The AUDUSD pair remains within the up and down 12-day trading range

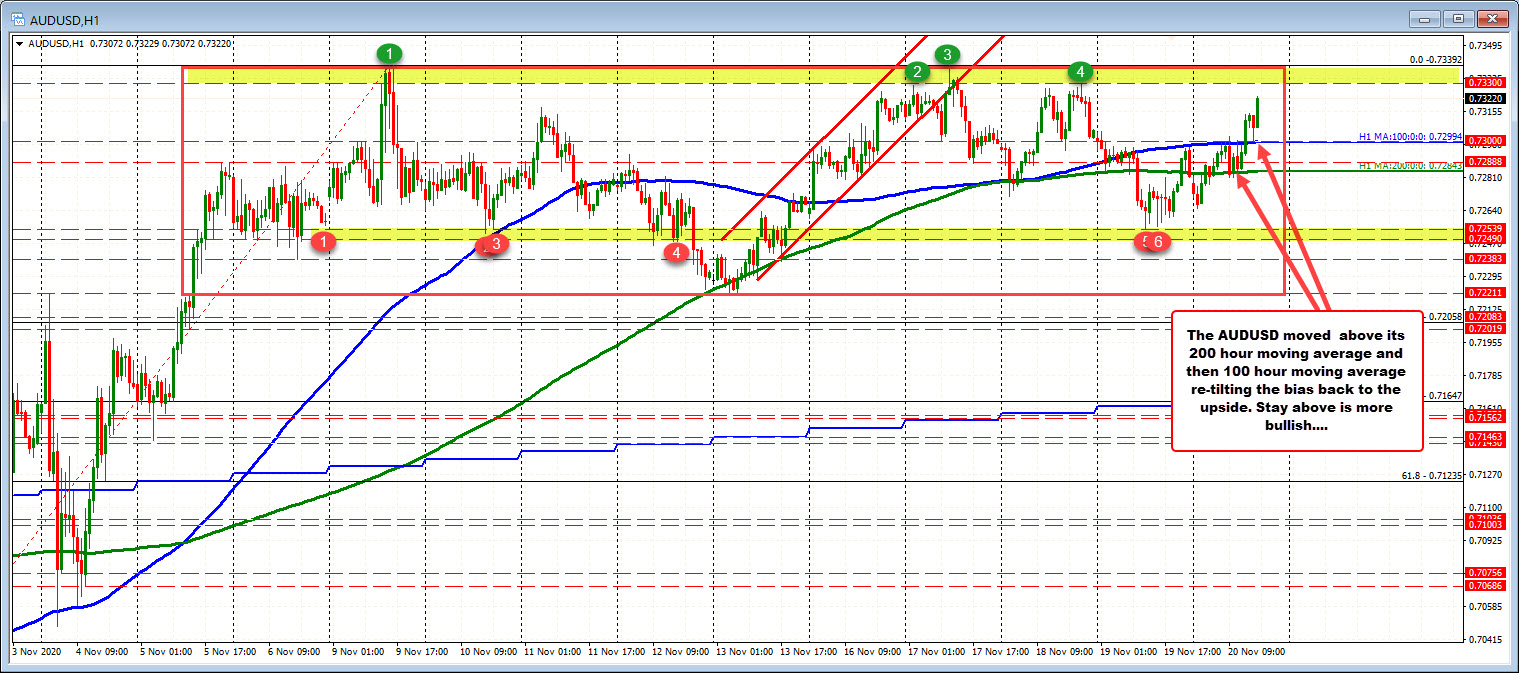

Since breaking above 0.7221 on November 5 (taking out the high from November 4), the pair as traded between that level and the high at 0.73392 (around 120 pips). We are in day number 12 since that break. Over that time period, the price retested the 0.7221 level on November 12 and November 13, and retested the November 9 high on November 17 and November 18 (within 9 pips).

Technically, the price action this week saw the move down to a high him him swing area between 0.7249 and 0.72539. The price held support against that level.

Today, the price initially moved lower and away from the 200 hour moving average at 0.72843 (green line in the chart above) but recovered and based near the 200 hour moving average, moved above the 100 hour moving average at 0.72994 (also a natural technical level). The most recent downside test based against that 0.7300 level before moving to a new session high at 0.73232.

The price for the AUDUSD currently trades at 0.7311.

The move back above the moving averages has re-tilted the bias back to the upside. Having said that the pair remains in the up and down trading range(s). Nevertheless, staying above the 100 and 200 hour moving averages is more bullish. The topside targets remain at 0.7330 and then the double top at 0.73392.

A move back below the 100 hour moving average would neutralize some of the bullish re-tilt. A move back below 0.72843, would increase the bearish bias and put control back in the sellers hands.

The up and down price action is indicative of a market that is unsure of the next move (otherwise, it would have moved away from this narrow area). At some point, there will be a break and run.

As traders we need to respect “the markets” opinion (the “market” is the collection of all buyers and sellers and their perception of where the price should be). If they get the shove higher from a vaccine distribution, a new stimulus, positive economic news or some other positive news, the technicals will support that. If there is disappointment from delays in vaccine distribution, no stimulus, deteriorating economic conditions, etc., the price action will show that is well.