One last pain trade before the year comes to a close?

That could very well be the case for USD/JPY as it starts to near the support region from the early November lows at 103.18-19, with the pair continuing to keep in a downwards trajectory since the middle of the year.

The 100-day moving average (red line) has been a key level in keeping the downside momentum going from a technical point of view while dollar weakness remains the key driver pushing the pair lower from a fundamental perspective.

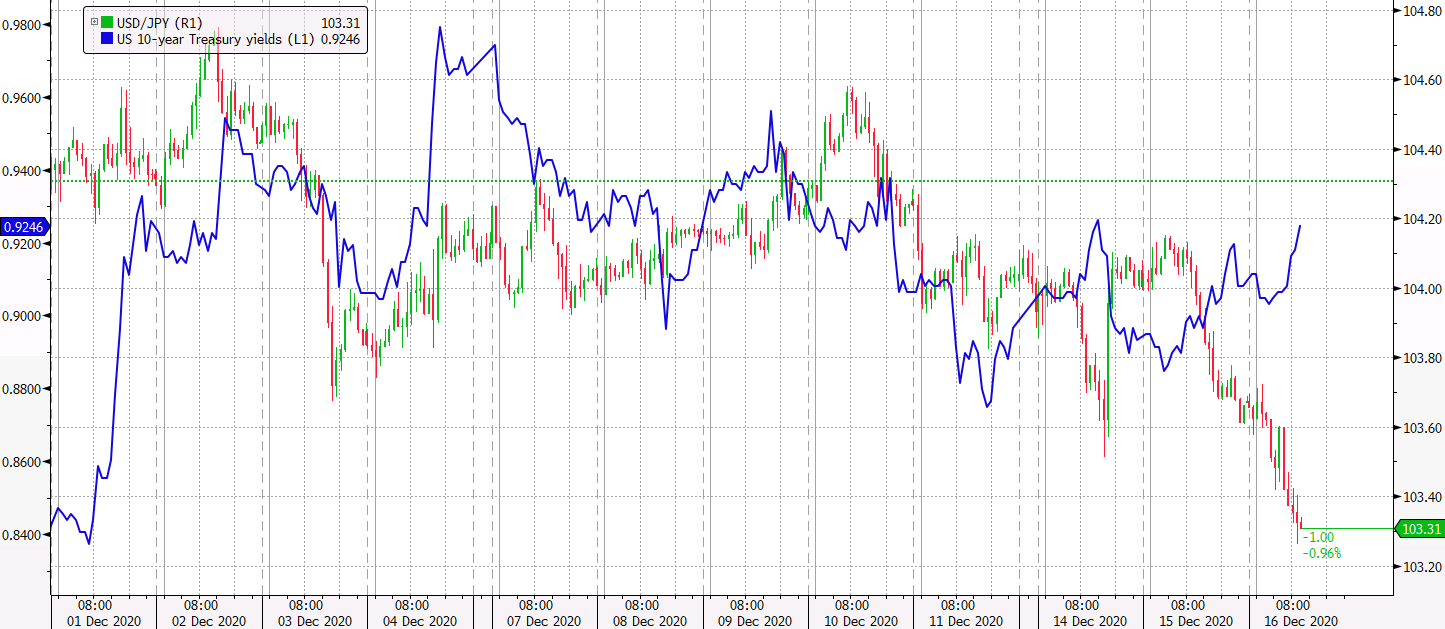

The latter continues to impose itself on the market again today as we see a divergence between USD/JPY price action and that of Treasury yields:

Going back to the USD/JPY chart, a breach below the November lows could potentially set up one final pain trade for the year with little support standing in the way of a push towards 102.00 below the support region pointed out above.

The caveat of course will be the Fed meeting later today. That will help to set the tone as we look towards the closing stages of the year and how that might play out.