Sterling rises broadly in early US session on rumor that Brexit trade deal is “pretty much there”. But just like recent price actions, upside of the Pound is capped so far, waiting for confirmation. Dollar turns softer after a mixed batch of economic data, while firmer risk sentiment also sends Swiss Franc and Yen lower. Canadian Dollar shrugs better than expected GDP data.

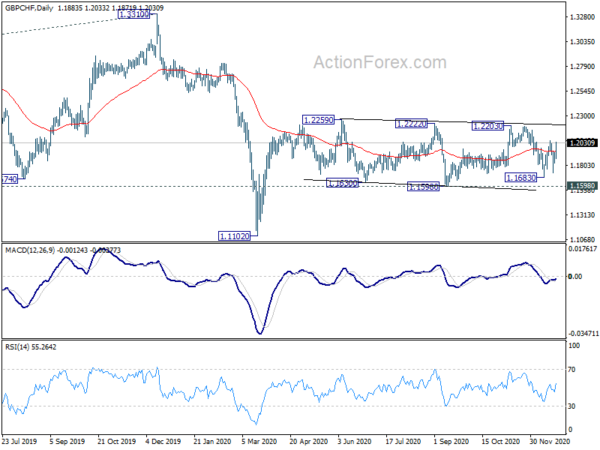

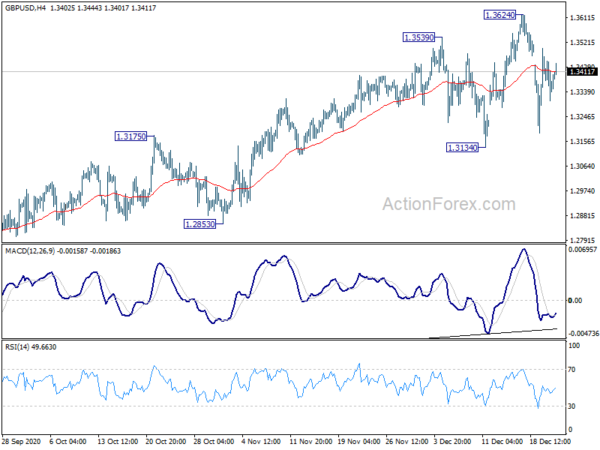

Technically, focuses are now on Sterling pairs. To confirm underlying buying, GBP/USD has to break through 1.3624 resistance. GBP/JPY has to break through 140.70 resistance. More importantly, EUR/GBP has to break through 0.8861 support. Also, GBP/CHF has to break through 1.2203 resistance.

In Europe, currently, FTSE is down -0.01%. DAX is up 0.92%. CAC is up 0.80%. Germany 10-year yield is up 0.053 at 0.541. Earlier in Asia, Nikkei rose 0.33%. Hong Kong HSI rose 0.86%. China Shanghai SSE rose 0.76%. Singapore Strait Times rose 0.22%. Japan 10-year JGB yield rose 0.0004 to 0.011.

Merry Christmas to our readers. We’ll be back on Dec 28.

US initial jobless claims dropped to 803k, continuing claims dropped to 5.3m

US initial jobless claims dropped -89k to 803k in the week ending December 19, below expectation of 900k. Four-week moving average of initial claims rose 4k to 818.25k.

Continuing claims dropped -170k to 5337 in the week ending December 12. Four-week moving average of continuing claims dropped -118k to 5538k.

Durable goods orders rose 0.9% mom to USD 244.2B in November, above expectation of 0.6%. That’s also the seven consecutive months of increase. Ex-transport orders rose 0.4%, below expectation of 0.5%. Ex-defense orders rose 0.7%. Transportation equipment rose 1.9%.

Personal income dropped -1.1% mom to USD 221.8B in November, worse than expectation of -0.3%. Spending dropped -0.4%, worse than expectation of -0.2% mom. Headline PCE index slowed to 1.1% yoy, below expectation of 1.2% yoy. Core PCE index was unchanged at 1.4% yoy, below expectation of 1.5% yoy.

Canada GDP rose 0.4% mom in Oct, 6th consecutive rise

Canada GDP rose 0.4% mom in October, above expectation of 0.3% mom. That’s the sixth consecutive month of increase. Overall, total economic activity was about -4% below February’s pre-pandemic level. Goods-producing industries rose 0.1% mom. Services-producing industries rose 0.5%. Activity rose in 16 of 10 industrial sectors.

BoJ discussed impacts of prolonged pandemic impacts

In the minutes of October 28-29 BoJ meeting, one member said the bank should “avoid bringing a premature end” to the pandemic policy responses, as the impact “might be prolonged”.

Another member warned, “given that monetary easing was expected to be prolonged, the Bank should further look for ways to enhance sustainability of the policy measure so that it would not face difficulty in conducting such purchases when a lowering of risk premia of asset prices was absolutely necessary.”

Also, one noted “attention should be paid to the possibility that the more prolonged the crisis response, the more the structural reforms toward sustainable growth would be delayed”.

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.3294; (P) 1.3382; (R1) 1.3460; More…

Intraday bias in GBP/USD remains neutral for the moment, as consolidation continues. On the upside, break of 1.3624 will target 61.8% projection of 1.1409 to 1.3482 from 1.2675 at 1.3956 next. However, firm break of 1.3134 will confirm short term topping and turn bias to the downside for deeper decline towards 1.2675 support.

In the bigger picture, focus stays on 1.3514 key resistance. Decisive break there should also come with sustained trading above 55 month EMA (now at 1.3308). That should confirm medium term bottoming at 1.1409. Outlook will be turned bullish for 1.4376 resistance and above. Nevertheless, rejection by 1.3514 will maintain medium term bearishness for another lower below 1.1409 at a later stage.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BoJ Monetary Policy Meeting Minutes | ||||

| 07:00 | EUR | Germany Import Price Index M/M Nov | 0.50% | 0.30% | 0.30% | |

| 13:30 | CAD | GDP M/M Oct | 0.40% | 0.30% | 0.80% | |

| 13:30 | USD | Initial Jobless Claims (Dec 18) | 803K | 900K | 885K | 892 K |

| 13:30 | USD | Personal Income Nov | -1.10% | -0.30% | -0.70% | -0.60% |

| 13:30 | USD | Personal Spending Nov | -0.40% | -0.20% | 0.50% | 0.30% |

| 13:30 | USD | PCE Price Index M/M Nov | 0.00% | -0.10% | 0.00% | |

| 13:30 | USD | PCE Price Index Y/Y Nov | 1.10% | 1.20% | 1.20% | |

| 13:30 | USD | Core PCE Price Index M/M Nov | 0.00% | 0.10% | 0.00% | |

| 13:30 | USD | Core PCE Price Index Y/Y Nov | 1.40% | 1.50% | 1.40% | |

| 13:30 | USD | Durable Goods Orders Nov | 0.90% | 0.60% | 1.30% | 1.80% |

| 13:30 | USD | Durable Goods Orders ex Transportation Nov | 0.40% | 0.50% | 1.30% | 1.90% |

| 15:00 | USD | New Home Sales Nov | 990K | 999K | ||

| 15:00 | USD | Michigan Consumer Sentiment Index Dec F | 81.4 | 81.4 | ||

| 15:30 | USD | Crude Oil Inventories | -2.9M | -3.1M | ||

| 17:00 | USD | Natural Gas Storage | -160B | -122B |