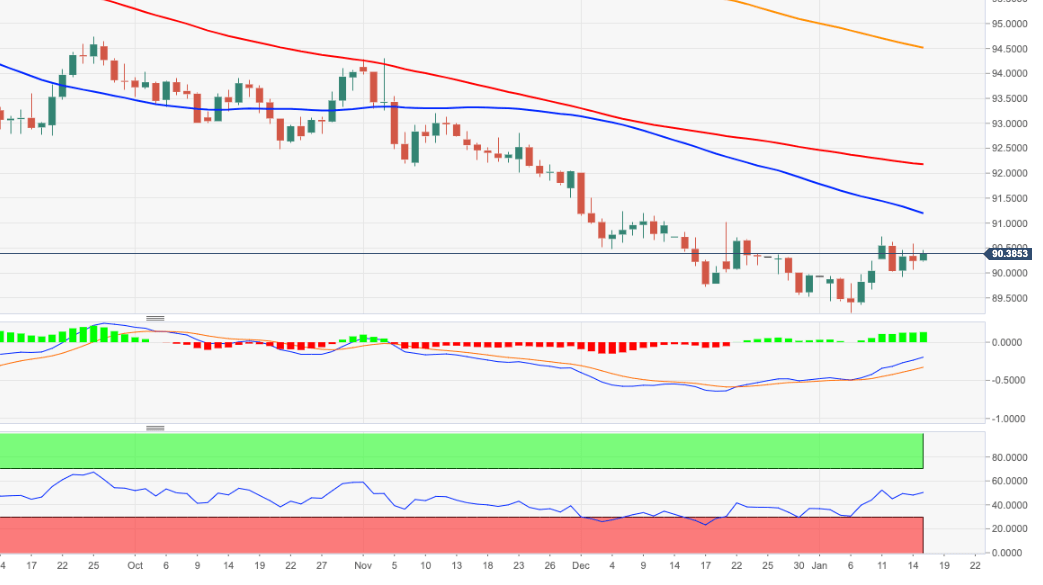

- DXY extends the side-lined trading above 90.00 on Friday.

- Further upside targets the 2021 high near 90.70.

DXY remains in a consolidative-mode and manages well to keep the trade above the 90.00 mark for the time being.

If bulls regain control of the sentiment on a more serious stance, then the index could re-visit the so far YTD tops in the 90.70/75 band ahead of the weekly high in the 91.00 region (December 21). Above this level, the prevailing downside pressure is expected to mitigate somewhat.

In the longer run, as long as DXY trades below the 200-day SMA, today at 94.50, the negative view is forecast to prevail.

DXY daily chart

This article was originally published by Fxstreet.com. Read the original article here.