Yen appears to be trying to reverse the losses posted earlier this week, as helped by pull back in treasury yields. US 10-year yield is trading at around 0.88 a the time of writing, well below this week’s high at 0.975. German 10-year yield is also back pressing -0.55 handle. Still, Yen remains the second weakest for the week, following Swiss Franc. New Zealand Dollar remains the strongest one, despite today’s retreat. Sterling is the second strongest, at it defending near term support against Dollar.

In Europe, currently, FTSE is down -0.58%. DAX is up 0.20%. CAC is up 0.25%. German 10-year yield is down -0.021 at -0.554. Earlier in Asia, Nikkei dropped -0.53%. Hong Kong HSI dropped -0.05%. China Shanghai SSE dropped -0.86%. Singapore Strait Times dropped -0.02%. Japan 10-year JGB yield dropped -0.0037 to 0.027.

Fed Williams: Growth to slow somewhat in Q4 and early next year

– advertisement –

New York Fed President John Williams warned that “the very large rise in COVID cases recently clearly puts a question market on the ability of the economy to weather this period.” Thus, he’d “expect the growth in the fourth quarter, and maybe into early next year to slow somewhat.”

Williams also noted that the economy is still in a extraordinary situation that needs fiscal support. “The reason the economy is still going is because we know people still have some of the stimulus checks and unemployment checks,” he said. “Those saved benefits are helping people pay rent and put food on the table.”

US PPI came in at 0.3% mom , 0.5% yoy in October, versus expectation of 0.2% mom, 0.3% yoy. PPI core was at 0.1% mom, 1.1% yoy, versus expectation of 0.3% mom, 0.9% yoy.

ECB Schnabel: Vaccines puts us back in our baseline scenario

ECB board member Isabel Schnabel said new restrictions in Europe “dampened substantially, the outlook for the fourth quarter, and then also for the first quarter of next year.” Though, there was “excellent news” regarding coronavirus vaccine”. And that “puts us back in our baseline scenario”, which sees a strong rebound 2021.

Separately, Governing Council member Pablo Hernandez de Cos also said, “the vaccine is very positive news, regarding investor confidence, consumers confidence and economic activity. But I would like to be cautious. In the short term, restrictions will continue across Europe.”

Eurozone GDP grew 12.6% qoq in Q3, down -4.4% yoy

Eurozone GDP grew 12.6% qoq in Q3, the sharpest rise since the times series started in 1995. Over the year, however, GDP dropped -4.4% yoy. Employment grew 0.9% qoq, dropped -2.0% yoy. EU GDP grew 11.6% qoq, dropped -4.3% yoy. Employment grew 2.7% qoq, dropped -1.8% yoy.

Also released, Eurozone trade surplus widened to EUR 24.8B in September versus expectation of EUR 22.3B. Swiss PPI came in at 0.0% mom, -2.9% yoy in October.

RBNZ Orr: Be careful, be prepared and don’t run around on predictions

RBNZ Governor Adrian Orr said the improved growth and inflation projections in the latest Monetary Policy Statement released this week “is a very bod assumption”. The central bank has been “at pains to explain to people that we are creating scenarios, not projections of certainty,” he said.

“If the economy continued to grow and do what it’s doing, well that’s a beautiful world, but that’s a big if,” Orr added. “So today’s news around Covid just puts it back into perspective. Be careful out there, be prepared, don’t run around on predictions.”

Orr has the new FLP is “such an invasive way into the banking sector to provide very low cost of funding”. He’ll be on watch to make sure that’s passed on to borrowers and investors.” As for the further easing, Orr said purchases of foreign assets is “not a preferred option” that would not have a significant impact “really in the long term”.

“We are very comfortable where we are with the funding for lending and the quantitative easing program we’re doing at present.”

New Zealand BusinessNZ PMI dropped to 51.7, not getting too carried away with recovery

New Zealand BusinessNZ Performance of Manufacturing Index dropped from 54.0 to 51.7 in October. Production dropped from 56.7 to 51.1. New orders dropped from 58.1 to 52.4. But employment rose from 51.7 to 52.6.

BusinessNZ’s executive director for manufacturing Catherine Beard said that the sector remains in a state of flux, although still managing to keep in positive territory.

BNZ Senior Economist, Craig Ebert said that “October’s PMI serves as a gentle reminder of not getting too carried away with the sense of recovery, even if the worst of COVID’s impacts can be assumed to be behind us”.

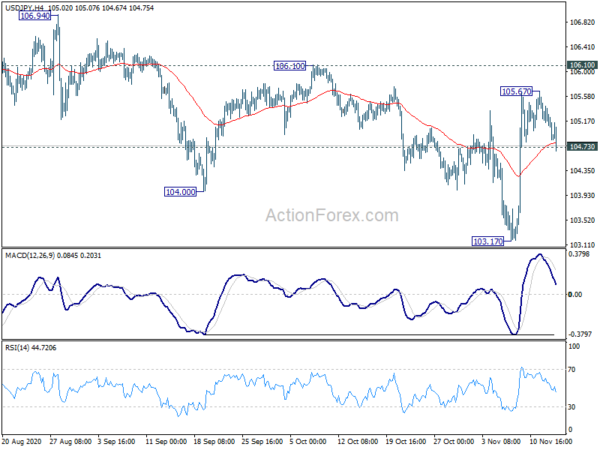

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 104.97; (P) 105.22; (R1) 105.38; More...

USD/JPY’s breach of 104.73 minor support argues that rebound from 103.17 might have completed at 105.67, ahead of 106.10 resistance. It’s also back below 55 day EMA, staying well inside near term falling channel. Intraday bias is turned back to the downside for 103.17 low. Break will resume whole decline from 111.71. On the upside, firm break of 106.10 resistance should confirm completion of fall from 111.71, and turn outlook bullish for further rally.

In the bigger picture, USD/JPY is still staying in long term falling channel that started back in 118.65 (Dec. 2016). Hence, there is no clear indication of trend reversal yet. The down trend could still extend through 101.18 low. On the upside, break of 106.10 resistance will suggest that the decline from 111.71 has completed. Focus will then be back to this resistance to signal medium term reversal.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | NZD | BusinessNZ Manufacturing Index Oct | 51.7 | 54 | ||

| 07:30 | CHF | Producer and Import Prices M/M Oct | 0.00% | 0.10% | 0.10% | |

| 07:30 | CHF | Producer and Import Prices Y/Y Oct | -2.90% | -3.10% | ||

| 10:00 | EUR | Eurozone Trade Balance (EUR) Sep | 24.8B | 22.3B | 21.9B | |

| 10:00 | EUR | Eurozone GDP Q/Q Q3 P | 12.60% | 12.70% | 12.70% | |

| 10:00 | EUR | Eurozone Employment Change Q/Q Q3 P | 0.90% | 0.70% | -2.90% | |

| 13:30 | USD | PPI M/M Oct | 0.30% | 0.20% | 0.40% | |

| 13:30 | USD | PPI Y/Y Oct | 0.50% | 0.30% | 0.40% | |

| 13:30 | USD | PPI Core M/M Oct | 0.10% | 0.30% | 0.40% | |

| 13:30 | USD | PPI Core Y/Y Oct | 1.10% | 0.90% | 1.20% | |

| 15:00 | USD | Michigan Consumer Sentiment Index Nov P | 82 | 81.8 | ||

| 15:30 | USD | Natural Gas Storage | -3B | -36B |