Dollar extends recovery in European but there appears to be no follow through buying so far. It remains one of the weakest for the week, together with Yen and Sterling. Australian and New Zealand Dollars are paring some of this week’s gains too. The US Senate and House certified President-elect Joe Biden’s victory in the presidential election. Though, markets have little reaction to the news so far. European stocks are mixed for now, while DOW might extend record run with a stronger open. There is also little reactions to the bunch of data released from US, Canada, Eurozone and UK.

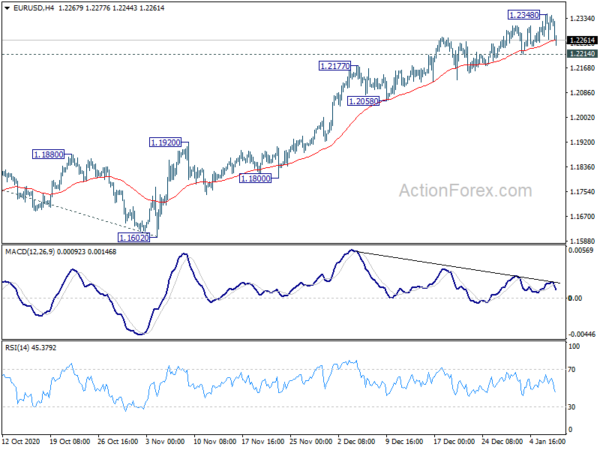

Technically, there is prospect of short term bottoming in Dollar, considering divergence conditions in 4 hour MACDs. But some levels need to be taken out first, including 1.2214 minor support in EUR/USD, 0.7641 minor support in AUD/USD, 103.89 minor resistance in USD/JPY and 1.2797 minor resistance in USD/CAD. The next move may come after tomorrow’s non-farm payrolls report.

In Europe, currently, FTSE is down -0.58%. DAX is up 0.36%. CAC is up 0.36%. German 10-year yield is down -0.0052 at -0.556. Earlier in Asia, Nikkei rose 1.60%. Hong Kong HSI dropped -0.52%. China Shanghai SSE rose 0.71%. Singapore Strait Times rose 1.54%. Japan 10-year JGB yield rose 0.0203 to 0.040.

US initial jobless claims dropped slightly to 787k, continuing claims dropped to 5.07m

US initial jobless claims dropped -3k to 787k in the week ending January 2, below expectation of 798k. Four-week moving average of initial claims dropped -18.8k to 818.8k. Continuing claims dropped -126k to 5072k in the week ending December 26. Four-week moving average of continuing claims dropped -177k to 5274k.

Also released US trade deficit widened to USD -68.1B in November, above expectation of USD -64.5B. Canada trade deficit narrowed to CAD -3.3B, smaller than expectation of CAD -3.6B.

Eurozone CPI unchanged at -0.3% yoy in Dec, core CPI unchanged at 0.2% yoy

Eurozone CPI was unchanged at -0.3% yoy in December, below expectation of -0.2% yoy. CPI core was also unchanged at 0.2% yoy. Looking at the main components, food, alcohol & tobacco is expected to have the highest annual rate in December (1.4%, compared with 1.9% in November), followed by services (0.7%, compared with 0.6% in November), non-energy industrial goods (-0.5%, compared with -0.3% in November) and energy (-6.9%, compared with -8.3% in November).

Eurozone retail sales dropped -6.1% mom in Nov, well below expectations

Eurozone retail sales dropped sharply by -6.1% mom in November, well below expectation of -3.0% mom. Volume of retail trade decreased by -10.6% mom for automotive fuels, by -8.9% mom for non-food products (within this category mail orders and internet increased by 1.8% mom) and by -1.7% mom for food, drinks and tobacco.

EU retail sales dropped -5.0% mom. Among Member States for which data are available, the largest decreases in the total retail trade volume were observed in France (-18.0% mom), Belgium (-15.9% mom) and Austria (-9.9% mom). The highest increases were registered in the Netherlands (+2.6% mom), Croatia (+2.5% mom) and Germany (+1.9% mom).

Eurozone Economic Sentiment Indicator rose 2.7 pts to 90.4 in Dec

Eurozone Economic Sentiment Indicator rose 2.7 pts to 90.4 in December. Employment Expectation Indicator rose 1.4 pts to 88.3. Amongst the largest euro-area economies, the ESI increased significantly in Italy (+6.8), Spain (+3.3) and, to a lesser extent, in the Netherlands (+2.5) and France (+2.1), while it remained broadly unchanged in Germany (+0.1).

Looking at some details, industrial confidence rose from -10.1 to -7.2. Services confidence dropped from -17.1 to -17.4. Consumer confidence rose from -17.6 to -13.9. Retail trade confidence rose from -12.7 to -13.1. Construction confidence dropped from -9.3 to -7.9.

