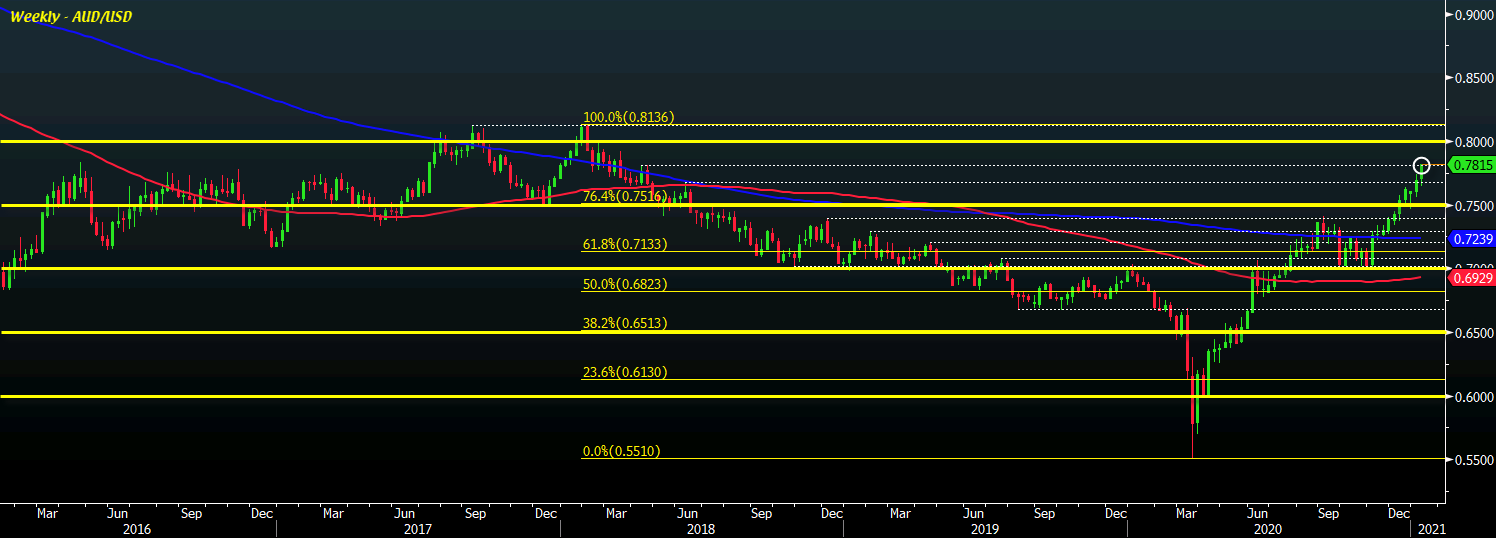

AUD/USD trades to a high of 0.7815, the highest level since March 2018

Tech may be bearing the brunt of the decline still (Nasdaq futures down 1.6%) in the wake of a Democratic sweep but Dow futures and Russell 2000 futures are suggesting a different tune, as value stocks take the lead on the session.

Meanwhile, 10-year Treasury yields continue to keep a break above 1% as it pushes to a fresh session high of 1.027% – up by over 7 bps on the day currently.

Despite that, the dollar is failing to find shelter in all of this as it keeps weaker alongside the yen in trading today.

Of note, AUD/USD has now climbed to its highest levels since March 2018 as price breaches the April 2018 high of 0.7810. That level will still be one to watch ahead of the close today and this week but buyers continue to look poised for a move towards 0.8000.

If a sharp move higher in yields is failing to ignite a spark in the dollar – even if just for a brief period – then the greenback sure has bigger worries to follow in the year.

We could very well be on the cusp of a dollar devaluation (yields higher, USD weaker) narrative but let’s see if the moves today can keep up ahead of US trading later.