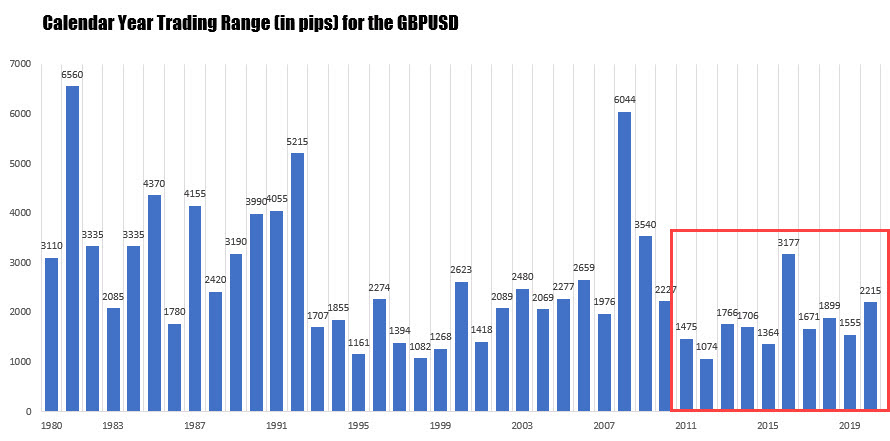

The range is 2215 pips, but only up 224 pips from the close of year 2019

The GBPUSD had a volatile down and up trading year that saw the price open the year at 1.3257. The high on the first day of the year reached 1.32656 and that was the high until August 19 when the price reached 1.32665.

The low for the year was reached on March 20 at 1.14083 during the height of the pandemic when the dollar was king. The high was reached in December at 1.36237. The low to high trading range was 2215 pips.

The 2215 pips, represents the 2nd highest trading range for the pair in the last 10 years – surpassed only by the 3177 pips in 2016. The 10 year average is 1790 pips. The range this year surpassed the average by 424 pips or by 23.7%. Last years range was 1555 which was the 4th lowest trading range over a 10 year period.

Technically, the pair worked down to test the 200 day MA in late February/early March (green circle 1). Tumbled through the 200 day MA on March 12 and fell to the year low on March 20 at 1.14083.

The pair quickly rose to test the 200 day MA in April twice (green circles 2 and 3), only to find sellers. IN June, the price rose above the MA line for a few days, but fell back below on the failed break (green circle 4).

In July, the market finally was able to break and run (green circle 6), ending the run with a test of the 2019 high on September 1. A sharp fall back to retest the 100 and 200 day MAs (converged) at the end of September, was the last shot for the bears in 2020. That fall fizzled after sellers failed on their attempt to break the key MAs, and the price stepped higher – surpassing the 2019 and September 2020 highs in the process – in December.

December has seen up and down trading as the Brexit and the Covid storylines dominated. However, the last high on Friday stalled just below the early December high at 1.36237. The double top would be a hurdle needed to get above in the new year if the buyers are to keep full control. Giving the sellers some hope in addition to the double top, is that the recent fall from the high last week has taken the price below the old swing highs from December 2019 and September 2020 between 1.34816 and 1.35138. Stay below would give the sellers some hope. Move above the area, and the sellers are NOT WINNING.

On the downside, the pairs recent lows in November and December (see red numbered circles) have formed a defined upward sloping trend line currently cutting across at 1.3244 (and moving higher). In the new trading year, getting and staying below that line would tilt the bias more to the downside. It would also take the price below the 38.2% of the run up from the September low (around a 950 pips move higher from the September low). The 50% of the same move higher and the rising 100 day MA (blue line) are at the 1.31487 area. Getting below those technical levels would be a bigger shift in the sellers/bears direction. Absent that, however, and the move from the high is just more of a correction.

SUMMARY: Overall, the year started at 1.3257. The current price is around 1.3500 or 243 pips from that closing level. Given the 2215 pip range, being 243 pips higher illustrates the down and up nature of the price action in 2020. Of course Covid and the Brexit saga dominated the news in the UK for the pair in 2020. The US election may have also helped swing the dollar at times.

Technically, the price spent most of the time from February to July below the 200 day MA, and most of the time after July above the 200 (and 100) day MA. That tilts the bias more to the upside going into 2021. However, a double top near highs in December, give some cause for pause, but there is a lot more work to be done by the sellers to prove they deserve control.