Dollar’s decline continues in Asian session today, with mild risk-on markets in the background. FOMC rate decision overnight triggered little reactions in the markets, and the greenback holds on to the near term trajectory. Sterling is currently the strongest one, awaiting BoE rate decision, and more news regarding Brexit trade talks. New Zealand Dollar is the next strongest today, after better than expected GDP rebound.

Technically, Sterling pairs could be a focus for the rest of the week. GBP/USD is having another attempt to break through 1.3539 resistance decisive, yet, there is no conviction. Attention will also be on 140.70 resistance in GBP/JPY and break will affirm underlying upside momentum of the Pound. EUR/GBP and GBP/CHF are staying around mid-point of recently established range. We’ll are anticipating a breakout for now, until something firm about Brexit trade agreement happens.

In Asia, Nikkei closed up 0.18%. Hong Kong HSI is up 0.32%. China Shanghai SSE is up 0.91%. Singapore Strait Times is down -0.36%. 10-year JGB yield is down -0.0006. Overnight, DOW dropped -0.15%. S&P 500 dropped -0.18%. NASDAQ rose 0.50%. 10-year yield dropped -0.003 to 0.920.

NASDAQ hit new record after FOMC, on track to 12901 projection

US stocks ended mixed overnight with NASDAQ closed at another record, but DOW edged down slightly. Fed left monetary policy as widely expected. FOMC noted, “path of the economy will depend significantly on the course of the virus,” and it pledged to “be prepared to adjust the stance of monetary policy as appropriate”. The commitment to maintain accommodative policy supported overall market sentiment. Additionally, there’s optimism that Congress inched close to compromising on a USD 900B fiscal stimulus package.

NASDAQ closed up 0.50% at 12658.18. Upside momentum is relatively unconvincing as seen in daily MACD. But there is no sign of topping yet. Further rise should be seen to 61.8% projection of 6631.42 to 12074.06 from 10822.57 at 12901.65. The projection level represents an important near term hurdle to clear. Decisive break there could prompt upside re-acceleration in early part of next year. Though, rejection there, followed by 12214.73 support would mix up the medium term outlook a bit, and at least bring deeper correction to 55 day EMA (now at 11853.94) first.

Dollar index holding on to 90 support, but risks on the downside

Dollar index is still holding on to 90 psychological support for the moment, even though the greenback is trading as the worst performing one for the week. The level coincides with 38.2% projection of 102.99 to 91.71 from 94.30 at 90.00. Though, as EUR/USD has already taken out 1.2177 resistance, selloff in Dollar could take off any time.

In the bearish case, next downside target will be 61.8% projection at 87.34. Though, rebound from current level, followed by break of 91.23 resistance should indicate short term bottoming and bring rebound. Down trend extension would then be delayed to the early part of Q1.

Australia employment grew 90k in Nov, unemployment rate dropped to 6.8%

Australia employment grew 90k in November, to 12.86m, much better than expectation of 50.0k. Over, the year, though, employment was still down -0.6% or -83.1k. Looking at some details, Full-time jobs rose 84.2k to 8.73m. Part-time jobs rose 5.8k to 4.14m.

Unemployment rate dropped -0.2% to 6.8%, better than expectation of 7.0%. Participation rate rose 0.3% to 66.1%. Hours worked rose 2.5% mom.

New Zealand GDP grew record 13% qoq in Q3

New Zealand GDP grew 14.0% qoq in Q3, stronger than expectation of 12.8% qoq. That’s also the largest quarterly rise on record. However, on an annual bases, GDP dropped -2.2% over the year. Growth in Q3 was not enough to fully makeup for the economic impact of the coronavirus pandemic and the responding measures.

Looking at some more details, Services industries rose 11.1% qoq. Goods-producing industries rose 26.0% qoq. Primary industries rose 4.6% qoq.

Looking ahead

SNB and BoE monetary policy decisions are the major focus in European session. Eurozone will release CPI final. Later in the day, Canada will release ADP employment. US will release jobless claims housing starts and building permits, and Philly Fed manufacturing survey.

