Major indices lower on the week as well

The major European indices are closing the week with sharp declines of over 1%. For the week, today’s price action has also increased the declines with the FTSE 100 and Spain’s Ibex the biggest decliners.

The provisional closes are showing:

- German DAX, -1.4%

- France’s CAC, -1.2%

- UK’s FTSE 100, -1.0%

- Spain’s Ibex -1.8%

- Italy’s FTSE MIB -1.1%

For the week:

- German DAX, -1.8%

- France’s CAC, -1.8%

- UK’s FTSE 100, -2.1%

- Spain’s Ibex, -1.80%

- Italy’s FTSE MIB, -2.1%

In other markets as London/European traders look to exit:

- Spot gold is trading down $14 and 6 $0.80 or -0.8% at $1831.50

- Spot silver is down 6 $0.09 or -2.71% at $24.80

- Bitcoin is trading down $-2700 or -7.04% at $36,000. The low price did extend to over -10% on the day

- WTI crude oil futures are trading down $1.13 -2.11% $52.44

A snapshot of the US stock market shows major indices lower but off there lowest levels:

- S&P index -15.62 points or -0.41% at 3779.90. The low price reached 3749.62

- NASDAQ index fell -49.97 points or -0.38% and 13062.80. The low price reached 12949.76

- Dow industrial average is down -110 points or -0.35% at 30883.70. The low price reached 30612.67

in the US debt market, the yields are lower:

- 2 year 0.135%, -0.4 basis points

- 5 year 0.453%, -3.0 basis points

- 10 year 1.09%, -3.9 basis points

- 30 year 1.840, -3.1 basis points

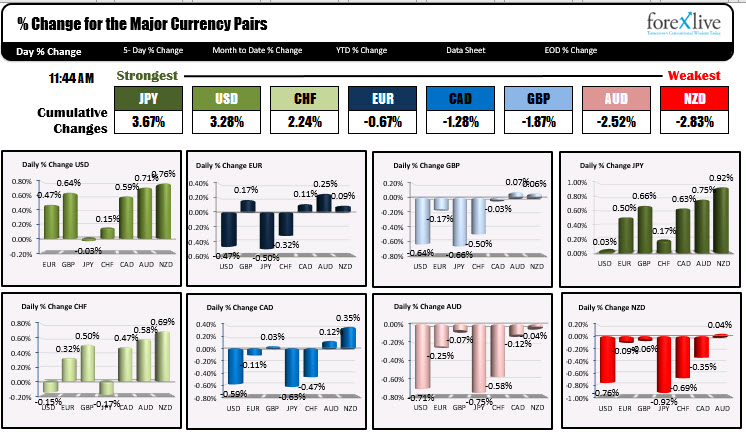

In the forex market, the JPY and the NZD remain the strongest and weakest currencies. The USD is stronger but off the highs for the day.

This article was originally published by Forexlive.com. Read the original article here.