Volatility continues today as US Presidential election vote counts are released. The final results are unknown at this point, narrowed down the results of just a few states. At the time of writing, Yen is the stronger one, followed by Swiss Franc. Sterling and Kiwi are the weaker ones. In other markets, European indices are generally higher while NASDAQ future is posting strong gain. US 10-year yield is notably lower, trading below 0.8 handle. Gold is back above 1900 but hesitates to extend gains.

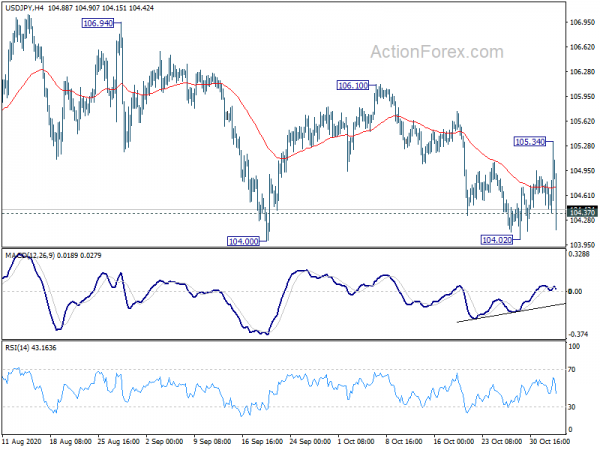

Technically, USD/JPY’s focus is back on 104.00 support after sharp intraday reversal. Sustained break there will resume the larger fall from 111.71. That could be a sign of risk aversion, or falling treasury yield, or selloff in Dollar. We’ll see how the pair interacts with other instruments.

– advertisement –

In Europe, currently, FTSE is up 1.33%. DAX is up 1.30%. CAC is up 1.72%. German 10-year yield is down -0.0164. Earlier in Asia, Nikkei rose 1.72%. Hong Kong HSI dropped -0.21% China Shanghai SSE rose 0.19%. Singapore Strait Times rose 0.75%. Japan 10-yaer JGB yield dropped -0.0077 to 0.039.

US ADP employment grew only 365k, well below expectation

US ADP private employment grew only 365k in September, well below expectation of 690K. By company size, small businesses added 114k jobs, medium businesses added 135k, large businesses added 116k. By sector, goods-producing industries added 17k, service-providing industries added 348k.

“The labor market continues to add jobs, yet at a slower pace,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “Although the pace is slower, we’ve seen employment gains across all industries and sizes.”

Also released trade deficit narrowed to USD -63.9B in September, small than expectation of USD -64.2B.

Canada trade deficit widened slightly to CAD -3.3B, larger than expectation of -2.2B.

UK PMI: Economy on course for double-dip recession

UK PMI services was finalized at 51.4 in October, sharply lower from September’s 56.1. PMI Composite was finalized at 52.1, down from 56.5. That’s also the lowest level for four months.

Tim Moore, Economics Director at IHS Markit: “October data indicates that the UK service sector was close to stalling even before the announcement of lockdown 2 in England… November’s lockdown in England and a worsening COVID-19 situation across the rest of Europe means that the UK economy seems on course for a double-dip recession this winter and a far more challenging path to recovery in 2021.”

Eurozone PMI composite finalized at 50.0, outlook increasingly dark except for Germany

Eurozone PMI Services was finalized at 46.2 in October, down from September’s 48.0. PMI Composite dropped to 50.0, down from last month’s 50.4. Germany PMI Composite hit a 3-month high at 55.0. But Italy (49.2), Ireland (49.0), France (47.5) and Spain (44.1) were in contraction.

Chris Williamson, Chief Business Economist at IHS Markit said: “With lockdown measures being tightened, it is becoming increasingly hard to see how the eurozone economy will avoid falling back into decline, especially as some countries, including France, Italy and Spain, are already contracting again. Only in Germany has the strength of the manufacturing sector countered the renewed downturn in service sector activity, leading to increasingly polarised economic trends among the euro area’s member states. However, for all countries the outlook has grown increasingly dark.”

Eurozone PPI at 0.3% mom, -2.4% yoy in Sep

Eurozone PPI came in at 0.3% mom, -2.4% yoy in September, matched expectations. For the month, Industrial producer prices increased by 0.8% mom in the energy sector and by 0.1% mom for intermediate goods, while prices remained stable for capital goods, durable consumer goods and non-durable consumer goods. Prices in total industry excluding energy remained stable.

EU PPI was at 0.3% mom, -2.2% yoy. The highest increases in industrial producer prices were recorded in Ireland (+4.3% mom), Hungary (+1.2% mom) and the Netherlands (+0.9% mom), while the largest decreases were observed in Cyprus (-1.3% mom), Estonia and Finland (both -0.8% mom), Greece and Lithuania (both -0.3% mom).

China Caixin PMI services rose to 56.8, composite rose to 55.7

China Caixin PMI Services rose to 56.8 in October, up from 54.8, beat expectation of 55.2. That’s the second best reading since 2020, just after June’s high of 58.4. PMI Composite rose to 55.7, up from 54.5.

Wang Zhe, Senior Economist at Caixin Insight Group said: “Overall, as the domestic epidemic situation stabilizes, recovery remained the main economic theme…. The development of the epidemic in Europe and the U.S. is still an uncertain factor affecting economic trends. In the coming months, a continued recovery of the Chinese economy is highly likely, but it is necessary to be cautious about the normalization of monetary and fiscal policies in the post-epidemic period.”

New Zealand unemployment rate surged to 5.3%, most people unemployed in 8 years

New Zealand unemployment rate jumped to 5.3% in Q3, up from Q2’s 4.0%, but was slightly better than expectation of 5.4%.The 1.3% jump was the biggest quarterly increase on record. Labor force participation rate rose 0.2% to 70.1%. Employment dropped -0.8% over the quarter, matched expectations. 37k more New Zealanders were unemployed, bringing the total to 151k, highest in eight years.

“We are continuing to see the economic effects of COVID-19, and its associated border and business closures,” labour market and household statistics senior manager Sean Broughton said. “Last quarter’s low unemployment rate of 4.0 percent was explained in part by people’s inability to be ‘actively seeking’ and available for work during the national lockdown that was in place for much of the quarter. This quarter’s increase in unemployment reflects a return to more normal job-hunting behaviours.”

Australia retail sales dropped -1.1% mom in Sep

Australia retail sales dropped -1.1% mom in September, better than preliminary reading of -1.5% mom. It’s also an improvement over August’s -4.0% mom. In seasonally adjusted terms, there were falls in New South Wales (-0.9%), Queensland (-1.2%), Western Australia (-1.7%), South Australia (-2.9%), Victoria (-0.4%), the Australian Capital Territory (-2.4%), and Tasmania (-2.0%). The Northern Territory (4.3%) rose.

AiG Performance of Construction Index rose to 52.7 in October, up from 45.2. It’s the first expansionary result since August 2018.

USD/CHF Mid-Day Outlook

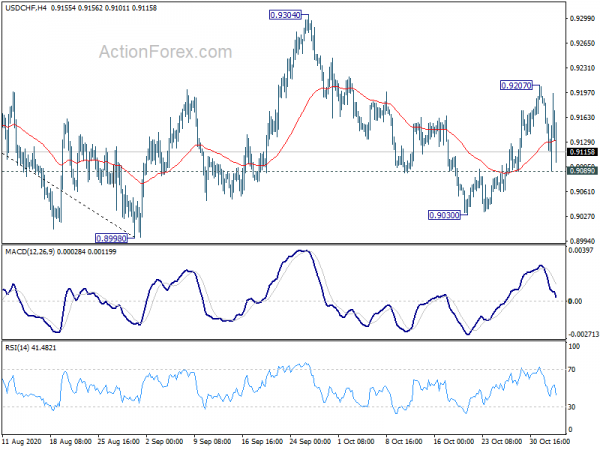

Daily Pivots: (S1) 0.9094; (P) 0.9143; (R1) 0.9169; More…

USD/CHF is still staying in range of 0.9089/9207 despite much volatility. Intraday bias remains neutral at this point. Another rise is in favor as long as 0.9089 support holds. Above 0.9207 will target 0.9304 resistance next. Break will target 38.2% retracement of 0.9901 to 0.8998 at 0.9343. On the downside, break of 0.9089 minor support will turn bias back to the downside for 0.9030 support instead.