Suggested reading on BoE: BOE Preview – Staying Cautious about Brexit Outlook

AUD/USD Daily Report

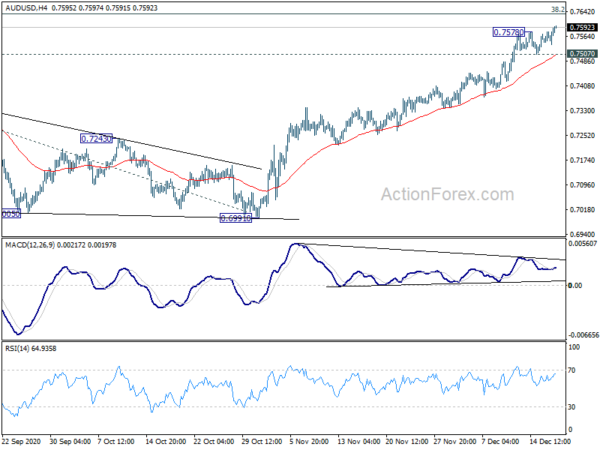

Daily Pivots: (S1) 0.7552; (P) 0.7565; (R1) 0.7592; More…

AUD/USD’s rally resumes by breaking 0.7578 temporary top. Intraday bias is back on the upside for 0.7635 key long term fibonacci level. Decisive break there will carry larger bullish implications. Next target will be 61.8% projection of 0.5506 to 0.7413 from 0.6991 at 0.8170. On the downside, break of 0.7507 support is needed to indicate short term topping. Otherwise, outlook will remain bullish in case of retreat.

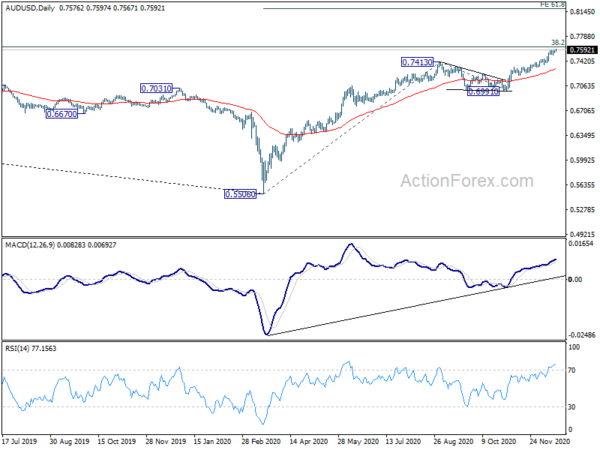

In the bigger picture, the sustained trading above 55 week EMA (now at 0.6994) is a sign of medium term bullishness. Nevertheless, AUD/USD will still need to overcome 38.2% retracement of 1.1079 (2011 high) to 0.5506 (2020 low) at 0.7635 decisively to indicate completion of long term down trend from 1.1079. In that case, next medium term target would be 61.8% retracement at 0.8950. Rejection by 0.7635 will retain long term bearishness instead.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | GDP Q/Q Q3 | 14.00% | 12.80% | -12.20% | -11.00% |

| 0:30 | AUD | Employment Change Nov | 90.0K | 50.0K | 178.8K | |

| 0:30 | AUD | Unemployment Rate s.a. Nov | 6.80% | 7.00% | 7.00% | |

| 7:00 | CHF | Trade Balance (CHF) Nov | 4.12B | 3.86B | ||

| 8:30 | CHF | SNB Interest Rate Decision | -0.75% | -0.75% | ||

| 9:00 | CHF | SNB Press Conference | ||||

| 10:00 | EUR | Eurozone CPI Y/Y Nov F | -0.30% | -0.30% | ||

| 10:00 | EUR | Eurozone CPI – Core Y/Y Nov F | 0.20% | 0.20% | ||

| 12:00 | GBP | BoE Interest Rate Decision | 0.10% | 0.10% | ||

| 12:00 | GBP | BoE Asset Purchase Facility | 895B | 895B | ||

| 12:00 | GBP | MPC Official Bank Rate Votes | 0–0–9 | 0–0–9 | ||

| 12:00 | GBP | MPC Asset Purchase Facility Votes | 0–0–9 | 0–0–9 | ||

| 13:30 | CAD | ADP Employment Change Nov | -79.5K | |||

| 13:30 | USD | Housing Starts Nov | 1.53M | 1.53M | ||

| 13:30 | USD | Building Permits Nov | 1.55M | 1.54M | ||

| 13:30 | USD | Initial Jobless Claims (Dec 11) | 780K | 853K | ||

| 13:30 | USD | Philadelphia Fed Manufacturing Survey Dec | 20 | 26.3 | ||

| 15:30 | USD | Natural Gas Storage | 0.07% |