- NZD/USD has struggled to regain composure after sliding below the 0.7200 level.

- The pair has been weighed by a stronger US dollar amid a risk-off market tone and higher US bond yields.

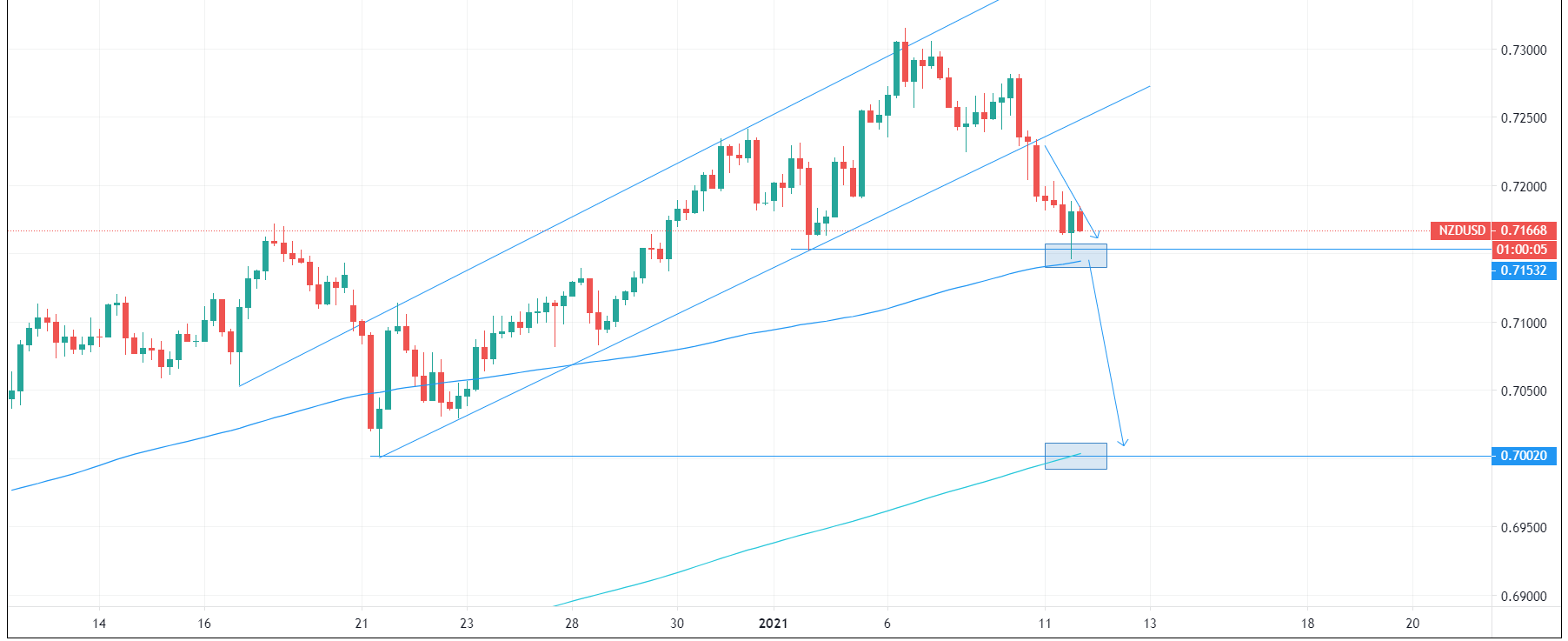

- NZD broke to the south of a bullish medium-term trend channel in early Monday Asia trade.

NZD/USD opened Monday Asia Pacific FX trade (at 22:00GMT on Sunday) above the 0.7200 level, but, amid a broad pick up in the US dollar, slipped as low as 0.7150 right before the start of the US trading session. The pair subsequently rebounded but was only able to make it back into the 0.7180s before sliding back to current levels in the 0.7160s. At present, NZD/USD trades roughly 0.9% lower or down by about 60 pips on the day.

Driving NZD/USD on Monday

Amid a lack of any notable news or events down under, USD was the driving force behind price action in the NZD/USD cross on Monday. In a nutshell, markets have been trading with a defensive bias on Monday (stocks, commodities, risk-sensitive currencies all lower, while USD and bond yields are higher).

A few “explanations” for today’s defensive tone have been bandied about; 1) an unwind in overweight risk on positioning (profit-taking in “frothy” stocks, risk FX and commodity longs, as well as in USD short), 2) Covid-19 concerns (new variants reported in Japan and rumours in the US and talk of tighter lockdowns in the UK and Germany), 3) US/China concerns (after the US moved to normalise relations with Taiwan and reports emerged suggesting the US is mulling further “action” on China) and, finally, 4) rising US bond yields attracting flows from other assets classes (and into US government bond via USD).

NZD was an underperforming G10 currency alongside the likes of AUD and CAD primarily given its sensitivity to risk appetite and downside in commodity prices. The RBNZ announced that it had been hacked over the weekend, news that certainly weighed on the New Zealand stock market during Asia Pacific trade, but seemingly has not had much of an impact on NZD.

The week ahead

Going into the week, Credit Agricole was cautious on NZD (and AUD), saying that at current levels (which in NZD/USD at the time were above 0.7200), the kiwi was becoming overextended, given who far above the NZ-US 2-year yield differential it was. For this reason, Credit Agricole thinks the antipodes will be especially vulnerable this week if US yields continue to move higher.

In terms of economic releases, Building Permits data for November will be released at 21:45GMT on Thursday, but aside from that, the focus ought to remain on global macro and USD dynamics. Thus, US bond yields, US politics, the path of the pandemic and vaccinations and US data (December CPI on Wednesday and December Retail Sales on Friday) will be the main focus.

NZD/USD breaks out of medium-term trendline

At the open of the Asia Pacific session, NZD/USD broke below a medium-term upwards trend channel. The trend channel was previously supported by an upwards trend channel linking the 21, 22 and 28 December and 4 January lows. The trendline break opened the door for a rapid move to the downside and a test of the 4 January low at just above 0.7150, as well as the 21-day moving average just below 0.7150. Monday’s downside move was forecast as a strong possibility in an article posted by FXStreet last Friday.

Should USD continue to pick up and these two downside levels of support go, the next area to target will be the 0.7000 level (also the 7 and 21 December lows), which happens also to coincide with the 50DMA at 0.70038.

NZD/USD four hour chart