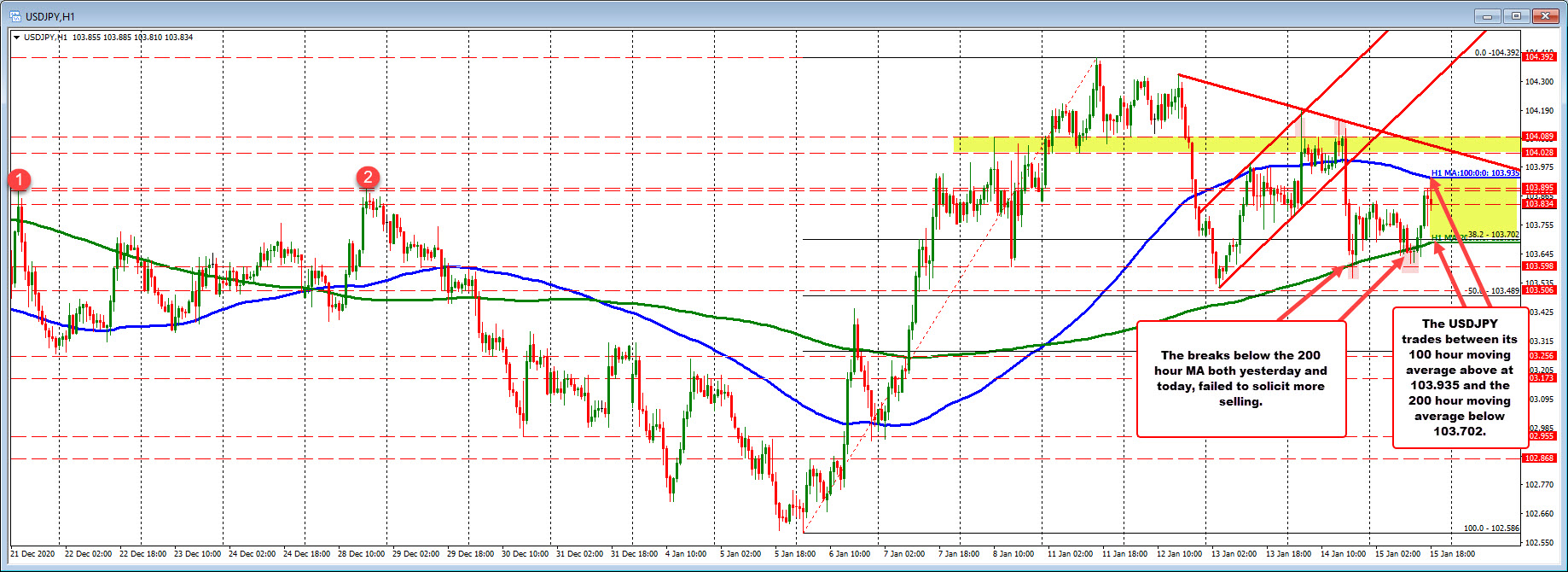

USDJPY 100 hour moving average at 103.935. The 200 hour moving averages at 103.70

The USDJPY tried for the 2nd consecutive day to break below the 200 hour moving average. However, like yesterday, the momentum on the break could not be sustained, and the price has rebounded higher.

The moved to the upside took the price up to 103.895. Going back in time that was near the high from December 28. On December 21, the high came in just below that level. Also above sits the falling 100 hour moving average (blue line) at 103.935. Those levels would need to be rebroken (and stay broken) to tilt the bias more to the upside.

Yesterday the price moved above the 100 hour moving average, but ran out of steam and reverse sharply lower after Feds Powell said change in policy is ‘no time soon’.

For now, the pair sits between the 2 moving averages as traders await the next shove.

PS. For the week, the USDJPY price last Friday closed at 103.88. With the current price trading around 103.80, the price is only down marginally for the week (-8 pips). The high price was on Monday at 104.392. The low price extended extended to 103.519 on Wednesday. That low was just above the 50% retracement of the 2021 trading range at 103.489. Going forward, getting below the 200 hour moving average and then the 50% retracement would be needed to increase the bearish bias.

For buyers, the 100 hour moving average at 103.935 and the downward sloping trendline currently at 104.05 are the next steps to increase the bullish bias