Can oil finally make a break?

In the span of a few months, oil went from the world’s most-volatile commodity to a sleepy backwater.

That won’t last.

WTI crude climbed 40-cents on Friday to wrap up a 5% gain on the week to $42.15. It’s now up 17% this month and 25% since the election-night lows. More importantly, it’s beginning to threaten the top of the range that’s persisted since June. That top of it is at $43.78/barrel.

Looking at the chart, the latest move isn’t that impressive but that ignores that the rally came just as Libya started to dump an additional 1 million barrels per day into the market.

The big risk is two weeks away and the OPEC meeting. The market has settled around a 3 or 6-month cut extension but there are plenty of warning signs that it won’t be smooth or easy to get a deal.

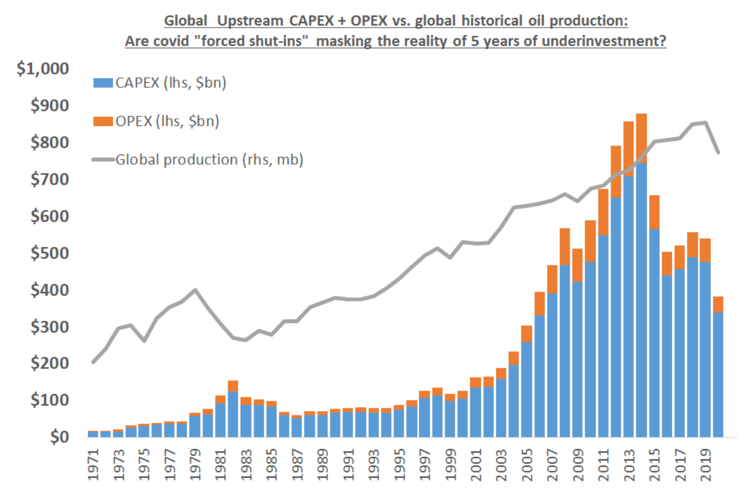

Looking ahead, I think this is one of the most-important charts in the world. It highlights falling capex in the oil market, something that’s going to continue next year. We are headed towards a period of undersupply in the market when the pandemic ends.