Published on 17 December 2020 from Prime Minister’s Office, 10 Downing Street, the UK government has released a statement which stresses that ”the situation in (our) talks with the EU is very serious tonight. progress seems blocked and time is running out.

Full official statement

The Prime Minister spoke to Commission President Ursula von der Leyen this evening about the state of play in the UK / EU negotiations.

The Prime Minister underlined that the negotiations were now in a serious situation. Time was very short and it now looked very likely that agreement would not be reached unless the EU position changed substantially.

He said that we were making every effort to accommodate reasonable EU requests on the level playing field, but even though the gap had narrowed some fundamental areas remained difficult.

On fisheries he stressed that the UK could not accept a situation where it was the only sovereign country in the world not to be able to control access to its own waters for an extended period and to be faced with fisheries quotas which hugely disadvantaged its own industry. The EU’s position in this area was simply not reasonable and if there was to be an agreement it needed to shift significantly.

The Prime Minister repeated that little time was left. He said that, if no agreement could be reached, the UK and the EU would part as friends, with the UK trading with the EU on Australian-style terms.

The leaders agreed to remain in close contact.

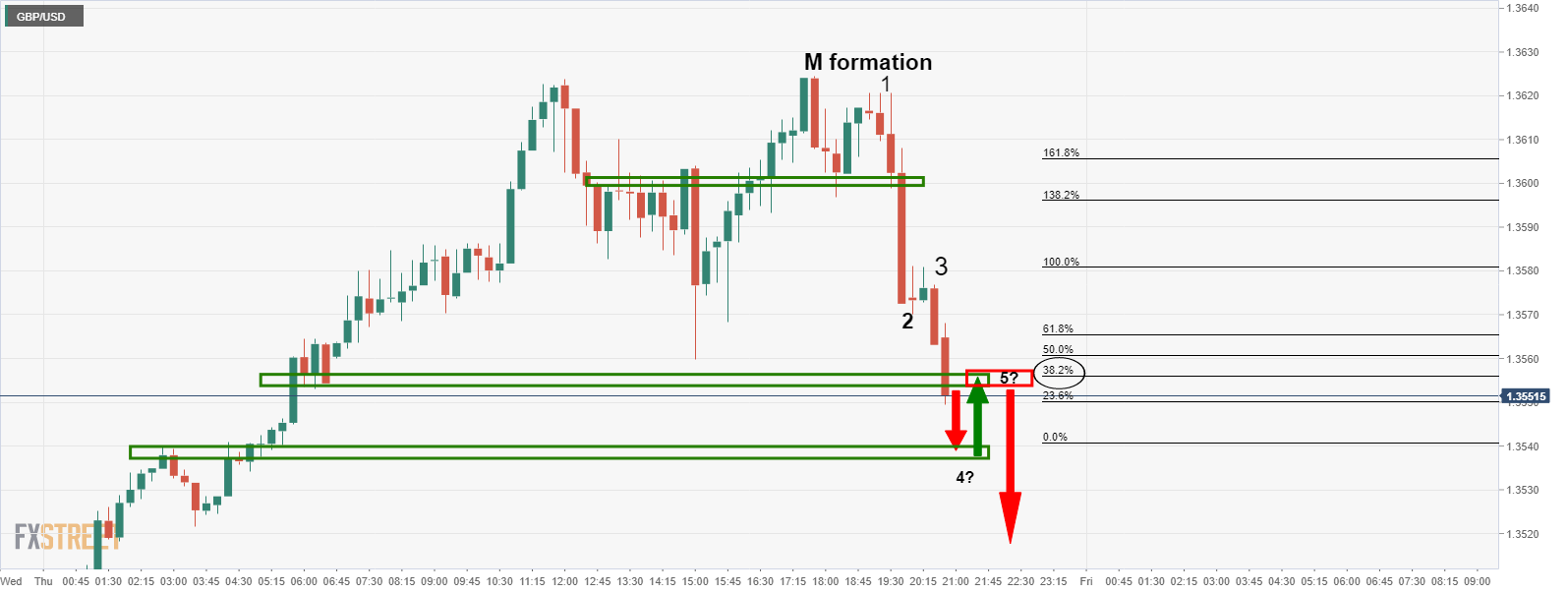

GBP/USD update

The pound is under pressure and on the brink of falling through yet another layer of 15-min support towards the 1.3540 support and prior resistance: