Sure, sure

Aso also adds that the central bank’s ETF purchases are part of its monetary policy actions, not to directly prop up stock prices.

This is the usual rhetoric we’ve been getting from Japanese officials for the longest of time now. But we all know that the BOJ pretty much acts accordingly as to what the government needs it to in order to ensure the ‘Abenomics’ pillars are “working”.

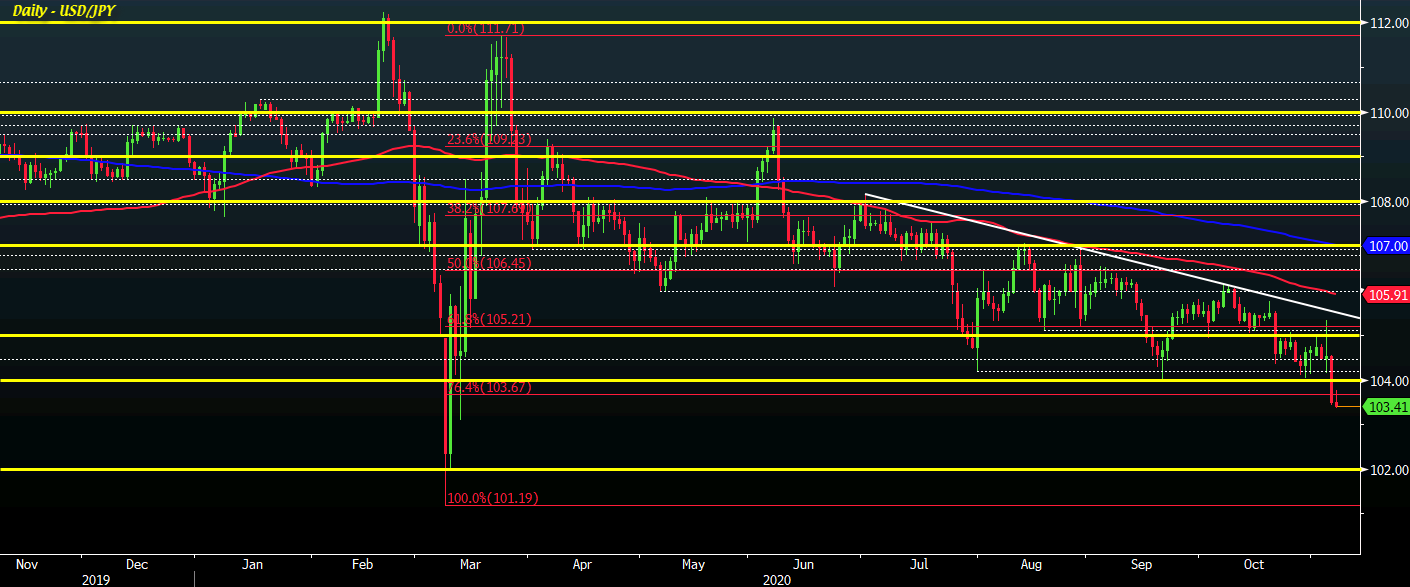

Either way, you can bet that Japanese officials are starting to get a little nervous when looking at the USD/JPY chart after the break below 104.00 yesterday:

There is pretty much no technical support, unless you really want to count the 12 March low @ 103.09, all the way to 102.00 as the pair continues its descend since June.

This article was originally published by Forexlive.com. Read the original article here.