- Silver prints mild losses, recently fails to extent recovery moves from $23.87.

- Sustained trading below the key HMA suggests further downside.

- Monthly horizontal support challenges the bears amid normal RSI conditions.

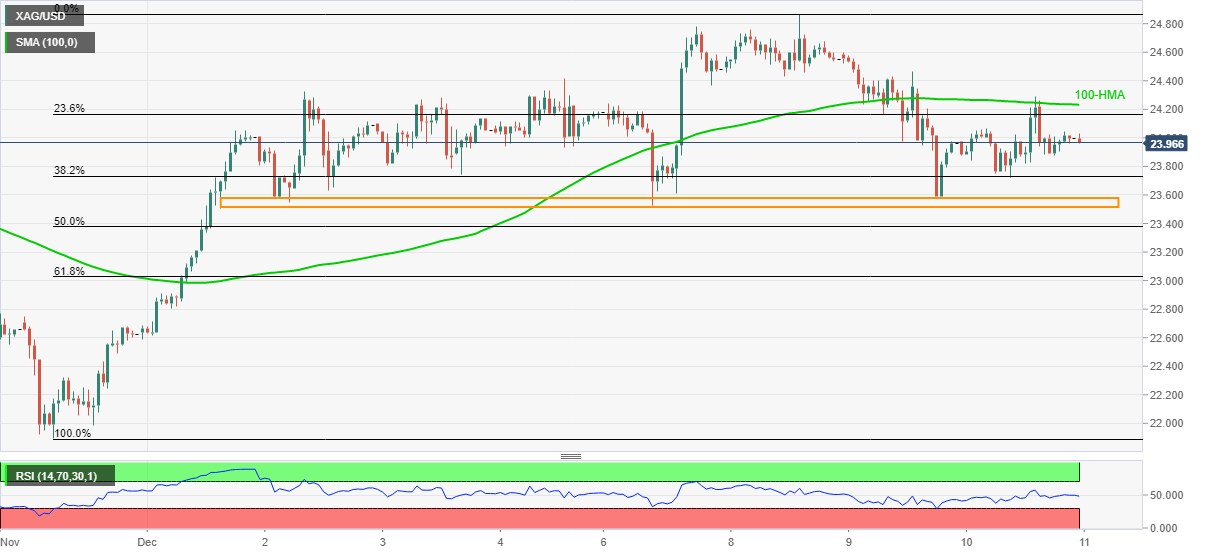

Silver declines to $23.96, down 0.17% intraday, during Friday’s Asian trading. In doing so, the white metal keeps its U-turn from 100-HMA, marked the previous day, while defying Thursday’s recovery moves.

Considering the normal RSI conditions backing the latest pullback from the key HMA, the commodity prices can weaken further. However, a horizontal area comprising lows marked since December 01, between $23.50 and $23.60, offers a tough nut to crack for the silver sellers.

In a case where the metal bears dominate past-$23.50, 61.8% Fibonacci retracement of November 30 to December 08 upside, at $23.02, will challenge the further downside.

Alternatively, an upside clearance of 100-HMA, at $24.23 now, will have to refresh the monthly top of $24.86 before eyeing the $25.00 threshold.

During the quote’s successful rise above the $25.00 round-figure, November’s high near $26.00 will be in the spotlight.

Silver hourly chart

Trend: Pullback expected