Also released, Germany factory orders rose 2.3% mom in November, above expectation of -1.2% mom. Swiss retail sales rose 1.7% yoy in November, below expectation of 3.5% yoy.

UK PMI construction dropped to 54.6, positive end to the year

UK PMI Construction dropped slightly to 54.6 in December, down from 54.7, matched expectations. Markit noted that output expansion maintained for the seventh month in a row. Employment returned to growth amid strong rise in new orders. Supply shortages pushed up input costs.

Tim Moore, Economics Director at IHS Markit: “December data illustrated a positive end to the year for the UK construction sector, mostly fuelled by a sharp rebound in house building. Overall output growth has slowed in comparison to the catch-up phase last summer, but now it is encouraging to see the recovery driven by new projects and stronger underlying demand.”

Japan announced limited state of emergency in Tokyo, Saitama, Kanagawa and Chiba

Japan announced a limited state of emergency in Tokyo, and three neighboring prefectures of Saitama, Kanagawa and Chiba. 30% of the country’s population are covered. The one-month emergency measure would run from Friday to February 7. Restaurants and bars are asked to close by 8pm. Residents should refrain from non-urgent outings. Crowds at sports and big events are limited to 5000 people.

“The global pandemic has been a tougher one than we expected, but I’m hopeful we can overcome this,” Prime Minister Yoshihide Suga said. “For this to happen, I must ask citizens to endure life with some restrictions.”

Released from japan, labor cash earnings dropped -2.2% yoy in November, versus expectation of -0.9% yoy.

Australia trade surplus narrowed to AUD 5B in Nov, as imports jumped 10% mom

Australia goods and services imports rose 10% mom to AUD 31.4B in November. Goods and services exports rose 3% mom to AUD 36.4B. Trade surplus narrowed to AUD 5.02B, below expectation of AUD 6.45B. Building permits rose 2.6% mom in November.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2279; (P) 1.2314; (R1) 1.2362; More…

Intraday bias in EUR/USD is turned neutral with today’s retreat. Some consolidations would be seen but further rise is expected with 1.2214 minor support intact. Break of 1.2348 would target 61.8% projection of 1.0635 to 1.2011 from 1.1602 at 1.2452 next. Though, considering bearish divergence condition in 4 hour MACD, break of 1.2214 will suggest short term topping. Intraday bias will be turned back to the downside, for pull back to 1.2058 support.

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. We’d be alerted to topping sign around 1.2516/55. But sustained break there will carry long term bullish implications.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Labor Cash Earnings Y/Y Nov | -2.20% | -0.90% | -0.70% | |

| 00:30 | AUD | Building Permits M/M Nov | 2.60% | 3.80% | 3.30% | |

| 00:30 | AUD | Trade Balance (AUD) Nov | 5.02B | 6.45B | 7.46B | 6.58B |

| 07:00 | EUR | Germany Factory Orders M/M Nov | 2.30% | -1.20% | 2.90% | 3.80% |

| 07:30 | CHF | Real Retail Sales Y/Y Nov | 1.70% | 3.50% | 3.10% | 4.30% |

| 09:00 | EUR | ECB Economic Bulletin | ||||

| 09:30 | GBP | Construction PMI Dec | 54.6 | 54.7 | ||

| 10:00 | EUR | Eurozone CPI Y/Y Dec P | -0.30% | -0.20% | -0.30% | |

| 10:00 | EUR | Eurozone CPI Core Y/Y Dec P | 0.20% | 0.20% | 0.20% | |

| 10:00 | EUR | Eurozone Economic Sentiment Indicator Dec | 90.4 | 89.5 | 87.6 | 87.7 |

| 10:00 | EUR | Eurozone Industrial Confidence Dec | -7.2 | -8.2 | -10.1 | |

| 10:00 | EUR | Eurozone Consumer Confidence Dec | -13.9 | -14 | -13.9 | -17.6 |

| 10:00 | EUR | Eurozone Services Sentiment Dec | -17.4 | -15 | -17.3 | -17.1 |

| 10:00 | EUR | Eurozone Business Climate Dec | -0.41 | -0.63 | ||

| 10:00 | EUR | Eurozone Retail Sales M/M Nov | -6.10% | -3.00% | 1.50% | 1.40% |

| 12:30 | USD | Challenger Job Cuts Dec | 134.50% | 45.40% | ||

| 13:30 | CAD | International Merchandise Trade (CAD) Nov | -3.3B | -3.6B | -3.8B | |

| 13:30 | USD | Trade Balance (USD) Nov | -68.1B | -64.5B | -63.1B | |

| 13:30 | USD | Initial Jobless Claims (Jan 1) | 787K | 798K | 787K | 790K |

| 15:00 | USD | ISM Services PMI Dec | 54.5 | 55.9 | ||

| 15:00 | CAD | Ivey PMI Dec | 53.1 | 52.7 | ||

| 17:00 | USD | Natural Gas Storage | -142B | -114B |