38.2% retracement of 121.63 to 127.48 at 125.24 briefly. Focus is back on 125.91 minor resistance. Firm break there will argue that the pull back from 127.48 has completed earlier than expected. That would bring stronger rally for a retest on 127.48 high.

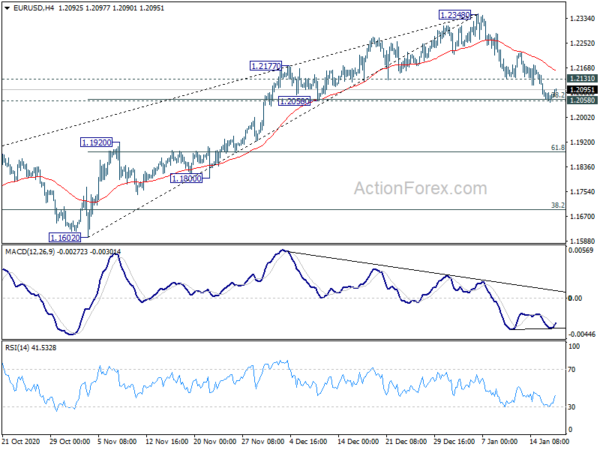

Recovery in EUR/USD is relatively weaker comparing to the above two pairs. Though, 4 hour MACD’s cross above signal line does suggest stabilization, after hitting 1.2058 cluster support (38.2% retracement of 1.1602 to 1.2348 at 1.2063). Break of 1.2131 would turn bias to the upside for stronger rebound back towards 1.2348 high.

New Zealand NZIER business sentiment further improved in Q4

The latest NZIER Quarterly Survey of Business Opinion showed a net 15% of business expect a deterioration in general economic conditions over the coming months. That’s notable improvement from Q3’s 38% and the worst reading of 68% during the most pessimistic period in March 2020.

On companies’s own activity, a net 1% reported reduced demand. NZIER said This measure suggests a rebound in annual GDP growth to around 2 percent at the end of 2020 from the lockdown lows in mid-2020.

Looking ahead

Main focus will be Germany ZEW economic sentiment in European session. Germany will release CPI final. Eurozone will release current account. Italy will release trade balance. Swiss will release PPI. Later in the day, Canada will release manufacturing sales and wholesale sales.

GBP/JPY Daily Outlook

Daily Pivots: (S1) 140.41; (P) 140.83; (R1) 141.30; More…

GBP/JPY rebounded strong after drawing support from 140.31 support. But upside is limited below 142.23 resistance so far. Intraday bias remains neutral first. With 140.31 intact, further rise is in favor. Firm break of 142.23/71 resistance zone will resume whole rise from 123.94 to 147.95 key resistance next. On the downside, through, considering bearish divergence condition in 4 hour MACD, break of 140.31 will confirm short term topping at 142.34, and rejection by 142.71. Intraday will will be turned back to the downside for 139.96 support next.

In the bigger picture, rise from 123.94 is seen as a rising leg of the sideway consolidation pattern from 122.75 (2016 low). As long as 147.95 resistance holds, an eventual downside breakout remains in favor. However, firm break of 147.95 will raise the chance of long term bullish reversal. Focus will then be turned to 156.59 resistance for confirmation.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:00 | NZD | NZIER Business Confidence Q/Q Q4 | -6 | -40 | ||

| 7:00 | EUR | Germany CPI M/M Dec F | 0.50% | 0.50% | ||

| 7:00 | EUR | Germany CPI Y/Y Dec F | -0.30% | -0.30% | ||

| 7:30 | CHF | Producer and Import Prices M/M Dec | 0.10% | -0.10% | ||

| 7:30 | CHF | Producer and Import Prices Y/Y Dec | -2.70% | |||

| 9:00 | EUR | Italy Global Trade Balance (EUR) Nov | 7.57B | |||

| 9:00 | EUR | Eurozone Current Account (EUR) Nov | 26.6B | |||

| 10:00 | EUR | Germany ZEW Economic Sentiment Jan | 60 | 55 | ||

| 10:00 | EUR | Germany ZEW Current Situation Jan | -68 | -66.5 | ||

| 10:00 | EUR | Eurozone ZEW Economic Sentiment Jan | 45.5 | 54.4 | ||

| 13:30 | CAD | Manufacturing Sales M/M Nov | 0.60% | 0.30% | ||

| 13:30 | CAD | Wholesale Sales M/M Nov | 0.90% | 1.00% |