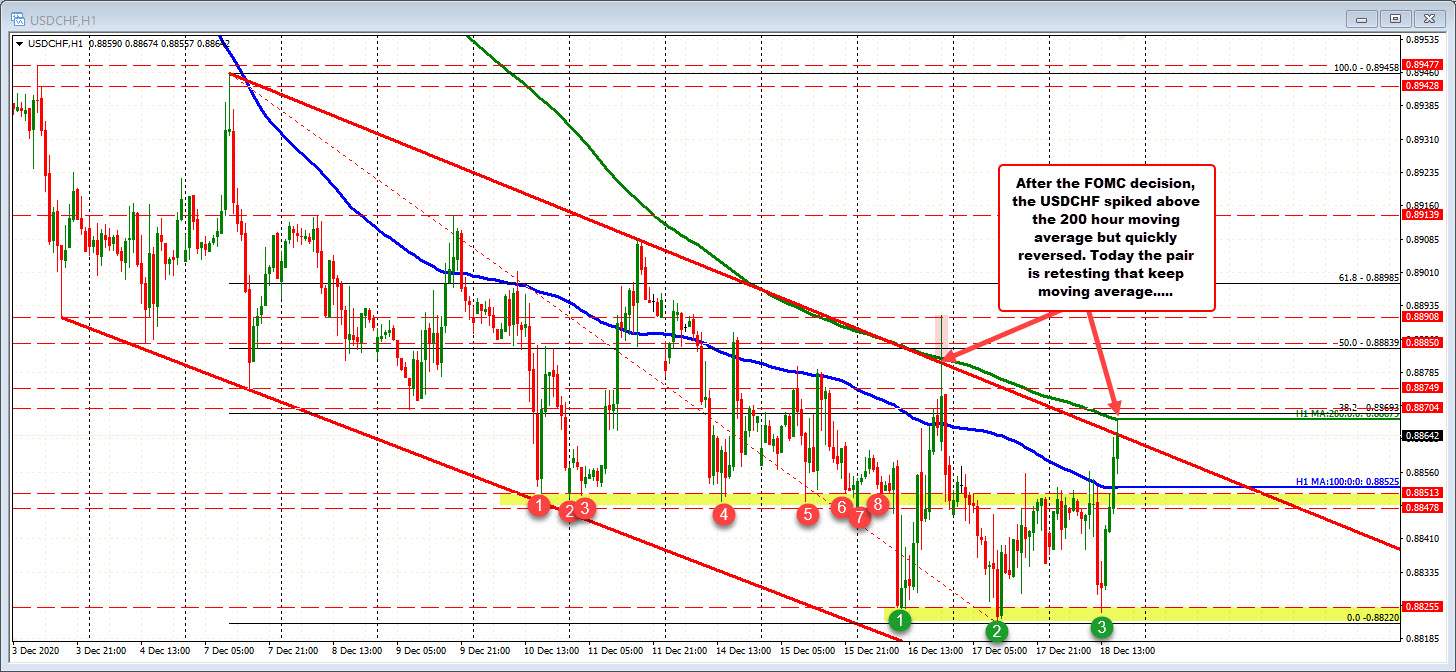

Dollar buying helps to push the USDCHF back toward it’s 200 hour MA

The USDCHF is bouncing to new session highs as flows head more into the US dollar as stocks move lower from earlier gains.

The moved to the upside has the USDCHF testing its 200 hour moving average currently at 0.88679. The high price just reached 0.88674 – just below that level.

Recall from Wednesday after the FOMC, the USDCHF spiked and breached the MA level only to rotate back to the downside.

Support now comes in against its 100 hour moving average at 0.88525. That is just above an old floor from December 10, December 11, December 14, December 15 and for parts of December 16.

The lows this week came in between 0.88221 and 0.88255 on Wednesday Thursday and again today (before the run higher). That create another floor that if broken, would be more bearish.

A move above the 200 hour MA, should open the door for further upside momentum with the 50% retracement of the move down from the December 7 swing high at 0.88839 as the Next major target.

The price of the USDCHF is not closed above its 200 hour moving average since November 25.