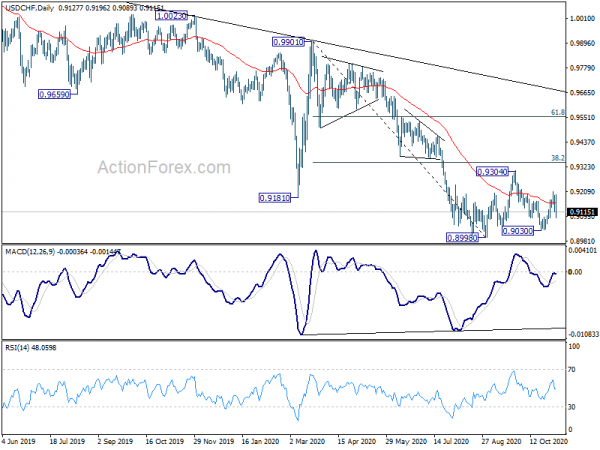

In the bigger picture, decline from 1.0237 is seen as the third leg of the pattern from 1.0342 (2016 high). There is no clear sign of completion yet. On resumption, next target will be 138.2% projection of 1.0342 to 0.9186 from 1.0237 at 0.8639. Nevertheless, strong break of 0.9304 resistance will be an early sign of trend reversal and turn focus back to 0.9901 key resistance for confirmation.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Construction Index Oct | 52.7 | 45.2 | ||

| 21:45 | NZD | Employment Change Q3 | -0.80% | -0.80% | -0.40% | |

| 21:45 | NZD | Unemployment Rate Q3 | 5.30% | 5.40% | 4.00% | |

| 21:45 | NZD | Labour Cost Index Q/Q Q3 | 0.40% | 0.30% | 0.20% | |

| 23:50 | JPY | Monetary Base Y/Y Oct | 16.30% | 14.50% | 14.30% | |

| 23:50 | JPY | BoJ Minutes | ||||

| 00:30 | AUD | Retail Sales M/M Sep | -1.10% | -1.50% | -1.50% | |

| 01:45 | CNY | Caixin Services PMI Oct | 56.8 | 55.2 | 54.8 | |

| 08:45 | EUR | Italy Services PMI Oct | 46.7 | 47 | 48.8 | |

| 08:50 | EUR | France Services PMI Oct F | 46.5 | 46.5 | 46.5 | |

| 08:55 | EUR | Germany Services PMI Oct F | 49.5 | 48.9 | 48.9 | |

| 09:00 | EUR | Eurozone Services PMI Oct F | 46.9 | 46.2 | 46.2 | |

| 09:30 | GBP | Services PMI Oct F | 51.4 | 52.3 | 52.3 | |

| 10:00 | EUR | Eurozone PPI M/M Sep | 0.30% | 0.30% | 0.10% | |

| 10:00 | EUR | Eurozone PPI Y/Y Sep | -2.40% | -2.40% | -2.50% | |

| 13:15 | USD | ADP Employment Change Oct | 365K | 690K | 749K | 753K |

| 13:30 | CAD | Trade Balance (CAD) Sep | -3.3B | -2.2B | -2.4B | -3.2B |

| 13:30 | USD | Trade Balance (USD) Sep | -63.9B | -64.2B | -67.1B | -67.0B |

| 14:45 | USD | Services PMI Oct F | 56 | 56 | ||

| 15:00 | USD | ISM Services PMI Oct | 57.8 | 57.8 | ||

| 15:30 | USD | Crude Oil Inventories | 0.3M | 4.3M |